The pound is under pressure again and continues its downward correction after the rapid growth that occurred against the backdrop of the victory of the Conservative Party of Great Britain in parliamentary elections. Yesterday's weak report on the service sector, together with today's data on the UK labor market, where there was a sharp increase in the number of applications for unemployment benefits, intensified discussions once again about the likely reduction in interest rates in the UK next year. The unemployment rate itself remained unchanged from August to October 2019.

The problem, in addition to the growth in the number of applications, was also represented by the growth rate of wages, which turned out to be the lowest between March and May. This suggests a weakening inflationary pressure, which can also strengthen discussions on lowering interest rates without fears of a sharp inflation jump.

According to the data, the unemployment rate was 3.8%, and unemployment among women fell to 3.5%. However, applications for unemployment benefits in the UK in November rose by 28,000, turning out to be much worse than the forecasts of the economists. In total, the number of unemployed in the UK fell by 13,000 from August to October 2019 according to the MOT.

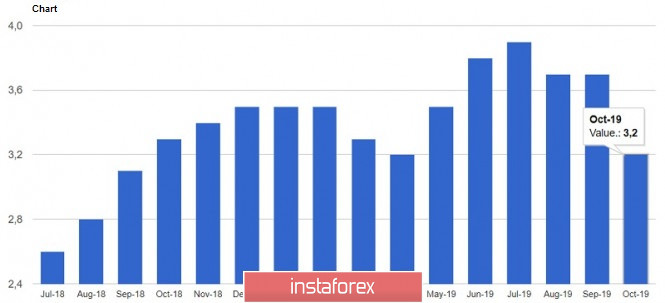

As I noted above, the pressure on the pound was exerted by the report on the slowdown in wage growth, which will negatively affect retail sales by the end of the year. Thus, wages increased by only 3.2% compared to the same period of the previous year, while the indicator increased immediately by 3.6% in the previous three-month period. Due to this, economists expected higher wage growth. In this case, the average weekly earnings rose from August to October by 3.5% against 3.6% in the previous three-month period. Now, reducing the number of vacancies is an alarming signal for the economy, as many employers refrain from making decisions on hiring new employees.

If we consider the slowdown in wage growth in the context of increasing inflationary pressure, the probability of reducing, if necessary, the Bank of England interest rates increases significantly. However, it is worth recalling that during the last meeting, the English regulator, on the contrary, stated that it was ready to raise interest rates, provided that Brexit did not have too negative an impact on the country's economy.

In addition, pressure on the pound is also linked to increased fears that the UK might exit the EU at the end of next year without a new trade agreement. This is discussed in more detail in my previous reviews. The actions of Boris Johnson indicate this precisely so far after the victory of his party in the elections. If a crude agreement is signed with a number of shortcomings, the country's economic prospects will be overshadowed, and the pound will return to the downward channel at the beginning of next year, as additional measures of stimulating the economy by the Bank of England will be required.

As for the technical picture of the GBP/USD pair, the correction has reached quite important levels, from which profit-taking on short positions is noticeable, as well as the gradual return of large buyers to the market. Meanwhile, support 1.3160 is a quite important level, on which a further upward trend may depend. Bulls, in turn, need a return to resistance 1.3220, which will give buyers confidence and throw a pair of back to the highs of 1.3270 and 1.3320.

EUR/USD

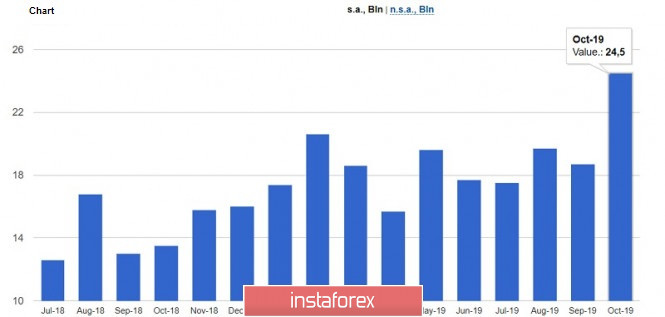

The European currency continues to trade in a narrow side channel after the evidence that the positive balance of foreign trade in the eurozone increased this year in October. However, this was only able to keep EUR/USD from another decline, while large players do not seek to return to the market. According to the report, the balance rose to 28.0 billion euros against 13.2 billion euros in October 2018, which is clearly a good indicator.

Meanwhile, S&P Global Ratings predicts that the European Central Bank will lower its deposit rate by another 10 basis points next year in March if the situation in industry and the economy does not improve. Apparently, the asset repurchase program will also be expanded. Currently, the deposit rate is at the level of -0.5%.

Today, data on industrial production in the US for November of this year are expected, and a statement by Mark Carney, Bank of England Governor, will also take place late at night.

As for the technical picture of the EUR/USD pair, it remained virtually unchanged. At the moment, the bears will strive to push the trading instrument below the support of 1.1110, which will lead to the lows of 1.1070 and 1.1040. On the other hand, problems for euro buyers may begin in the resistance area of 1.1165, with an upward correction, which can be continued anytime soon. Thus, larger players will prefer protection level 1.1200, which is a kind of psychological level. Its breakthrough will lead to the continuation of the upward trend of the European currency.

The material has been provided by InstaForex Company - www.instaforex.com