EUR/JPY has come under impulsive bearish pressure, leading the price below 128.00 area earlier. The price is currently climbing higher for a retracement towards 128.50-129.50 area before continuing with the trend. Despite the recent weakness of EUR, it managed to put impulsive pressure over JPY today which indicates that JPY has given in under the current market conditions.

EUR is struggling for gains in the context of Italy's budget deficit which made EUR lose ground against JPY for last few days. In light of the recent speech by ECB President Draghi, the monetary policy was unchanged despite a slowdown in the economic growth which could lead to certain economic distress. Throughout the week, the economic calenday contains a series of macroeconomic reports. Tomorrow French Flash GDP is expected to increase to 0.4% from the previous value of 0.2% and German Prelim CPI is expected to decrease to 0.1% from the previous value of 0.4%.

On the other hand, today Japan's Retail Sales report was published with a decrease to 2.1% as expected from the previous value of 2.7% which caused weakness in JPY, leading to heavy losses. Moreover, BOJ seems quite comfortable, leaving its policies unchanged. The BOJ Policy Rate report slated for Wednesday is expected to maintain the key policy rate unchanged at -0.10%.

Meanwhile, JPY is expected to extend weakness against EUR until BOJ comes up with better forecasts on the the domestic economy. Otherwise, EUR gains may sustain longer which might lead to stronger counter trend momentum in the future leading to more volatility and indecisiveness.

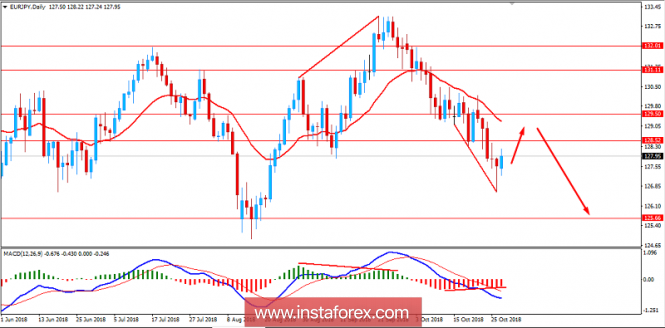

Now let us look at the technical view. The price is currently pushing higher towards 128.50-129.50 area while staying away from the dynamic level mean of 20 EMA. Additionally, price forming Bullish Divergence along the way also indicates certain retracement for a while. Though the bias is still bearish as the price remains below 129.50 area, certain bullish retracement is expected before the price continues with the trend in the future.

SUPPORT: 125.50

RESISTANCE: 128.50, 129.50

BIAS: BEARISH

MOMENTUM: VOLATILE