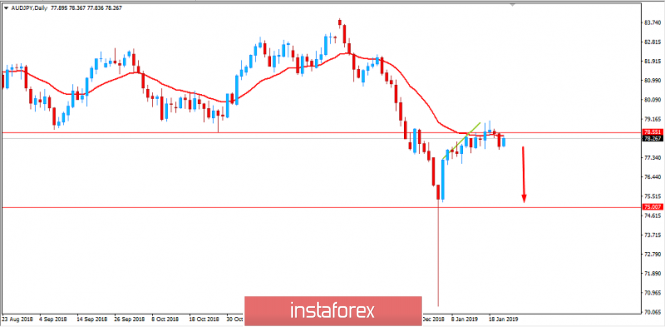

AUD/JPY has been indecisive and volatile at the edge of 78.50 area from where it is expected to sink lower. Ahead of employment reports tomorrow, AUD has been quite bearish in ligh of the recently published economic reports while JPY has promising prospects.

Recently Australia's HIA New Home Sales report was published with a significant decrease to -6.7% from the previous value of 3.6% and today MI Leading Index report was published with a decrease to -0.2% from the previous value of -0.1%. Tomorrow Australian Employment Change report is going to be published which is expected to see a drastic fall towards 17.3k from the previous figure of 37.0k while Unemployment Rate is expected to be unchanged at 5.1%. As the expectation of the employment reports are gloomy, the actual negative prints are expected to affect AUD which might lead to severe weakness.

On the JPY side, today BOJ Policy Rate was published unchanged as expected at -0.10%. The Bank of Japan cuts its inflation forecasts today but maintains its massive stimulus program. BoJ Governor Kuroda warns about the growing risk for the economy from trade protectionism and faltering global demand. Rising pressure from the US-China Trade War is adding tensions for Japan and undermining years of efforts by policy makers for durable growth. Despite efforts to encourage economic growth, there are still certain risks involved. Despite the risks, Kuroda stated that Japan's economy is rising and expected to grow till fiscal 2020 with proper sustainability.

Meanwhile, JPY is expected to be the stronger currency in the pair with the optimistic view and solid economic reports, whereas upcoming economic reports with downbeat figures are expected to lead to further weakness with a target towards 75.00 support area in the coming days. As the price remains below 80.00 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 75.00

RESISTANCE: 78.50, 80.00

BIAS: BEARISH

MOMENTUM: VOLATILE