Dear colleagues.

For the currency pair Euro / Dollar, we continue to monitor the local structure for the top of September 17 and the development of this structure is expected after the breakdown of 1.1728. For the Pound / Dollar currency pair, the price is still in the consolidated zone. For the currency pair Dollar / Franc, the price forms the initial conditions for the upward cycle of September 18. For the currency pair Dollar / Yen, the continuation of the upward movement is possible after the passage at the price range of 112.46 - 112.64. For the currency pair Euro / Yen, the continuation of the upward movement is expected after the breakdown of 131.86. For the Pound / Yen currency pair, the subsequent development of the upward movement is expected after the breakdown of 148.43 and the level of 146.82 is the key support.

Forecast for September 20:

Analytical review of currency pairs in the scale of H1:

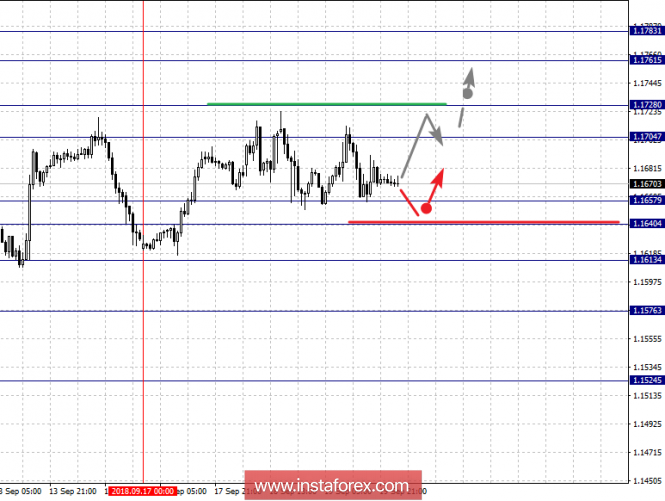

For the EUR / USD currency pair, the key levels on the scale of H1 are: 1.1783, 1.1761, 1.1728, 1.1704, 1.1657, 1.1640, 1.1613 and 1.1576. Here, we continue to follow the local upward structure of September 17. The short-term upward movement is expected in the range of 1.1704 - 1.1728 and the breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.1761. The potential value for the top is the level of 1.1783, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the range of 1.1657 - 1.1640 and the breakdown of the last value will have to the development of a downward movement. Here, the target is 1.1613. As a potential value for the bottom, we are considering the level of 1.1576.

The main trend is a local structure for the top of September 17.

Trading recommendations:

Buy 1.1704 Take profit: 1.1725

Buy 1.1730 Take profit: 1.1760

Sell: 1.1655 Take profit: 1.1642

Sell: 1.1638 Take profit: 1.1615

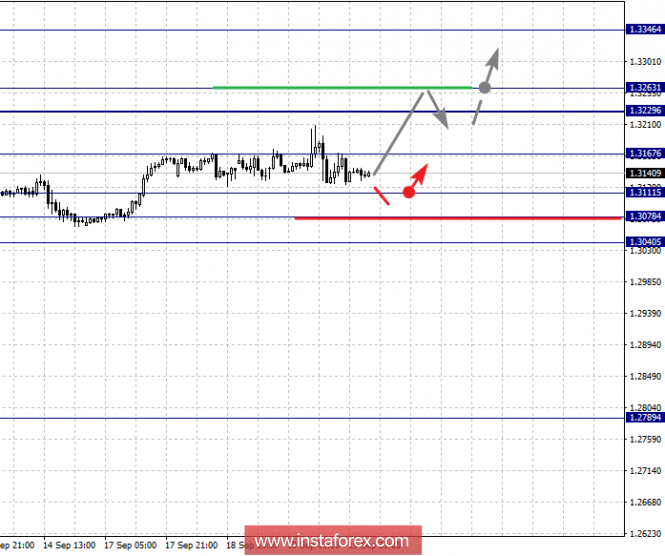

For the Pound / Dollar currency pair, the key levels on the scale of H1 are: 1.3346, 1.3263, 1.3229, 1.3167, 1.3111, 1.3078 and 1.3040. Here, we continue to follow the upward cycle of September 5. The continued upward movement is expected after the breakdown of 1.3167. In this case, the first target is 1.3229 and in the range of 1.3229 - 1.3263 is the consolidation of the price. The potential value for the top is the level of 1.3346, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the range of 1.3111 - 1.3078 and the breakdown of the last value will lead to an in-depth correction. Here, the potential target is 1.3040.

The main trend is the upward cycle of September 5.

Trading recommendations:

Buy: 1.3167 Take profit: 1.3229

Buy: 1.3264 Take profit: 1.3344

Sell: 1.3111 Take profit: 1.3080

Sell: 1.3076 Take profit: 1.3040

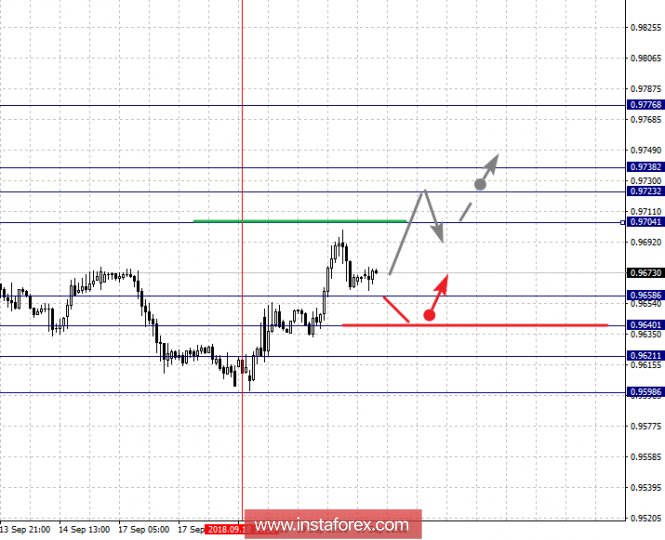

For the currency pair Dollar / Franc, the key levels on the scale of H1 are: 0.9776, 0.9738, 0.9723, 0.9704, 0.9658, 0.9640 and 0.9621. Here, the price forms the potential for the top of September 18. The continued development of the upward trend is expected after the breakdown of 0.9704. In this case, the target is 0.9723 and the pass at the price range of 0.9723 - 0.9738 should be accompanied by a pronounced movement towards the potential target of 0.9776.

The short-term downward movement is possible in the range of 0.9658 - 0.9640 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9621 and this level is the key support for the top.

The main trend is the formation of the potential for the top of September 18.

Trading recommendations:

Buy: 0.9704 Take profit: 0.9720

Buy: 0.9740 Take profit: 0.9774

Sell: 0.9656 Take profit: 0.9640

Sell: 0.9638 Take profit: 0.9622

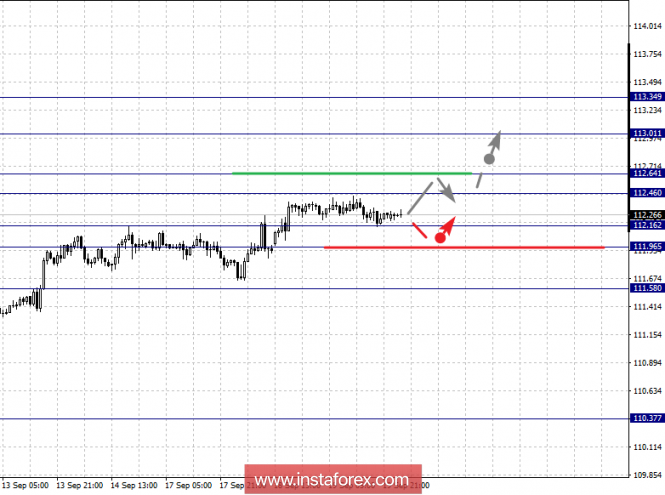

For the Dollar / Yen currency pair, the key levels on the scale of H1 are: 113.34, 113.01, 112.64, 112.46, 112.16, 111.96 and 111.58. Here, we continue to follow the upward structure of September 7. The short-term upward movement is possible in the range of 112.46 - 112.64 and the breakdown of the last value will allow to expect movement to the level of 113.01, near this consolidation value. The potential value for the top is the level of 113.34, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the range of 112.16 - 111.96 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 111.58 and this level is the key support for the top.

The main trend is the upward structure of September 7.

Trading recommendations:

Buy: 112.46 Take profit: 112.62

Buy: 112.66 Take profit: 113.00

Sell: 112.16 Take profit: 111.97

Sell: 111.94 Take profit: 111.60

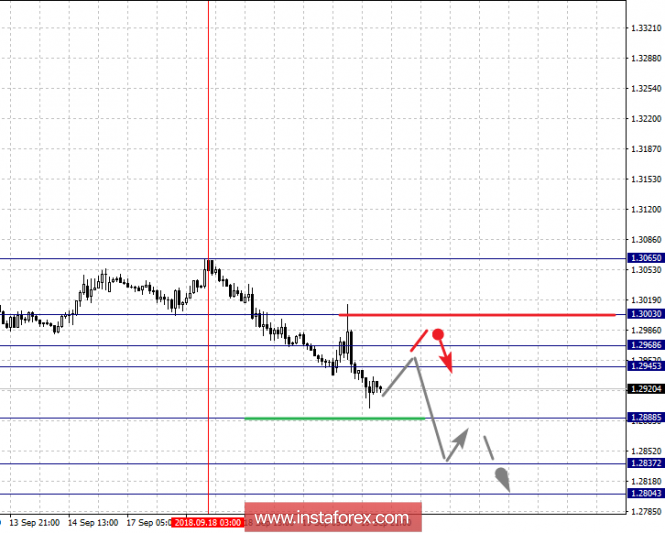

For the Canadian Dollar / Dollar currency pair, the key levels on the scale of H1 are: 1.3065, 1.3003, 1.2968, 1.2945, 1.2888, 1.2837 and 1.2804. Here, we determined the subsequent goals for the downward movement from the local structure on September 18. The continued downward movement is expected after the breakdown of 1.2888. In this case, the target is 1.2837. We consider the level of 1.2804 to be a potential value for the downward structure, after which we expect consolidation, and also a rollback to the top.

The short-term upward movement is possible in the range of 1.2945 - 1.2968 and the breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3003 and this level is the key support for the downward structure from September 18.

The main trend is a local downward structure from September 18.

Trading recommendations:

Buy: 1.2945 Take profit: 1.2966

Buy: 1.2970 Take profit: 1.3000

Sell: 1.2888 Take profit: 1.2840

Sell: 1.2835 Take profit: 1.2805

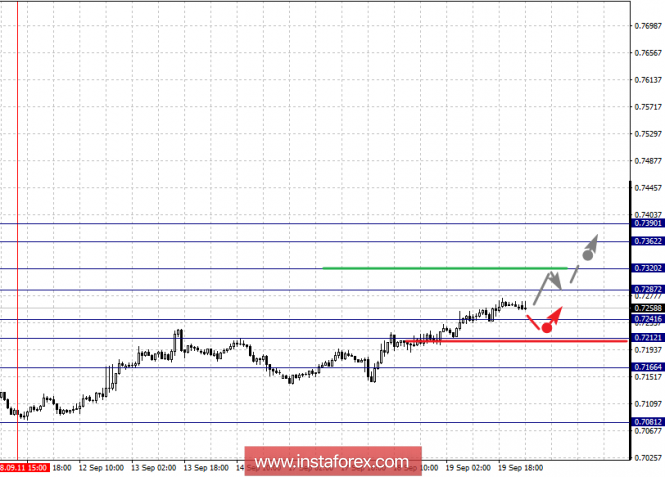

For the Australian Dollar / Dollar currency pair, the key levels on the scale of H1 are: 0.7390, 0.7362, 0.7320, 0.7287, 0.7241, 0.7212 and 0.7166. Here, we follow the upward cycle of September 11. The short-term upward movement is expected in the range of 0.7287 - 0.7320 and the breakdown of the last value will lead to a movement to the level of 0.7362. The potential value for the top is the level of 0.7390, after which we expect consolidation.

The short-term downward movement is expected in the range of 0.7241 - 0.7212, from this range, there is a high probability of a turn up. The breakdown of the level of 0.7212 will have a long correction. Here, the target is 0.7166.

The main trend is the ascending structure of September 11.

Trading recommendations:

Buy: 0.7287 Take profit: 0.7320

Buy: 0.7322 Take profit: 0.7360

Sell: 0.7241 Take profit: 0.7212

Sell: 0.7210 Take profit: 0.7168

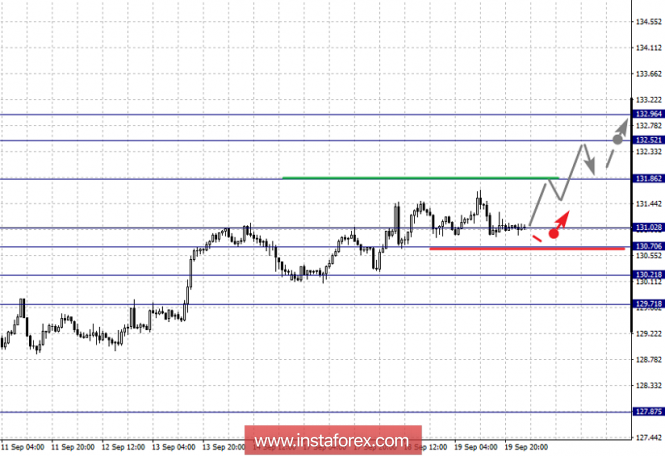

For the currency pair Euro / Yen, the key levels on the scale of H1 are: 132.96, 132.52, 131.86, 131.02, 130.70, 130.21 and 129.71. Here, we continue to follow the development of the upward cycle of September 10. The continued upward movement is expected after the breakdown of 131.86. In this case, the target is 132.52. The potential value for the upward trend is the level of 132.96, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the range of 131.02 - 130.70 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 130.21 and this level is the key support for the top. Its passage by the price will have to develop the downward movement. In this case, the target is 129.71.

The main trend is the upward cycle of September 10.

Trading recommendations:

Buy: 131.88 Take profit: 132.50

Buy: 132.55 Take profit: 132.90

Sell: 131.02 Take profit: 130.72

Sell: 130.68 Take profit: 130.25

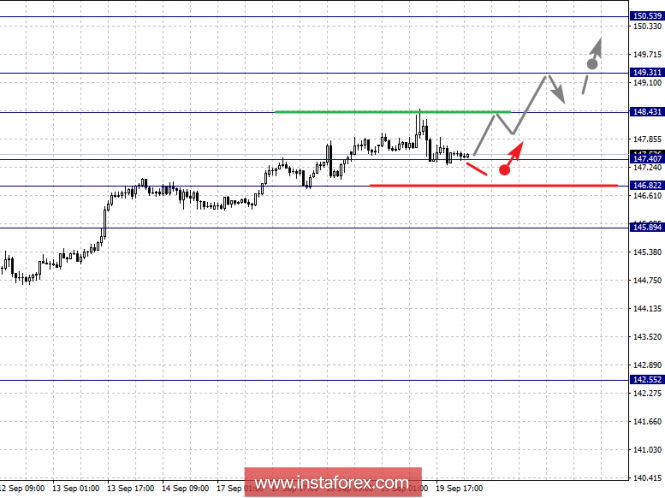

For the Pound / Yen currency pair, the key levels on the scale of H1 are: 150.53, 149.31, 148.43, 147.40, 146.82 and 145.89. Here, we continue to follow the upward structure of September 7. The continuation of the upward movement is expected after the breakdown of 148.43. In this case, the target is 149.31. The consolidation is near this level, and hence, there is a high probability of pullback downwards. The potential value for the top is 150.53, from which we expect a correction.

The short-term downward movement is possible in the range of 147.40 - 146.82 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 145.89 and this level is the key support for the upward structure of September 7.

The main trend is the upward structure of September 7.

Trading recommendations:

Buy: 148.45 Take profit: 149.20

Buy: 149.35 Take profit: 150.50

Sell: 147.40 Take profit: 146.88

Sell: 146.78 Take profit: 146.00

The material has been provided by InstaForex Company - www.instaforex.com