NZD/JPY has been impulsive and non-volatile inside the recent bearish bias which created a double bottom pattern at 72.50 area with a daily close from where the price is expected to climb higher in the coming days. Despite positive economic reports from New Zealand this week, JPY has been quite dominant with the gains.

This week New Zealand Overseas Trade Index report was published with an increase to 0.6% from the previous value of -2.0% which unfortunately did not meet the forecast value of 1.1% and ANZ Commodity Prices report showed an increase to -1.1% from the previous value of -3.3%. Today RBNZ Governor Orr spoke about the long-term planning for the development rather than any short-term temporary solutions and he also outlined the current priorities for the change which includes regulated financial institutions and movement of the money in the economy.

On the JPY side, JPY managed to meet the expectations and also provided better than expected readings that encouraged JPY to push the price lower against NZD in the process. Today Japan's Household Spending report was published with an increase to 0.1% from the previous value of -1.2% which was expected to be at -0.9% and Average Cash Earnings decreased to 1.5% from the previous value of 3.3% which was expected to be at 2.4%.

Meanwhile, JPY has been quite mixed amid the macroeconomic data today which made NZD gain certain momentum in the process which is expected to result in certain bullish pressure in the nearest days. Though JPY is still quite strong fundamentally, a certain counter-move is expected for a while with impulsive NZD gains. On the otjert hand, JPY weakness can be observed in light of the figures from recently published economic reports.

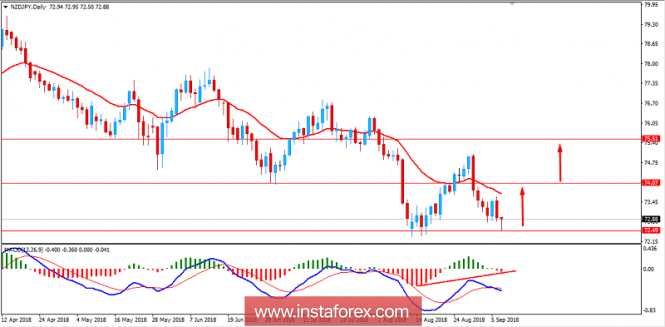

Now let us look at the technical view. The price is currently residing at the edge of 72.50 support area from where it is expected to push higher towards 74.00 and later towards 75.50 area in the coming days. While price formed a Double Bottom pattern in the chart, it also gave birth to a Bullish Regular Divergence which is expected to result to certain bullish pressure in the pair. As the price remains above 0.7250 with a daily close, the bullish bias is expected to continue.

SUPPORT: 72.50, 72.00

RESISTANCE: 74.00, 75.50

BIAS: BEARISH

MOMENTUM: VOLATILE