In September, after a period of rapid growth, the price of gold stopped near the level of $ 1,500. How long will the consolidation continue, should traders and investors expect a decline in the price of gold and when growth is possible? We will analyze in this article.

The summer of 2019 was very favorable for gold. Within three months, the price rose from the level of 1300 to 1550 dollars per troy ounce, and it seemed that gold was about to reach the level of $ 1600, but it was not there. Thus, September turned out to be not very successful for gold, which pretty much disappointed many investors, and speculators focusing on rising prices began to suffer losses. So what really happened and what should we expect next?

In order to answer this question, we need to understand how the gold market functions and what drives the price. I must say right away that I do not pretend to the truth in the last resort and may be mistaken in my assumptions. Nevertheless, I dare to bring them to the judgment of the readers.

First of all, we need to understand that the price of gold, which is formally determined in London, is in fact determined not there, but in the USA, because the largest trading volumes are held on the New York COMEX Exchange and the Chicago CME Exchange (COMEX-CME Group), where they trade gold futures. Despite the fact that futures require physical delivery and are traded every month, financial contracts are carried out on most contracts, which means that these commodity futures are largely subject to financial seasonality.

Financial seasonality, in turn, is formed by quarterly cycles, according to which futures trading in March, June, September and December have the greatest liquidity. To prove this, let's look at the volume and Open Interest of CME Gold Futures. On Tuesday, October 8, Open Interest in the November contract was equal to 1037 contacts, and in the December contract was equal to 482703 contracts. However, gold has its own specifics, and the most liquid contracts are those that close in February, April and August, although the most liquid are June and December.

In addition to futures contracts, the exchange trades monthly options tied to a specific futures: February (G), April (J), June (M), August (Q), October (V) and December (Z). There are still weekly options, but we will not consider them.

Options trading takes place through an open auction, when the buyer and the seller independently look for each other, placing orders in the exchange terminal. It is believed that in the general case, large players sell options and small traders buy, although this is not always the case, and most traders build various option designs, but ruthless statistics say that most options close out of money (out the money), which provides sellers with a positive mathematical expectation from the transaction.

Cases where sellers suffer losses, and most of the options are closed in money (in the money), are extremely rare, but possible. This is what happened this summer, when demand for gold exceeded all possible forecasts, and the trend turned out to be strong enough to force option sellers to supply futures at unprofitable prices.

The main impulse of Gold purchases was European and American exchange-traded funds, which actively bought gold in response to various factors, whether it be a reduction in the Fed and the ECB rates, a fall in overall profitability in the eurozone, trade wars or speculative positioning in futures and options (Fig.one). As we can see from the chart below, American and European funds actively bought gold in June and September.

Fig.1: Monthly cash flows of ETFs. Source: World gold council

As a result of the price increase, in May - September, option sellers suffered losses, but does this mean that they are ready to accept them in December? By no means, in fact, losses on the December contract will mean an extremely unfortunate year for option sellers, and in this regard, we can assume that they will try to correct the situation that is not in their favor by December.

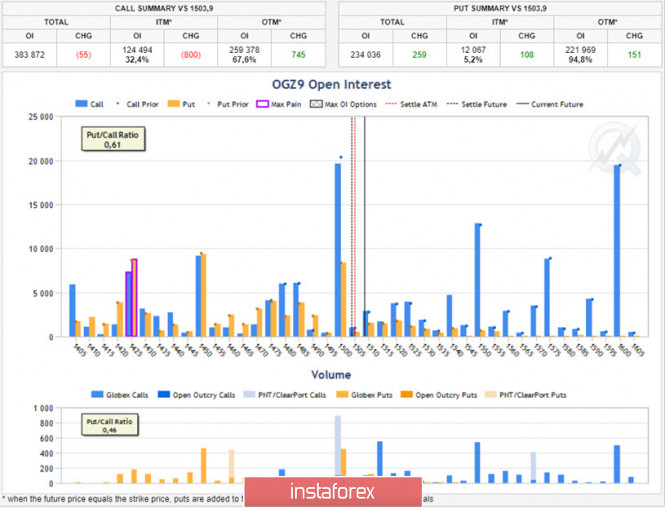

If we consider the situation in the December option contract OGZ9 (closing November 25), then it now looks like this. The Put / Call Ratio = 0.61 option ratio means that for 100 call options there are only 61 put options, and the maximum pain point for Max Pain buyers is at $ 1,425 (Fig.2). In other words, the higher the price, the greater the losses sellers will bear and the greater profit buyers will receive.

In the November option contract OGX9 (closing October 28), the ratio Put / Call Ratio = 0.71, and the MP point is located at around $ 1475. As you can see, in both contracts the interest of option sellers is significantly lower than the current futures - $ 1,510, which suggests the option of lowering the price of gold in the future in October and November.

Fig.2: The ratio of option positions in gold to the OGZ9 contract as of October 8th. CME Source

The fact that the mood in the futures market is gradually changing, says the latest report on the obligations of traders - COT, published by the US Commodity Futures Commission CFTC last Friday, October 4. According to the report, in just one week since the end of September, Open Interest in gold futures lost a fifth of open positions, falling from a record 1 million 248 thousand contacts up to 1 million 250 thousand contacts. The decline in the OI of futures in the cash gold market was reflected in the fall in prices from the level of 1,530 to 1,470 dollars per troy ounce.

Moreover, the main category of players who closed long positions in the futures market were Money Manager speculators. They belong to ETF exchange trading funds, which actively bought gold in the previous four months (Fig.one). Long positions Money Manager decreased from 309 thousand up to 254 thousand contracts in just one week. It is the category of speculators that the US Commodity Futures Commission classifies as major buyers in the commodity market. Thus, it turns out that buyers closed their long positions, but if the main buyers leave the market, then who will buy gold and move the price up?

It is assumed that closing long positions of speculators was by no means an accidental positioning. Perhaps, the drivers that are moving the price so far have stopped working, and some traders prefer to take profits in anticipation of new events. However, the technical picture that each of us can observe in the forex terminals fully confirms my assumptions.

So, what conclusion can I draw from my thoughts? According to the futures and options market, as well as reports on the positions of COT traders, I assume that the price of gold will undergo a correction to its rising trend in the daily time in October and November this year. This will enable investors to buy gold at lower prices, in turn, traders will be able to earn on lowering prices.

In my opinion, the rise in the price of gold will begin no earlier than the second half of November, on the night of New Year holidays, and most likely, after the December option contracts are closed, as well as after new growth impulses appear on the market. Such impulse may include risks of falling stock markets, a policy of lowering Fed rates, positioning in the futures market, and the celebration of the lunar new year, which will be held in China and Asia from January 25 and the next few weeks.

The material has been provided by InstaForex Company - www.instaforex.com