Here are the options for the development of movement in an integrated form of currency instruments in H4 - #USDX, EUR / USD, GBP / USD and USD / JPY from October 10, 2019.

Minuette (H4 time frame)

____________________

US dollar Index

The movement of the dollar index #USDX from October 10, 2019 will continue to be determined by the development and the direction of the breakdown of the boundaries of 1/2 Median Line channel (98.77 - 98.95 - 99.15) Minuette operational scale fork. The details are shown in the animated chart.

The breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 99.15) of the Minuette operational scale fork will direct the movement of the dollar index to the boundaries of the 1/2 Median Line Minuette channel (99.30 - 99.45 - 99.57) with the prospect of reaching the lower boundary of the ISL38.2 (99.70) equilibrium zone of the Minuette operating scale fork.

In contrast, in case that the lower boundary of the 1/2 Median Line Minuette channel (support level of 98.77) is broken, the option of developing the downward movement #USDX to the targets is the local minimum 98.63 - the upper boundary of the ISL38.2 (98.40) equilibrium zone of the Minuette operational scale fork.

The details of the #USDX movement are presented in the animated chart.

____________________

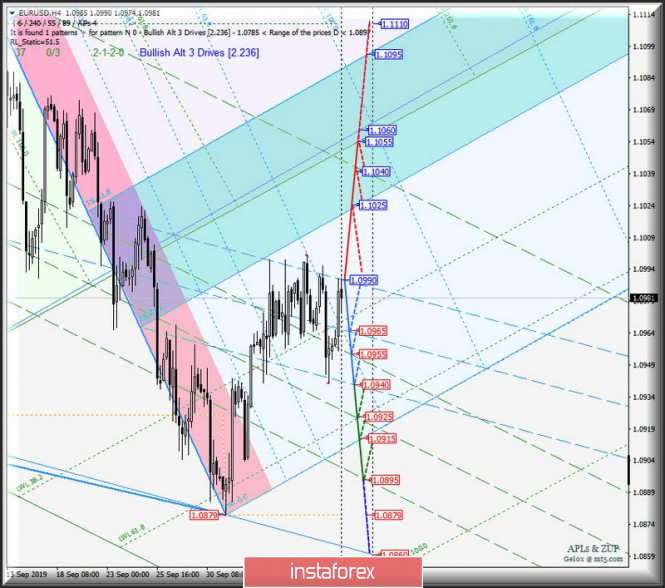

Euro vs US dollar

The single European currency continues to remain inside the 1/2 Median Line channel (1.0940 - 1.0965 - 1.0990) of the Minuette operational scale fork, the direction of breakdown of which will determine the further development of the EUR / USD movement from October 10, 2019. The marking the movement inside the 1/2 Median Line channel can be seen at the animated chart.

The breakdown of the lower boundary of the 1/2 Median Line channel (support level of 1.0940) of the Minuette operational scale fork - the development of the downward movement of the single European currency can be continued to the goals - 1/2 Median Line Minuette (1.0925) - the initial line of SSL Minuette (1.0915) - the lower boundary of the 1/2 Median Line channel (1.0895) of the Minuette operational scale fork.

In contrast, the breakdown of the upper boundary of the 1/2 Median Line Minuette channel (resistance level of 1.0990) will make it relevant to continue the development of the upward movement of EUR / USD to the equilibrium zone (1.1025 - 1.1060 - 1.1095) of the Minuette operational scale fork.

The details of the EUR / USD movement options are shown in the animated chart.

____________________

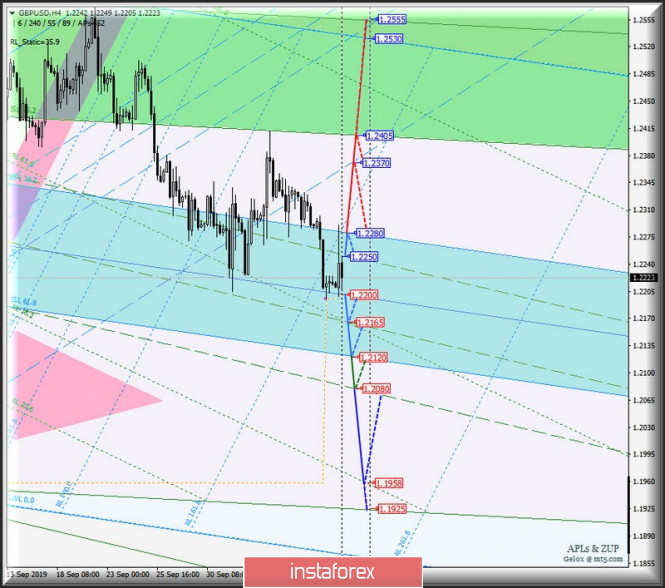

Great Britain pound vs US dollar

The movement of Her Majesty's GBP / USD currency from October 10, 2019 will be determined by the direction of the breakdown of the range :

- resistance level of 1.2250 at the upper boundary of the 1/2 Median Line channel Minuette operational scale fork;

- support level of 1.2200 of the 1/2 Median Line Minuette operating scale fork.

The breakdown of the 1/2 Median Line Minuette (support level of 1.2200) - the development of Her Majesty's currency movement towards goals - 1/2 Median Line Minuette (1.2165) - lower boundary of the ISL61.8 (1.2120 equilibrium zone of Minuette operational scale fork - lower boundary of 1/2 Median Line channel (1.2080) of the Minuette operational scale fork with the prospect of reaching a minimum of 1.1958.

Meanwhile, the breakdown of the upper boundary of the 1/2 Median Line Minuette channel (1.2250) will make the development of the upward movement of GBP / USD relevant whose goals will be - the upper boundary of ISL38.2 (1.2280) equilibrium zone Minuette operational scale fork - final Shiff Line Minuette (1.2370) - ISL38.2 (1.2405) lower boundary of the Minuette operational scale fork.

The details of the GBP / USD movement can be seen in the animated chart.

____________________

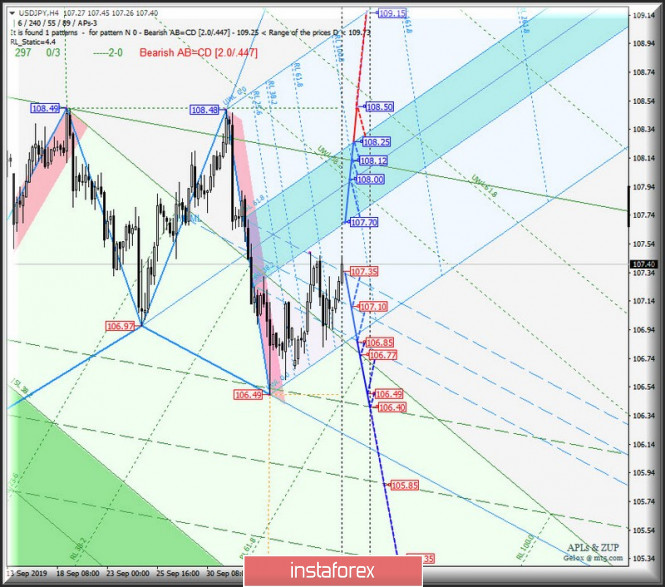

US dollar vs Japanese yen

As in the previous case, the movement of the USD / JPY currency of the "country of the rising sun" from October 10, 2019 will also be determined by the direction of the breakdown of the range:

- resistance level of 107.70 at the upper boundary of ISL38.2 equilibrium zone of the Minuette operational scale fork;

- support level of 107.35 at the upper boundary of the 1/2 Median Line channel Minuette operational scale fork.

The breakdown of ISL38.2 Minuette (resistance level of 107.70) - the development of the USD / JPY movement in the equilibrium zone (107.70 - 108.00 - 108.25) of the Minuette operational scale fork with the prospect of reaching a maximum of 108.50.

On the other hand, the breakdown of the support level of 107.35 - the movement of the currency of the "land of the rising sun" will continue in the 1/2 Median Line channel (107.35 - 107.10 - 106.85) of the Minuette operational scale fork with the prospect of reaching support levels - 106.77 (the initial SSL line for the Minuette operational scale fork) - local minimum 106.49 - the upper boundary of the 1/2 Median Line Minuette channel (106.40).

We look at the details of the USD / JPY movement in the animated chart.

____________________

The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy").

The formula for calculating the dollar index :

USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036.

where the power coefficients correspond to the weights of the currencies in the basket:

Euro - 57.6% ;

Yen - 13.6% ;

Pound Sterling - 11.9% ;

Canadian dollar - 9.1%;

Swedish Krona - 4.2%;

Swiss franc - 3.6%.

The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other.

The material has been provided by InstaForex Company - www.instaforex.com