The quotes for Brent and WTI futures soared to September highs, thanks to the OPEC + agreement, the willingness of the United States and China to sign a Phase 1 trade deal, positive macroeconomic statistics on the Celestial Empire and the victory of the Conservative Party in the parliamentary elections in Britain. The last time the variety of North Sea was above $ 65 per barrel was during the attacks on Saudi Arabia, and if it was a shock during the first half of autumn, then now, it is a set of events that is quite logical from the point of view of fundamental analysis.

Let investors doubt that an increase in OPEC + liabilities from 1.2 to 1.7 million b / s will be able to ensure stable price increases, however, according to the cartel itself, the agreement will balance the market in 2020. In addition, the Organization of Petroleum-producing Countries, and the IEA believe that the decline in international trade has reached a low point. The deal on the extension of the Vienna agreement to reduce production is very constructive according to Black Gold Investors. It helps smooth out the factor of increasing shale oil production in the USA. At the same time, further dynamics of black gold will depend on global demand.

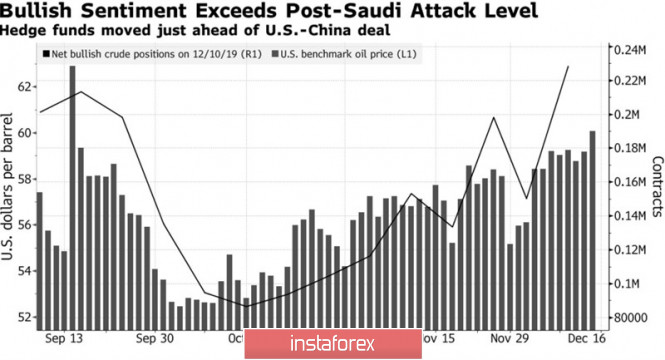

In this regard, Washington and Beijing's willingness to sign a trade agreement and positive macro statistics from China support the Brent and WTI bulls. The Celestial Empire, according to the White House, is ready to increase imports of American goods to $ 200 billion in two years, including imports of agricultural products - to $ 40-50 billion. In response, the States reduced tariffs from 15% to 7.5% by $ 120 billion in supply from China and have not introduced new ones since December 15. US stock indices saluted information about the imminent conclusion of the agreement with new historical highs. Thus, it is interesting that speculators on the eve of an important event increased their net longs by WTI by 52%, by Brent - by 13%.

Dynamics of speculative positions in oil

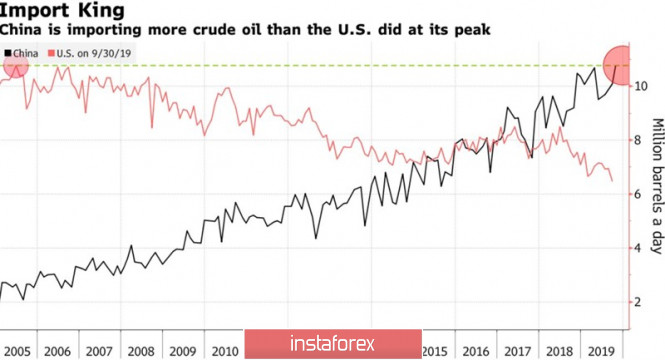

Moreover, oil bulls were supported by the acceleration of Chinese industrial production and retail sales from 4.7% to 6.2% and from 7.2% to 8% in November. China is the largest consumer of black gold, so the positivity from its economy, as a rule, contributes to higher prices. Indeed, the Asian country imported 11.8 million b/d of oil in November, breaking the record set by the United States in June 2005 at 10.77 million b/d.

Dynamics of American and Chinese oil imports

At first glance, such a factor as the victory of the Conservatives in the parliamentary elections in Britain is not able to influence the situation in the black gold market. In fact, reducing the risks of a disorderly Brexit to a minimum in the medium term should support both the pound and the euro. A significant share of these currencies in the structure of the USD index means that a decrease in political risks in Foggy Albion will negatively affect the US dollar. Moreover, as Brent and WTI are traded in US currency, its weakness will contribute to the continuation of the rally of the main grades of oil.

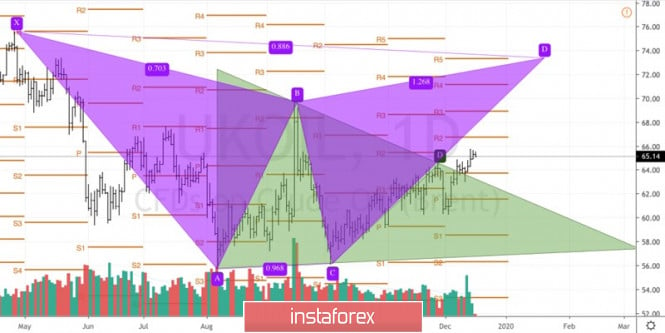

Technically, the chances of implementing the target by 88.6% for the Double Base pattern increased after Brent went beyond the green triangle and consolidated above support at $ 63.8 per barrel.

Brent daily chart