On Tuesday, the economic data published in the United States looks quite stable and without a noticeable deviation from forecasts. As a result of which stock indices are close to the record levels reached the night before. Moreover, industrial production in November showed an increase of 1.1% after two months of decline, the economic optimism index from IBD / TIPP showed 57p - the highest since May, the dollar remains in consolidation mode against most currencies G10.

The markets are trying to assess the prospects for the development of trade negotiations between the US and China, since the demand for the dollar as the main refuge currency directly depends on their success. However, there is some lull in the markets, while players prefer to be careful. Perhaps, some clarity will come on Friday.

EUR/USD

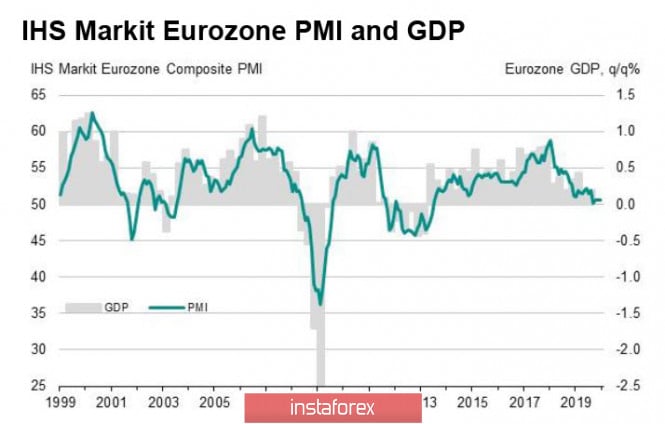

The industrial decline in the eurozone did not end - this is the main conclusion of the publication on Tuesday of the PMI Markit indices. On the other hand, the composite index remained stable at 50.6p, which indicates a slight expansion, but it was achieved solely due to the services sector, which showed growth to 54.2p, and production PMI fell to 45.9p.

The optimism that currently dominates the markets, based on the reduction of uncertainty due to the Brexit factor and the conclusion of the first phase of the US-China trade deal, has not yet been reflected in the PMI reports. The fourth quarter appears to be weak for the eurozone.

The ECB left the monetary policy unchanged at the last meeting, but announced its readiness to adjust its instruments. Perhaps this is what is happening - both inflation and economic growth are so unconvincing that there are reasons for another rate cut in March.

Technically, EUR/USD remains in the bullish channel, despite a shallow correction. The growth of the euro is supported by weak prospects for the dollar and an improvement in the prospects for global recovery. Now, support 1.1110/15. If the euro goes a little lower, then the chances of going sideways will increase. If support persists, then an attempt is likely to return to zone 1.1175 / 85.

GBP/USD

The pound is ready to begin a corrective reversal after the rapid growth before the election, for which there are several reasons.

Firstly, it is a weak economic growth. PMI indices published on Monday showed a slowdown in business activity across the entire spectrum of the economy - the index fell from 48.9p to 47.4p in the manufacturing sector, while in the services sector, it declined from 49.3p to 49p. The probability of seeing negative GDP growth rates in the 4th quarter increased, that is, the NIESR forecast of zero growth may be too optimistic.

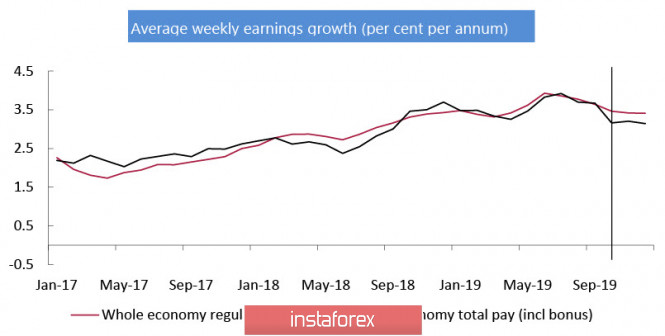

Secondly, wage growth is slowing. Growth for 3 months through October inclusive amounted to 3.5% excluding bonuses, but 3.2% with bonuses. As we can see, both indicators are worse than forecasts and worse than data a month ago.

The reduction in uncertainty gives a chance that growth will resume, but it is unlikely to end up sustainable since the growth in real wages (and adjusted for inflation is only 1.5% taking into account premiums) is ahead of productivity growth and growth in labor costs.

Thirdly, the political uncertainty, which would seem to have decreased after the convincing victory of the conservatives in the general election, is returning as negotiations with the European Union regarding the future trade agreement come to the fore. Moreover, negotiations will begin immediately after January 31, since the parties will have only 11 months to work out a full agreement, which is clearly not enough, given the world experience in developing such agreements. In turn, Boris Johnson introduced a bill to parliament that limits the possibility of extending the transition period, which increases the chances of breaking up relations without any agreement at all.

Technically, GBPUSD has not yet exhausted the strength of the upward impulse. Strong support is in the zone of 1.2960 / 3010, which will decide whether the pound will go into correction or continue to increase. Thus, the chances of resuming growth are still higher than the development of correction.

The material has been provided by InstaForex Company - www.instaforex.com