AUD/USD has been quite indecisive recently after pushing above 0.7200 area with a daily close amid impulsive bullish pressure earlier. Australia does not present macroeconomic economic reports or events this week, while USD is alert to high impact economic reports on the line. Thus, certain volatility is expected in this pair which might lead to a definite momentum in the pair.

AUD has been quite mixed amid the recent economic reports, while the empty economic calendar from Australia weakened the overall pressure of AUD it had over USD in the process. The only economic report to be published in Australia this week on Friday is Private Sector Credit report which is expected to be unchanged at 0.4%.

On the USD side, today US Federal Reserve is widely expected to increase its official funds rate to 2.25% from the previous value of 2.00%. The anticipated rate hike is likely trigger higher volatility in the market. The rate hike is quite imminent and expected to weaken USD for certain period while strengthening for the long term. Moreover, FOMC Economic Projections, FOMC Statement, and FOMC Press Conference is also expected to play a vital role in developing the market sentiment. Additionally, today US New Home Sales report is going to be published which is expected to increase to 630k from the previous figure of 627k and Crude Oil Inventories is expected to increase to -0.7M from the previous figure of -2.1M.

Meanwhile, AUD is expected to be the weaker currency in the pair. USD may hold the upper hand if the economic events and reports favor the upcoming gains in the process. Though certain spikes may be observed in the process, a definite trend can be settled for the coming days.

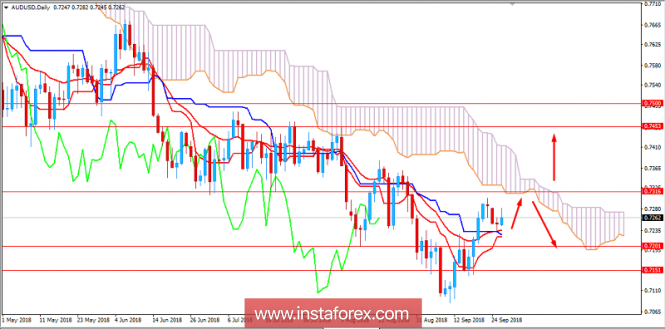

Now let us look at the technical view. The price is currently residing above the dynamic levels of 20 EMA, Tenkan and Kijun line while residing inside the middle of the range between 0.7200 to 0.7320 area. The price is still residing below 0.7320 area where the Kumo Cloud resistance also rests which is indicating further bearish momentum in the pair if the price remains below 0.7320 area with a daily close or else a daily close above 0.7320 will lead to further bullish pressure for the coming days. As the price remains below 0.7320 area, the bearish bias is expected to continue.

SUPPORT: 0.7200, 0.7150

RESISTANCE: 0.7320, 0.7450

BIAS: BEARISH

MOMENTUM: VOLATILE