4 hour time-frame

Amplitude of the last 5 days (high-low): 65p - 66p - 50p - 82p - 108p.

Average volatility over the past 5 days: 75p (average).

On Friday, GBP/USD currency pair began a downward movement, which was justified immediately for a number of factors. Firstly, the correction was clearly brewing after the pair's 300-point growth on the night when the vote was counted in the parliamentary elections. Even then, the probability of the victory of the party of Boris Johnson grew to almost 100%, and traders worked out this information. Secondly, do not forget that the pound as a whole has been growing for the last two or three weeks almost without a break based on the same high probability that the Conservative Party will win the election. Thirdly, if we exclude a few weeks of flat, then the British currency has been growing non-stop for more than two months, since October 10. Thus, after the election is left behind, the best time has come to take profits and begin the correction of the pound / dollar pair. In addition, do not forget that the currency pair traders all this time (more than 2 months) have zealously ignored absolutely all macroeconomic reports and data, both from the UK and from the United States. It cannot be that traders never worked out this information or continued to ignore any macroeconomic reports in the future. And if so, then the pound will begin to fall because the UK economic indicators remain at the level "below the plinth". Recent months have shown a serious slowdown in inflation, a fall in business activity in all sectors, a drop in industrial production, and negative or zero GDP growth. As with such indicators of the state of the economy, the British pound will be able to continue growth against the US currency in the issuing country whose macroeconomic statistics began to accelerate and grow again in recent weeks. Moreover, we continue to insist that Brexit is definitely a positive development after a three-year saga and it seems that the current composition of the Parliament will finally be realized, but the UK's secession from the EU itself is another negative development for the economy, Great Britain and, accordingly, pound sterling. Thus, we are still waiting for the pair to turn down and start a new long-term downward trend. This, of course, is not the only possible scenario, but the most likely, from our point of view, and to be more confident, you need to wait for the reversal down technical indicators. By the way, we remind you that the Bank of England may lower the key rate at the next meeting or do it immediately after January 31.

Meanwhile, Boris Johnson, who remained the country's prime minister, continues to celebrate the victory and hand out interviews. Johnson has already stated that "this is an exceptional victory for his party" and thanked absolutely all the inhabitants of Great Britain, and those who voted for the conservatives, and those who voted for other parties. In the near future, Boris Johnson is going to vote in Parliament on his deal with the European Union and now, no one expects that any problems will arise with this. Most likely, an agreement with the European Union will be approved and in early 2020, the UK will begin an 11-month transition period before the country finally leaves the Alliance. On the other hand, the leader of the Labor Party, Jeremy Corbyn, apologized to the party members for the failed result, and promised to regain the confidence of the residents who had previously voted for the Labor Party, but now they have changed their choice and even hinted that he might resign. "We will learn from this defeat, first of all, after listening to the Labor voters whom we lost ... This party exists to represent them. We will regain their trust." Corbyn said. The leader of the party, which won 59 seats less than in the 2017 elections, said: "The election results were a crushing blow for everyone who needs real changes in the country. I wanted to unite the country that I love, and I am sorry that we did not manage. I take responsibility for that." Well, the leader of the third most popular party in the UK, Nicola Sturgeon, said that the results of the Scottish party should return Boris Johnson to "reality" and recognize that the party received the right to hold a second referendum on independence, winning in 48 counties. "The results of this referendum on Scottish independence will need to be taken much more seriously than in 2014," Sturgeon said. Thus, as we see, the Scottish government does not want to leave the European Union, which has been openly stated more than once, but wants to leave the United Kingdom, because it understands that now Boris Johnson and his plans can no longer be stopped.

Based on all this, we believe that the most interesting thing for the UK and the British pound is just beginning. Now the "transition period", negotiations on trade relations between the UK and other countries, and the "battle for Scotland" will begin. And all this is against the background of continuing to slow down the UK economy.

Trading recommendations:

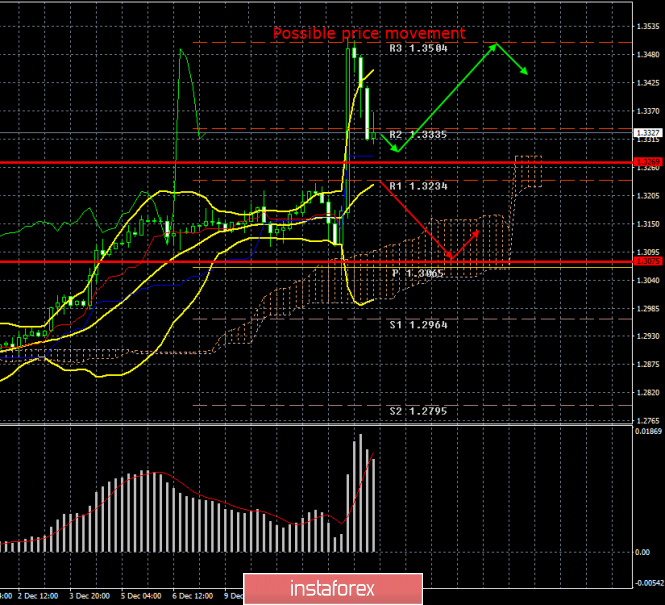

GBP/USD has started a downward correction, which could develop into a full-fledged downward trend. However, while the price is above the critical line, the chances remain that the British currency will continue to grow with targets around 1.3504. Thus, a rebound in the price from the Kijun-sen line can provoke the completion of the correction and leave bulls in business. However, breaking through the critical line for traders will be the first step towards a new downward trend with the first goals near the lower border of the Ichimoku cloud.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.

Support / Resistance Classic Levels:

Red and gray dotted lines with price symbols.

Pivot Level:

Yellow solid line.

Volatility Support / Resistance Levels:

Gray dotted lines without price designations.

Possible price movement options:

Red and green arrows.

The material has been provided by InstaForex Company - www.instaforex.com