4-hour timeframe

Amplitude of the last 5 days (high-low): 60p - 58p - 43p - 39p - 55p.

Average volatility over the past 5 days: 51p (average).

On Wednesday, October 9, the EUR/USD pair was unable to continue the downward movement that had begun the day before. Thus, the pair moved to the side channel, which is signaled by Bollinger Bands, now directed sideways. In the past few days, traders clearly cannot determine which way to trade the pair, and this is not surprising, since there were no important macroeconomic publications from the very beginning of the week. There are only daily speeches by Jerome Powell, who, however, does not say anything that traders could respond by rough opening of positions. Yesterday there was potentially important information that the Federal Reserve plans to start buying assets from the open market. Many traders even considered that the regulator resumes the quantitative easing program that it had already conducted but stopped its implementation long ago, but Powell explained that this is a temporary and small-scale redemption of short-term bills, and not about buying long-term government bonds. Thus, we can say that the news from the United States and the European Union, in principle, is coming, but there is no data that can move the pair from its spot. Based on this, we can only wait for these very data or the moment when the market will move for other reasons. These may be technical reasons, this may be the entry into the international currency market of a bank with a large application for the purchase of euros or dollars, which will cause a sharp change in supply and demand for this currency and, accordingly, a change in the exchange rate.

By the way, Jerome Powell has another speech set for tonight and we do not recommend missing it, although the last three of his speeches were not very interesting for the forex market. In addition, the minutes of the Fed meeting is set to be released today, however, these minutes very rarely contain any unexpected information. The FOMC minutes is rather a written summary of the results of the Fed meeting, that is, traders will not learn anything new from it.

The last two trading days of the week will be a little more interesting than the first three, but it is very difficult to call them fascinating from a fundamental point of view. The value of inflation in the United States for September will be published on Thursday, and, according to analysts, a slight acceleration is expected to reach 1.8% y/y. We can check whether Jerome Powell was right when he recklessly declared that inflation was at "acceptable levels". Last month, we recall, many also expected an acceleration in the consumer price index, but instead there was a slowdown. A speech by Mario Draghi will take place on Friday, which is unlikely to please buyers of the European currency, and is also unlikely to surprise investors at all. Mario Draghi will leave his position at the end of the month,so it makes little sense to conduct active work to change the monetary policy of the ECB now. Moreover, at the last meeting, he already announced a reduction in the deposit rate and revival of the QE asset-purchase program in November. Thus, it is unlikely that the ECB will go twice in a row to reduce the rate, therefore, nothing special can be expected from Mario Draghi.

Trading recommendations:

The EUR/USD pair went sideways. Thus, traders are now not recommended to conduct any trade. It is recommended to wait until the flat is completed, the Bollinger Bands widen to one side and only then should you open new positions for the euro/dollar pair.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

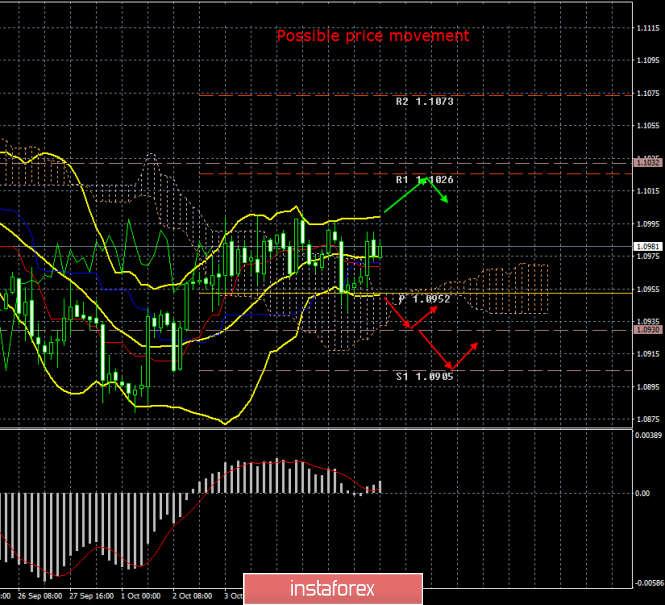

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.

The material has been provided by InstaForex Company - www.instaforex.com