Hello, dear colleagues!

The past week has been extremely volatile. The market was stormy, especially at the end of trading on December 9-13. The main influence on price movements was exerted by the elections in the UK and the next statements of US President Donald Trump, in his widely known Twitter account.

As for the British elections, there was a convincing victory won by the conservatives led by the current Prime Minister Boris Johnson. I will write about this in more detail in the next review.

On Friday night, Donald Trump tweeted that the trade deal with China is misinterpreted and far from resolved. Let me remind you that before this, the media, and the same Trump expressed confidence in the soon resolution of trade contradictions between Washington and Beijing through an agreement.

In theory, market participants have long had to get used to the extremely contradictory statements of the American leader. But the topic of a trade war between the United States and China is extremely important for the world economy, as it can significantly affect global economic growth, and provoke another global crisis.

This week, the eurozone and the US will report on the PMI indices, and the United States will publish GDP data. You can learn more about these and other events in the economic calendar. In this article, the main attention, as usual, will be paid to technical analysis and price charts of the euro/dollar currency pair.

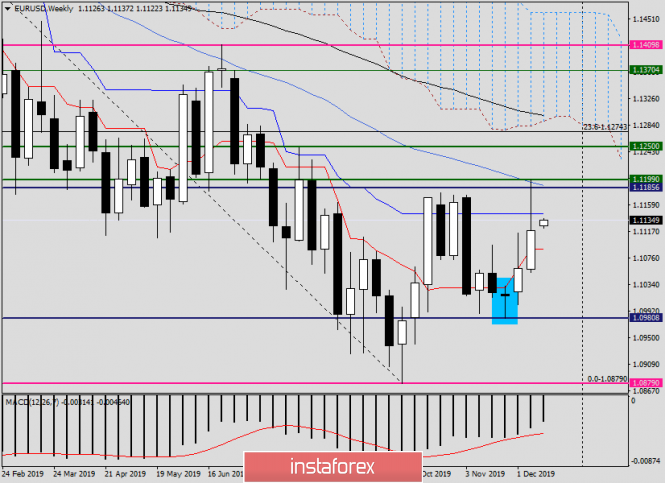

Weekly

Last week was mixed. Although the EUR/USD pair ended the trading on December 9-13 with a strengthening, the huge upper shadow of the last candle leaves many questions about the further ability of the quote to moving in a northerly direction. The upper shadow is much larger than the bullish body itself, this is the main point that allows us to doubt the prospects of further growth.

As you can see, the Kijun line of the Ichimoku indicator, the level of 1.1185 and the 50 simple moving average provided immediate resistance to the further rise. Now, to continue the rise, it is necessary to rewrite the previous highs at 1.11199 and close the trading of the current five-day period above the sign and a very strong level of 1.1200. Frankly, the task is not easy. Taking into account the shape of the last weekly candle and the price zone (near 1.1200), where the maximum values were shown, I see more chances at the trading on December 16-20 in a downward scenario. If this forecast is correct, we are waiting for the euro/dollar at 1.1090, 1.1053 and possibly near the key level of 1.1000.

In the case of alternative development of events, the euro will first have to rewrite the last highs at 1.11199, after which the players will have to overcome the important and very strong technical area of 1.1220-1.1250. Only a consolidation above 1.1250 will signal the further ability of the euro/dollar pair to move in a northerly direction. In this scenario, the subsequent targets will be 1.1280, 1.1300, 1.1335, and 1.1370. But that's another story. The number one task for EUR/USD bulls is to close trading on December 16-20 above the significant level of 1.1200.

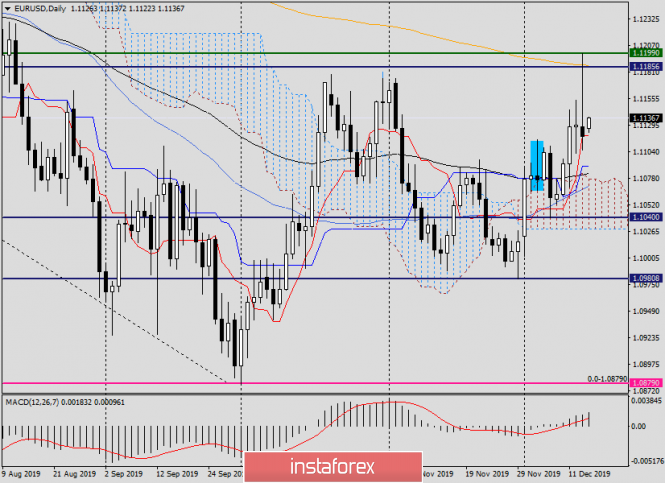

Daily

The candlestick patterns that appeared on the daily chart on December 12-13 should be considered bearish. For the picture to change, you need a big white candle with a closing price above Friday's highs of 1.11199. Once again, I emphasize that this mission is difficult to accomplish. The candlestick's upper shadow is too large for December 13, which indicates an extremely strong resistance of sellers near 1.1200.

In my personal opinion, at the current and subsequent trades, it seems more rational to search for points to sell the EUR/USD pair. If so, it is better to look for points to open short positions on the euro/dollar on the rise to 1.1142 and 1.1183.

At the same time, quite strong support lies in the area of 1.1000-1.0950, therefore purchases from here are technically quite justified. However, do not forget that long positions, in my opinion, have a corrective nature, and at any time can be replaced by a movement in the opposite direction.

The conclusion and the result are as follows: sales, at the moment, look like the main trading idea, purchases, counting on the correction, which creates much more risks. The final decision is exclusively individual. I have the honor to express my point of view, whether or not you agree with it.

Success and profits!

The material has been provided by InstaForex Company - www.instaforex.com