USD/CHF has been quite impulsive with bearish moves after being rejected off the 0.9980-1.00 resistance area. Amid downbeat economic data from the US, USD struggled to sustain the bullish momentum, while CHF gained without any positive economic reports.

Amid universal expectations of the rate hike by the US Federal Reserve in December, USD has been able to assert strength. Recently FED Chair Powell cleared up the plans of monetary tightening in December for the reason of healthy economic conditions. Today US Core PCE Price Index report is going to be published which is expected to be unchanged at 0.2%, Personal Spending is expected to be unchanged at 0.4%, Personal Income is expected to increase to 0.4% from the previous value of 0.2%, and Unemployment Claims is expected to decrease to 221k from the previous figure of 224k. Additionally, Pending Home Sales is expected to increase to 0.8% from the previous value of 0.5%. Besides, FOMC Member William is due to speak tomorrow on the Fed agenda for further monetary tightening. So, USD may regain its momentum in the coming days.

On the CHF side, recently Credit Suisse Economic Expectations report was published with a decrease to -42.3 from the previous figure of -39.1 which did not quite affect the CHF gains over USD. Today Switzerland's GDP report is going to be published which is expected to decrease to 0.4% from the previous value of 0.7%.

Meanwhile, CHF has been affected by weak economic data, whereas USD is propped up by the strong likelihood of the rate hike. Thus, USD is a more attractive asset for investors. This is leading to further bullish pressure despite certain pullbacks inside the upward bias.

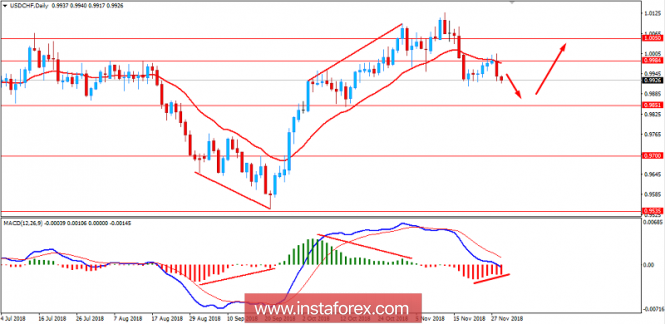

Now let us look at the technical view. The price has recently rejected off the 0.9980-1.00 area with a strong bearish engulfing daily candle which is expected to push the price lower towards 0.9850 from where certain bullish intervention may be observed in the future. As the price remains above 0.9700 area, the bullish bias is expected to continue.

SUPPORT: 0.9700, 0.9850

RESISTANCE: 0.9980-1.00, 1.0050

BIAS: BULLISH

MOMENTUM: VOLATILE