AUD/JPY has been quite impulsive with bullish gains recently which is expected to lead the price higher towards 83.50-84.50 resistance area in the coming days. A better-than-expected employment report helped AUD to gain and sustain bullish momentum while JPY is struggling due to a slowdown in Japan's economy and mixed economic reports.

Recently Auatralia's Construction Work Done report was published with a decrease to -2.8% from the previous value of 1.8% which was expected to be at -0.9%. Today Australia's Private Capital Expenditure report was also published worse than expected with a slight increase to -0.5% from the previous value of -0.9% which was expected to be at 1.1%. Moreover, HIA New Home Sales report was published with a decrease to -0.8% from the previous value of 1.1%. Despite downbeat economic results, AUD managed to sustain the bullish momentum with a slight pullback.

On the JPY side, BOJ is currently quite concerned with the economic sustainability rather than immediate development or growth. Lately the Bank of Japan dropped hints that it is serious about changes in its ultra-loose monetary policy if the situation demands. From the regulator's viepwoint, economic sustainability is ensured on condition of the 2% inflation target. Today Japan's Retail Sales report was published with an increase to 3.5% from the previous value of 2.2% which was expected to be at 2.7% and Tomorrow Unemployment Rate report is going to be published which is expected to be unchanged at 2.3%, Prelim Industrial Production is expected to increase to 1.3% from the previous value of -0.4%, and Tokyo Core CPI is expected to increase to 1.1% from the previous value of 1.0%. Additionally, Consumer Confidence report is going to be published which is expected to increase to 43.3 from the previous figure of 43.0 and Housing Starts is expected to increase to 0.4% from the previous value of -1.5%.

Meanwhile, AUD has been undermined by the fresh economic reports whereas JPY is optimistic. AUD gains are expected to be short-lived amid fundamentals. On the other hand, JPY has been propped up by expectations of solid data that expected to inject certain bearish momentum leading to a strong bearish counter-move in the coming days.

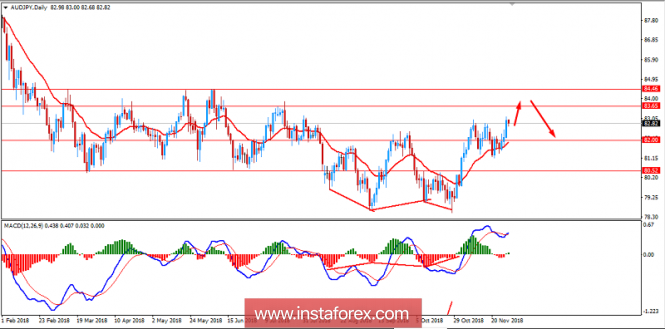

Now let us look at the technical view. The price is currently a bit bearish amid a pullback before pushing higher towards 83.50-84.50 resistance area. As the price rejects off the resistance area, certain bearish pressure is expected in the coming days which might lead the price to push lower towards 82.00 support area in the coming days. As the price remains below 85.00 area, there are certain chances of bearish intervention in the coming days.

SUPPORT: 80.50, 82.00

RESISTANCE: 83.50, 84.50, 85.00

BIAS: BULLISH

MOMENTUM: NON-VOLATILE