The main events of the outgoing year, which had a significant impact on world financial markets, were the trade confrontation between America and China, the situation around Britain's exit from the European Union and the monetary policies of the world's largest central banks.

These events were really the main ones and conducted the markets to the full. Of course, the results are necessarily summed up at the end of the outgoing year, but the most important thing is to identify or highlight the important topics of the coming year, which will highly affect the mood of market players and the dynamics of financial instruments.

The first and foremost remains the situation with trade negotiations between Washington and Beijing. The signing of the "1st phase" of a new trade agreement does not solve all the problems, but only a part of them. Therefore, the further success of their resolution will be in the focus of the markets. Under the influence of this topic, the volatility of all financial markets can significantly increase without exception.

On the other hand, the problem of UK exit from the EU is supposed to be completed on January 31. However, there is a risk which is quite high, that this Brexit epic may drag on, but in our opinion, at least for the first quarter of the new 2020. But unfortunately, the problems of the divorce of Britain and the EU, from which the negative impact of this event on the economies of continental Europe and "foggy Albion" will have a significant impact on the exchange rates of the euro and sterling for a long time to come even if everything is resolved.

Now, let's move to the issue of monetary policies of the largest world Central Banks. We expect them to remain soft and super soft. The Fed will pause the decision on rates, which may support the exchange rate of the American currency, especially against the euro. The ECB, most likely in the wake of Brexit, as well as the weakness of the European economy, will still expand incentive measures, which will weaken the single currency. In turn, sterling will fully depend on the situation with Brexit and its consequences. On the other hand, the Japanese yen will continue to be held hostage to its function of a safe haven currency, as will the Swiss franc. Commodity and commodity currencies will depend entirely on the situation around the Washington-Beijing trade negotiations, which will also have a significant impact on the dynamics of crude oil prices while stocks markets are likely to remain in favor, primarily due to the soft monetary policies of the world's Central banks.

Another event will not pass the markets - this is the election of a new US president. The tense struggle between D. Trump and the Democratic Party will only escalate, which could cause market unrest. Therefore, in general, we believe that nothing catastrophic will happen in the global economy.

Forecast of the day:

The USD/CAD pair is trading above the level of 1.3100. Thus, we consider it possible to sell it after crossing this level with the target of 1.3060 in the wake of an increase in crude oil prices.

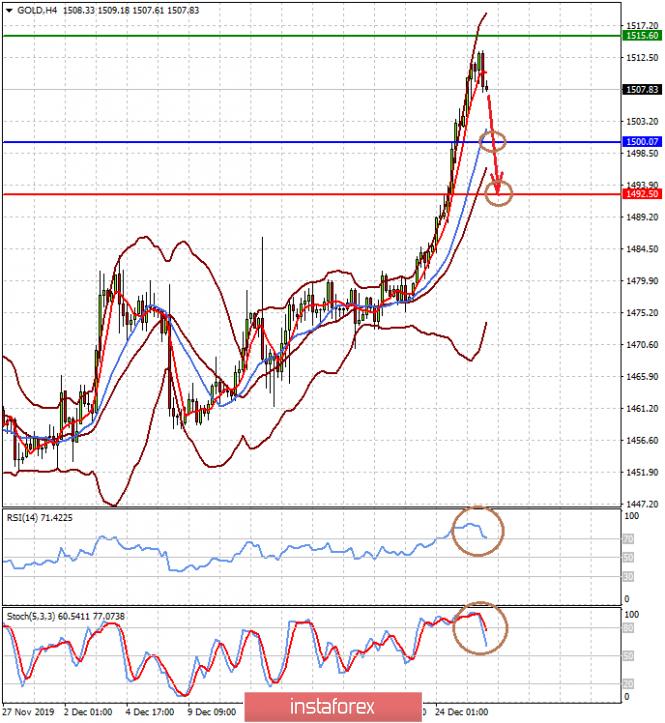

Gold quotes could not break through the strong resistance level of 1516.00. We consider it possible to sell it with a likely reduction in price to 1500.00, and then to 1491.00, which will correspond to Fibonacci retracements of 23% and 38%.