Markets continue to win back the positives associated with the signing of the first phase of a trade deal between the US and China and rising expectations for a global economic recovery. On Thursday, US stock indices updated historical records again. At the same time, the S&P 500 closed at 3239.91 and a rise in commodity prices was recorded on Friday morning. Brent surpassed the level of 68 dollars per barrel in anticipation of increased consumption.

Moreover, additional positive growth was ensured by the passage through Congress of a bill on government financing in 2020. Now, given that there is no deterioration in employment rates and consumer confidence has stabilized at high levels, it can be assumed that the risks have decreased, which means that some positivity will dominate during that time.

US dollar declines against most G10 currencies, while commodity currencies are especially confident. At the same time, there is still no serious reason to believe that the peak of the crisis is over - the growth in consumer activity by the end of the year is quite explained by seasonality, while the Brexit factors and the US-China deal have no clear prospects. The risk of breaking the agreement is real, although the key contradictions have not been resolved.

Forecasts for bet are neutral. On the one hand, a three-fold reduction in the rate this year has brought an additional impulse to the US economy. Thus, it is unlikely that the Fed will continue to lower the rate in the face of lower risks. On the other hand, the probability of a rate increase is even less, as inflationary expectations remain depressed.

As a result, the most likely scenario in the currency exchange market in the coming days is the development of current trends. The threat of sudden changes in sentiment is low.

NZD/USD

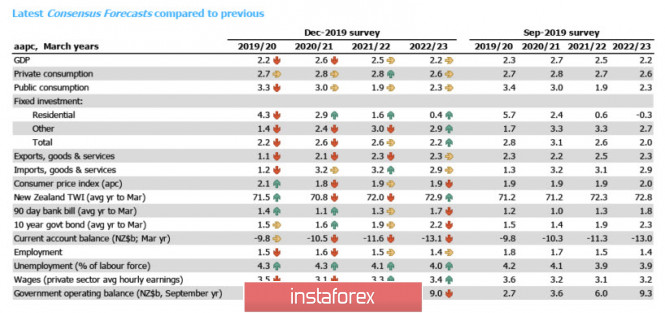

The NZIER Institute in a quarterly study of the state of the New Zealand economy worsened forecasts for most parameters when compared with September. NZIER expects not only a slowdown in GDP growth, but also a decrease in investment in business, a slowdown in exports, housing. However, inflation is forecasted to be positive only in the coming months, after which it will move down from the target levels of RBNZ. Therefore, a worsening labor market and a slowdown in wage growth are also expected.

The question of the RBNZ rate remains open. After an unexpected reduction in August, bets immediately went by 50p. As a result, RBNZ in November did not take any steps and took a break. In fact, the Central Bank was forced to act faster than the markets expected. These steps led to a positive impact on the economy - mortgage rates fell, which led to an increase in housing construction and household expenses.

Meanwhile, ANZ Bank also adheres to a close assessment, which predicts that the RBNZ will be forced to recognize the negative dynamics in inflation by May and will lower the rate again.

As a result, the forecast for TWI (NZD trade-weighted rate) for the coming months is positive, but it looks worse since spring than in September. This means that kiwi is close to the exhaustion of momentum, and thus, the factors that led to an increase in NZD in October-December are weakening.

Growth may continue if markets rely on continued global economic recovery, but such a scenario is unlikely. Resistance 0.6790 is reachable, however, the formation of the top and the closure of long positions will most likely begin near this level. On the other hand, closer is the resistance 0.6710 / 25. This is most likely the boundary of the growth of NZD in the current impulse.

AUD/USD

The Australian dollar has been steadily adding in recent days. The growth is steady, because it relies not only on positive changes in the external background, but also on its own domestic economic factors. Moreover, Australian currency received a strong impulse on December 19 after the publication of the employment report, which turned out to be noticeably better than expected in most parameters.

At the same time, a strong labor market gives the RBA reason to hold a pause in monetary policy, rising commodity prices and lowering tension support commodity currencies. Technically, AUD continues to implement the impulse, testing of the upper border of the channel 0.6975 / 80 is expected, after which either a correctional decline to supports 0.6927 or 0.6870 / 80 or a breakthrough of the channel will follow.

The material has been provided by InstaForex Company - www.instaforex.com