Gold continues to be bored in the trading range of $1185-1215 per ounce, sincerely counting on the emergence of new drivers that can pull it out of the state of consolidation. The rate of escalation of the trade war between the US and China, alas, did not work. The extension by Washington of import duties on $200 billion and a snapshot of Beijing in the form of additional tariffs on shipments of American goods in their market at $60 billion has almost no effect on the positions of the US dollar. It was the USD index rally in April-September that made the precious metal lose about 12% of its value.

Despite the fact that the intensification of the trade conflict previously helped the "greenback", as the US economy remained resistant to import duties of competitors, the S&P 500 grew, and the Shanghai Composite, on the contrary, lost about 25% of its January highs, the future may be different. The slowdown in GDP and the process of normalization of monetary policy of the Fed will put a heavy burden on the shoulders of the bulls on the USD index. Fans of the precious metal, on the contrary, are in high spirits. I believe that this scenario is kept in mind by investors. In this regard, neither the finding of speculative net short positions on gold near historical highs, nor the decline of gold ETF reserves to 2103.6 tons, the lowest indicator for almost a year does not allow the "bears" to withdraw the analyzed asset from the range of $1185-1215. According to Commerzbank estimates, in the third quarter, the outflow from specialized exchange-traded funds amounted to 84 tons, which is approximately equivalent to the volume of net purchases from central banks. It is interesting that silver ETFs show a different dynamics.

Dynamics of gold and silver ETF reserves

The US dollar does not receive preferences from the escalation of the trade conflict between the United States and China and for other reasons. First, both parties introduced lower tariffs (10-15%) than previously estimated (25%). This holds out hope for compromise in the future. Secondly, it is very difficult to wage a trade war on several fronts. In addition to China, the US is in a state of hostilities against Canada, intend to resume them against the EU and Japan. If the opponents unite their efforts, Washington will have a hard time. Finally, thirdly, the situation in the US debt market resembles the January events. Then rates on 10-year bonds grew, and the dollar, on the contrary, fell due to rumors that China is selling its stocks of treasury bonds. History repeats itself?

In the near future, the focus of investors will be a meeting of the FOMC. The derivatives market gives a 97% probability that the Fed will raise the Federal funds rate by 25 b.p. in September and an 87% chance that it will do it again in December. In terms of fundamental analysis, this is a bullish factor for the dollar and the yield of US Treasury bonds. Nevertheless, the implementation of the principle of "sell on rumors, buy on facts" can lend a helping hand to bulls for the XAU/USD.

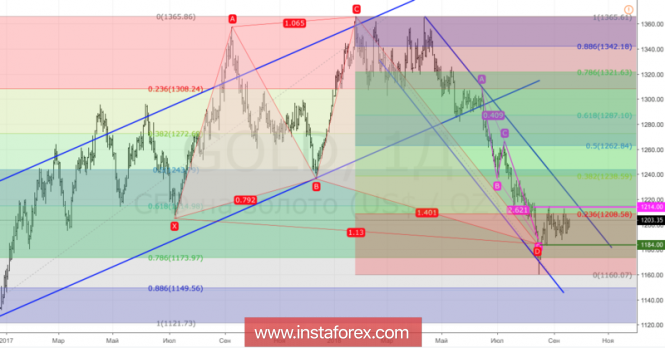

Technically, the output of quotations of gold outside the consolidation range of $1185-1215 increases the risks of a correction to the downtrend towards $1240 and $1260 per ounce, or either provides the bears a road to the south.

Gold, daily chart