GBP/USD has been trading firmly bearish after resignation of the Brexit Minister. This event shifted the overall market sentiment on GBP. While GBP has been struggling with the recently published economic reports, USD gained impulsive momentum, though it is struggling amid waning likelihood for a steady pace of monetary tightening and better-than-expected employments reports.

Recently GBP has been highly sensitive to BREXIT developments. GBP has been hurt by resignation of the Brexit Minister. Besides, GBP responds to news on the Brexit talks between UK Prime Minister Theresa May and the EU authorities. Apart from political factors, GBP has been performing quite poorly due to downbeat economic reports like CPI and Retail Sales. Today UK Inflation Report Hearing is going to be released which is expected to reveal neutral readings. Investors do not expect significant changes in monetary policy in the short term that might cause further GBP losses against USD. As there is no other high impact economic report to be considered this week, Inflation Report Hearing is the only market-moving event for GBP traders to look for this week.

On the USD side, upbeat employment encouraged further USD gains. The market sentiment is quite confused about further momentum in light of public remarks from Fed Vice Chair about revised agenda for monetary tightening. Waning confidence in steady rate hikes has lead to USD weakness. The FED is considering a gradual pace of rate increases. The regulator remains quite uncertain whether the official funds rate is going to be increased to 2.50% for a better reason. According to the FED's survey on labor participation in the US, the labor market is at full employment which is indeed a great plus point for the economy to boost itself in the future. Today US Building Permits report is going to be published which is expected to increase to 1.26M from the previous figure of 1.24M and Housing Starts is also expected to increase to 1.23M from the previous figure of 1.20M. Moreover, tomorrow Core Durable Goods Orders report is also going to be published which is expected to increase to 0.4% from the previous value of 0.0%.

Meanwhile, USD is quite solid ahead of the upcoming economic reports whereas GBP is expected to struggle further in the context of the BREXIT uncertainty until the UK strikes a deal with the EU for long-term stability. If the US provides better-than-expected reports, this is certainly bullish for USD. Thus, USD is likely to hold the upper hand over GBP in the short run.

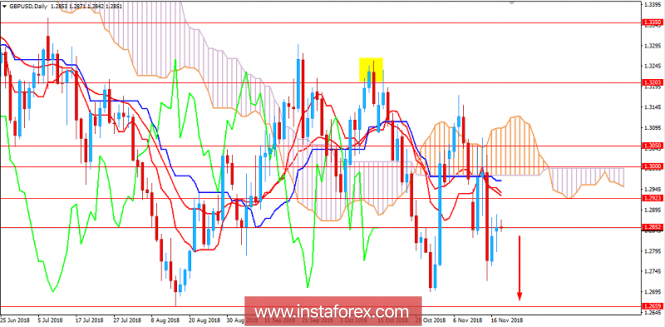

Now let us look at the technical view. The price is currently residing at the edge of 1.2850 area from where it is expected to push lower as per recent indecision in a strong bearish trend. The price is expected to push lower towards 1.2650 and later towards 1.2500 area as it remains below 1.30 with a daily close.

SUPPORT: 1.2500, 1.2650

RESISTANCE: 1.2850, 1.2920, 1.30

BIAS: BEARISH

MOMENTUM: VOLATILE