US stock indices reached new record highs after confirming the deal between the US and China, S&P managed to add 27% since the beginning of the year, and NASDAQ grew by 33%. Moreover, the results of the elections in the UK also contributed to reducing uncertainty, and as a result of which, the demand for profitable assets is growing, while bonds are being actively sold.

At the same time, euphoria regarding a trade transaction may turn out to be temporary. In essence, progress is only in the fact that new tariffs have not been put into effect, however, the key contradictions have not been removed. Thus, clarity may come on Friday. Optimism is likely to continue until this time.

NZD/USD

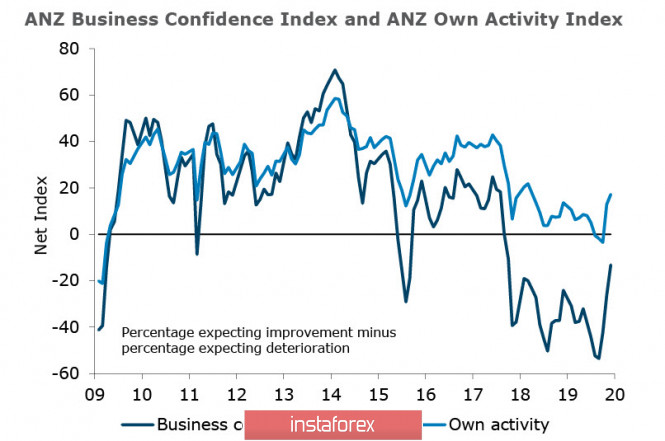

New Zealand's macroeconomic indicators look confident, and some slowdown in growth has not led to a change in the overall picture. Moreover, Westpac notes the highest level of consumer sentiment since Q1 in 2018, RBNZ sees the level of business optimism at the highest since October 2017, and ANZ notes a marked improvement in confidence in the business environment.

In addition, the rise in the ANZ Business Outlook survey is observed in almost all components of the index, but the most important component is growth in production. Most companies announce their intention to expand recruitment and increase investment, which looks rather unexpectedly against the backdrop of a global trend to reduce production.

In general, a positive reversal of a number of leading indicators can be noted, with GDP expected at 2.3% at the end of 2019. Obviously, part of these changes is explained by the rapid decrease in the RBNZ rate by 0.75% this year, and ANZ believes that this will not end there and another reduction will occur next year.

On Thursday, updated data on GDP in the 3rd quarter will be published. Trade balance in November, optimistic forecasts, and expectations support the growth of Kiwi, despite the short-term technical overbought.

The resistance zone of 0.6635 / 50 may turn out to be too strong for the current impulse; therefore, a correction to 0.6575 with subsequent consolidation is likely. On the other hand, any decline can be used to make purchases, since the momentum is still strong and the chances of reaching the year maximum of 0.6790 are quite high.

AUD/USD

The publication of the minutes of the RBA meeting did not bring any new information to the markets; the Australian dollar did not respond to the publication. The RBA, in turn, noted that a number of central banks have loosened monetary policy in response to the risks of declining global economies and suppressing inflation, which has led to better financing conditions for corporations, and a recent reduction in the RBA rate to lower lending rates for households.

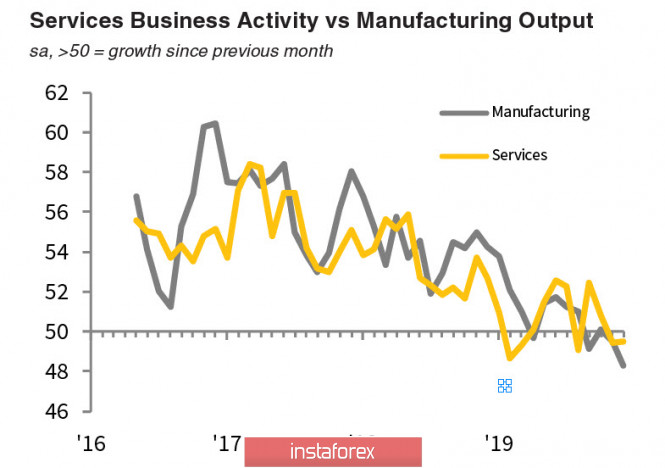

Meanwhile, financial conditions are improving, but this improvement is only reflected in the growth of stock indices. In a December business activity survey, Commonwealth Bank noted a further decline in PMI, with the manufacturing sector showing the sharpest decline in 44 months. As a result, production is declining, despite the improvement in the situation with new orders.

For the first time in 5 months, companies reduced their workforce, reduced raw material costs, and the overall situation is hardly positive. The low level of spending noted in the 3rd quarter will continue in the 4th, which increases the risk of weaker GDP growth than the market sees.

In turn, the pause in the actions of the RBA seems justified so far, but the November employment report, which will be published on Thursday morning, is of particular importance, since its results can lead to decisive action by the RBA at the next meeting.

As a result, the Australian dollar joins the wave of optimism, despite the rather weak internal indicators. The growth of AUD also relies on expectations of rising prices for raw materials, primarily oil. On Tuesday morning, AUD/USD is located near the support zone of 0.6850 / 60. From these levels, an attempt to resume growth is possible in order to gain a foothold above the resistance of 0.6924.

The material has been provided by InstaForex Company - www.instaforex.com