USD/CAD has been quite volatile and indecisive recently while residing above 1.2950-1.3050 area with a daily close. USD having better Employment reports failed to gain momentum over CAD's mixed fundamentals which does indicate the current market sentiment bias in the process.

This week CAD has been meeting expectations of the fundamental events whereas USD is still found struggling with certain mixed economic results. Recently Canada's Building Permits report was published with an increase to 0.4% from the previous value of -1.1% which was expected to be at 0.3% and Ivey PMI report was also published with an increase to 61.8 from the previous figure of 50.4 which was expected to be at 50.9. Bank of Canada's Governor Poloz said that Canada's economy is keeping its pace with the global pace of development whereas annual growth of 2 percent of growth over the next couple of years is expected while performing close to the capacity limits. Poloz was quite optimistic with the financial markets conditions where he thinks certain balance is needed to keep the stable growth going and if needed certain interest rate hikes may be also seen in the coming days but its not quite confirmed yet.

On the other hand, the US Congressional Election did not have much impact on the USD gains leading to further indecision in the process. Though the Employment reports were quite as per expectation while having significant increase in Employment Change with an unchanged Unemployment Rate is quite remarkable, but it failed to have an impact on the further gains as expected. Ahead of the FOMC Statement and Federal Funds Rate report to be published today which is expected to be unchanged at 2.25%, Unemployment Claims report was published with decrease to 214k as expected from the previous figure of 215k and Natural Gas Storage was increased to 65B from the previous figure of 48B which was expected to be at 56B.

As of the current scenario, though the price is quite corrective with no definite momentum in the process but CAD having better results with optimistic approach for the upcoming decision played a vital role for attracting the market bias towards CAD while USD struggles. Though Employment reports were better on the USD side but having mixed results put a setback for the USD in the process against CAD.

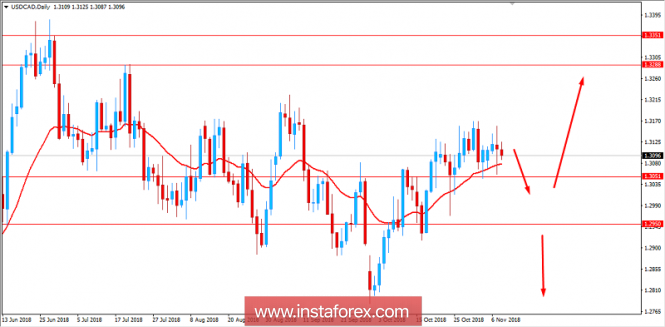

Now let us look at the technical view. The price is currently quite volatile and indecisive while having certain bullish rejections along the way above 1.2950-1.3050 support area in the process. As the price breaks below 1.2950 with a daily close, further bearish momentum is expected or else the price may counter impulsively to push it higher towards 1.3300-50 resistance area in the future. The price remaining above 1.2950 does indicate the bullish pressure is still quite strong in the process.

SUPPORT: 1.2950, 1.3050

RESISTANCE: 1.3300-50

BIAS: BEARISH

MOMENTUM: VOLATILE