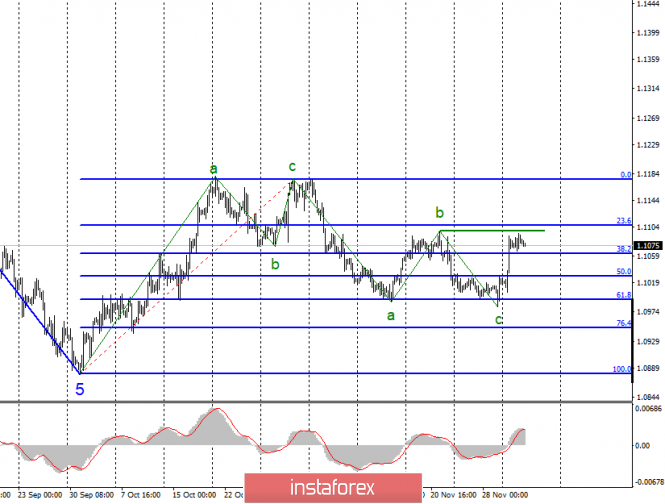

EUR / USD

On December 3, the EUR/USD pair completed without a fundamental change in the exchange rate. Despite the fact that the current wave marking involves the completion of the construction of the downward correctional part of the trend and the construction of a new upward trend, there are still doubts before the successful attempt to break the maximum of wave b that markets will be able to bring this scenario to life. Nevertheless, it will be possible to speak more confidently about the prospects for the euro currency after the peak of wave b remains below. If the attempt to break through the peak of wave b is unsuccessful, then the instrument can proceed to construct a horizontal wave structure.

Fundamental component:

On Tuesday, the news background for the euro-dollar instrument was weak. There were a lot of news and economic reports on Monday, which caused quite strong purchases of the euro. However, on Tuesday, there are no news except Donald Trump's new threats to impose duties on the entire world, in particular the countries of Europe and China. It is the topic of the trade war with China that keeps many economists awake, as the next deterioration in relations between Beijing and Washington could lead to another decline in the growth rate of the world economy and, as a result, of each individual country. On Monday, Donald Trump warned China again that if the deal, at least in the first phase, is not signed until December 15, he will introduce a new 15% duty on Chinese goods totaling $ 160 billion. Now, what is the probability that Beijing will suddenly take and sign a trade agreement, which, according to many experts, is unprofitable for him for the remaining 11 days? I find it extremely low. Therefore, the markets will witness a new conflict between the PRC and the USA in a week and a half. The relations between which have been complicated recently due to the adoption by the Senate and the US Congress of laws on human rights and democracy in Hong Kong and the signing of these laws by Donald Trump.

General conclusions and recommendations:

The euro-dollar pair supposedly completed the downward trend. Thus, I now recommend to buy the instrument with targets located near the calculated level of 1.1176, which equates to 0.0% Fibonacci. However, I also recommend waiting for a successful attempt to break through the peak of wave b before this.

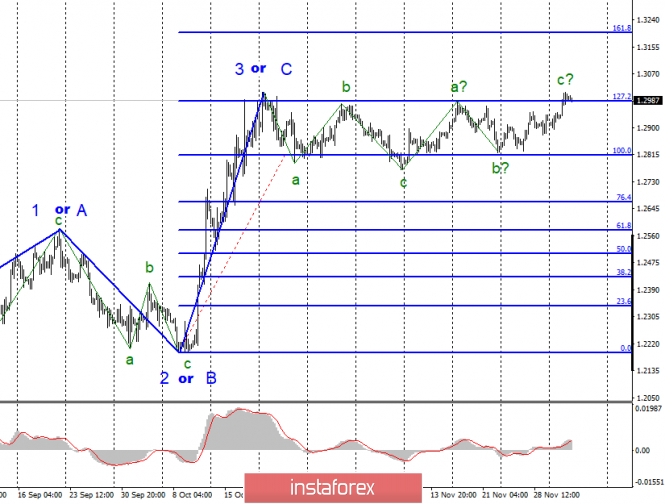

GBP / USD

On December 3, the GBP/USD pair gained about 55 basis points, and presumably remains within the framework of constructing the proposed wave c, the three-wave correction section of the trend. If the current wave marking is correct, then wave c is nearing completion, and after that, we are waiting for the construction of three waves down, which in general, can be described as a horizontal section of the trend starting from October 21. If this is true, then the instrument will begin to decline with targets located near the level of 100.0% Fibonacci in the near future.

Fundamental component:

On Tuesday, the news background for the GBP / USD instrument was quite inadequate. If we omit all the news from Donald Trump, only the index of business activity in the construction sector came out in the UK, which turned out to be below 50. Despite the fact that business activity in all areas of Britain remains in very weak condition, the British pound continues to grow and performed successfully an attempt to break through the level of 127.2% Fibonacci. Today, the third index will be released from a series of business activity, and this time in the service sector which may also remain below 50, indicating the weakness of this sphere. Moreover, all this news and reports should trigger the sale of the pound, but it is still growing, which cannot be connected with the upcoming elections, which, according to the majority, will be won by conservatives, and analytical agencies predict that Boris Johnson will be able to form a "majority parliament." Thus, the probability of a soft Brexit is growing, and together with it, is the pound sterling.

General conclusions and recommendations:

The pound-dollar instrument continues to build the correctional part of the trend. Thus, now, I still expect the pair to decline to 1.2770 after the MACD signal "down". The breakdown of the Fibonacci level of 127.2% indirectly indicates the willingness of the markets to further increase quotations, but when making purchases of the instrument, I recommend that you use Stop Loss below the level of 127.2%.

The material has been provided by InstaForex Company - www.instaforex.com