USD/JPY is currently quite impulsive with the bullish momentum which led the price to trade above 112.00 area. The price is expected to extend the upwards bias despite the recent daily close below it. Upbeat economic reports from the US today helped USD to gain momentum over JPY, while JPY is struggling on the back of weak reports.

Today Japan's Retail Sales report was published with a decrease to 2.1% as expected from the previous value of 2.7% which lead to certain JPY weakness. Moreover, BOJ seems quite comfortable, leaving its policies unchanged. The Bank of Japan is likely to maintain the key policy rate unchanged at -0.10% in the policy update on Wednesday.

On the USD side, ahead of macroeconomic reports throughout the week, USD is quite strong and dominating currently which is expected to assert its strength if the expectations are met. Today US Core PCE Price Index report was published with an increase to 0.2% from the previous value of 0.0% which was expected to be at 0.1%, Personal Spending decreased to 0.4% as expected from the previous value of 0.5% and Personal Income edged down to 0.2% which was expected to be unchanged at 0.4%. Ahead of the NFP this week, the pair is set to trade with higher volatility as the expectations are mixed with no decisive optimistic or pessimistic readings.

Meanwhile, JPY is expected to struggle further amid the unchanged stance of BOJ. On the other hand, USD is propped up by optimistic expectations of reports to be published this week. That's why certain gains may be observed in the coming days. If USD manages to perform better, further impulsive bullish gains can be observed this week.

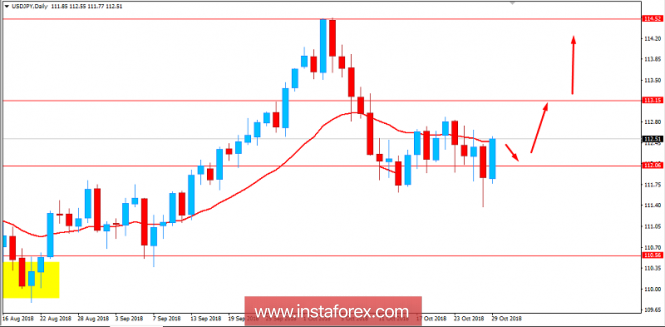

Now let us look at the technical view. The price has been quite volatile and indecisive at the edge of 112.00 area for a few days in a row. Impulsive bullish pressure is engulfing the previous bearish momentum which had a daily break below 112.00. This indicates firm bullish gains and its sustainability in the future. As the price closes above 112.00 with a daily close with steady strong momentum, the price is expected to push higher after a minor retracement towards 113.00 and 114.50 area in the future.

SUPPORT: 110.50, 112.00

RESISTANCE: 113.00, 114.50

BIAS: BULLISH

MOMENTUM: VOLATILE