To open long positions on EURUSD, you need:

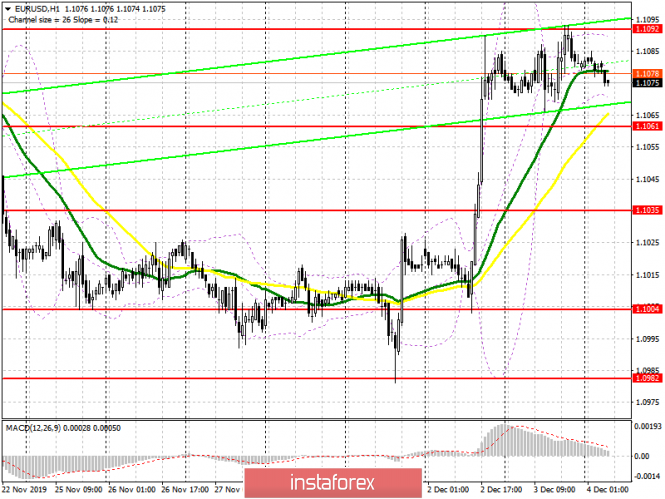

The lack of important fundamental statistics yesterday did not allow traders to continue the growth of EUR/USD in the afternoon. Already today, there are several important reports on the services sector of the eurozone countries, which can lead to a continuation of the upward trend formed at the beginning of this week. However, a new upward wave will be formed only after the breakout of the resistance of 1.1092, which will lead to an update of the highs in the area of 1.1109 and 1.1131, where I recommend taking the profits. In the scenario of EUR/USD decline in the first half of the day, it is best to open long positions after the formation of a false breakout in the support area of 1.1061 or buy immediately on the rebound from the minimum of 1.1035.

To open short positions on EURUSD, you need:

Like yesterday, the bears will rely on a failed break above resistance 1.1092 that will be the first signal for opening short positions in the euro the purpose of which will be the support of 1.1061, but more important will be a return to the support level of 1.1034, where I recommend taking the profit. It is in the area of 1.1034 Euro buyers will try to build the lower border of the new upward channel. In the scenario of EUR/USD growth above the resistance of 1.1091 in the first half of the day after good data on the services sector of the eurozone, which is generally in a fairly stable position, it is best to consider short positions after updating the maximum of 1.1109 or sell immediately on a rebound from the resistance of 1.1131.

Indicator signals:

Moving Averages

Trading is already in the area of 30 and 50 moving averages, and for the bulls not to miss the momentum, a breakout of the resistance of 1.092 is needed.

Bollinger Bands

The upper border of the indicator coincides with the resistance of 1.1092, while the breakdown of the lower border of the indicator in the area of 1.1070 may increase the pressure on the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands (Bollinger Bands). Period 20.