Problems in the manufacturing sector of the eurozone persist, while the dynamics of the service sector again began to show positive growth. A significant gap between sectors continues to widen, but so far there are no signs that the reduction in the production sector is gradually affecting the services sector. It should be noted that the risk of aggravation of the situation after the elections in the UK and the agreement reached by the US and China, which I described in more detail in my morning review, is also reduced.

Let me remind you that China and the United States managed to find a common language and agree on mutual concessions within the framework of the first phase of the trade agreement between the two countries. At the end of last week, U.S. President Donald Trump announced the upcoming reduction of duties to 7.5% for some goods from China, and canceled the new duties scheduled for December 15, this was done after China, as part of the agreement, agreed to huge acquisitions agricultural products and a number of other energy products.

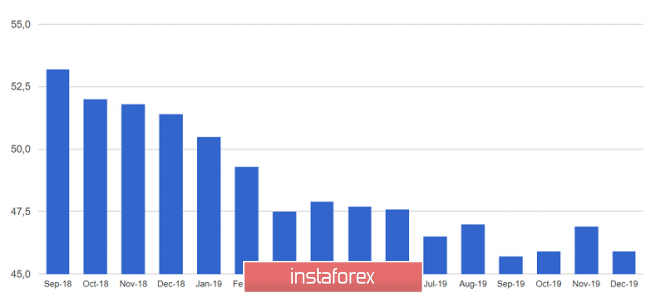

Returning to the report on the manufacturing sector, it is worth noting that the sector weighed on deep into the recession, and some signs of recovery that could be observed at the end of this summer did not make it possible for manufacturers to maintain a similar pace by the end of this year. Now we can safely say that the eurozone economy is ending 2019 in difficult conditions, and, given the gloomy prospects for the next year and the high probability of a further reduction in rates, this does not bode well for buyers of risky assets.

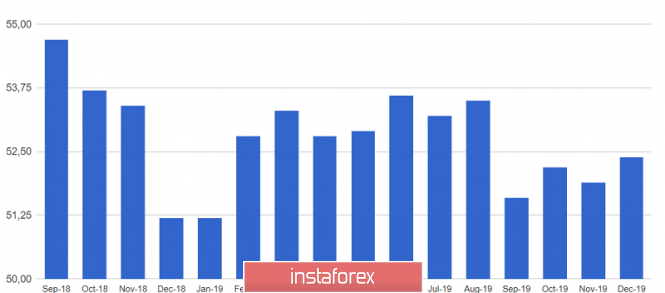

As I noted above, the preliminary index of PMI for the manufacturing sector of the eurozone fell to 45.9 points in December this year, remaining below 50 points, indicating a decrease. On the contrary, the forecast was an increase in the index to the level of 47.3 points. As for the service sector, here the preliminary index of PMI showed positive dynamics and grew to 52.4 points in December against 51.9 points in November with a forecast of 52.0 points.

The composite index remained unchanged at the level of 50.6 points in December against the same indicator in November of this year.

Given the low market volatility, the technical picture in the EURUSD pair has not changed. The upward trend is gradually slowing, and the growth of risky assets caused by the election results in the UK, gradually came to naught. At the moment, the bears will strive to push the trading instrument below the support of 1.1110, which will lead to the lows of 1.1070 and 1.1040. With an upward correction, which may continue after a report on manufacturing activity in the US, problems for euro buyers may begin in the resistance area of 1.1160. Larger players will prefer the 1.1200 level, which is a kind of psychological mark. Its breakthrough will lead to the continuation of the upward trend of the European currency.

GBPUSD

The British pound, apparently, will gradually be stuck in a narrow side channel, and a breakthrough of resistance at 1.3530 will occur only after the situation with Brexit has been clarified. The pound experienced pressure after today's preliminary report, which indicated a decrease in activity in the country's manufacturing and services sectors.

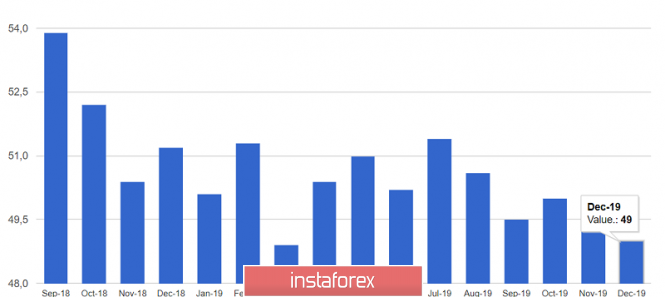

It is important to note that the composite index fell to its lowest level since 2016.

According to the data, the preliminary PMI for the services sector fell to 49.0 points in December 2019, after a slight increase to 49.3 points in November of this year. The manufacturing PMI also dropped, but even more, to 47.4 points from 48.9 points in November. As a result, the composite index fell to 48.5 points against 49.3 points in November. Values below 50 indicate a decrease in activity.

The decline in activity in two areas was directly related to the political uncertainty within the country, as well as to the lack of clarity about Brexit, which remains today. Weak global growth is also one of the reasons for the decline in sectors.

As for the technical picture of the GBPUSD pair, then, most likely, the pound will gradually lock in the side channel, and volatility will decrease. Strong support at 1.3320 and resistance at 1.3415 will be the main reference points for buyers and sellers. Going below 1.3320 will quickly push the trading instrument to the lows of 1.3260 and 1.3200. A break above the resistance of 1.3415 will lead to an update of the monthly high at 1.3520.

The material has been provided by InstaForex Company - www.instaforex.com