USD/CHF has been quite volatile and corrective at the edge of 0.9700 area from where it has recently pushed lower impulsively as a daily close. USD has been quite impulsive with the recent bearish momentum ahead of the NFP report, whereas USD trading lower as expected might allow CHF to dominate in the process.

Though USD has been quite trading mixed amid the recent economic reports, today's economic reports are going to provide definite insight for further momentum of the currency. Today US Average Hourly Earnings report is going to be published which is expected to decrease to 0.2% from the previous value of 0.3%, Non-Farm Employment Change is expected to increase to 191k from the previous figure of 157k and Unemployment Rate is expected to decrease to 3.8% from the previous value of 3.9%.

On the CHF side, this week has been quite positive with the economic reports including GDP report with the better-than-expected result of 0.7%, though decreasing from the previous value of 1.0% but better than the forecast of 0.5%.CPI report was published with an increase to 0.0% as expected from the previous negative value of -0.2%. Today Unemployment Rate report is going to be published which is expected to be unchanged at 2.6% and Foreign Currency Reserves is expected to show an increase from the previous figure of 750B.

Meanwhile, CHF has been performing quite well amid the recent economic reports which are also reflected in the market through impulsive gains against USD in the process. Ahead of the upcoming macroeconomic reports to be published today on the both currencies of the pair, certain volatility is expected to hit the market. CHF is expected to have the upper hand because of downbeat forecasts for US reports today.

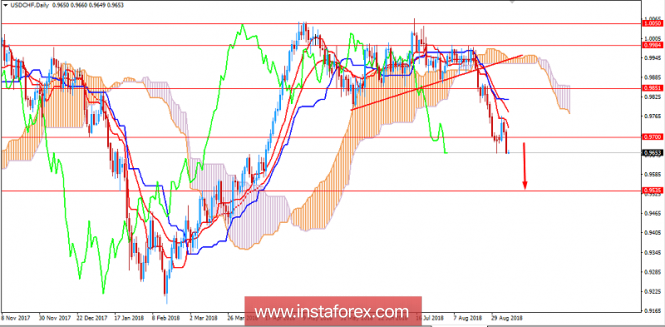

Now let us look at the technical view. The price has been quite impulsive with the bearish gains after breaking below 0.9700 area with a daily close. The bearish trend is still quite non-volatile and expected to push lower towards 0.9550 support area in the coming days. As the price remains below 0.9850 area with a daily close, the bearish bias is expected to continue further.

SUPPORT: 0.9550

RESISTANCE: 0.9700, 0.9850

BIAS: BEARISH

MOMENTUM: IMPULSIVE and NON-VOLATILE