Today will be the key event in the fall. The US Federal Reserve's meeting on monetary policy, which is expected to raise the key rate by a quarter point, plus updated macroeconomic forecasts will be published.

The current stage of the state of the US economy looks very convincing. The GDP growth is higher than in Europe and Japan, the labor market is close to full employment, inflation is also near the target. FOMC members have no reason to change rhetoric, and the market is already laying in the current quotes both a rate hike and a hawk position FOMC.

At the same time, there are a number of factors that do not allow us to predict with the same certainty the growth of the dollar following the meeting. In order for the bullish expectations to be realized, it is required that investors positively assess the situation in the US economy in the medium term, which at present there are quite big doubts.

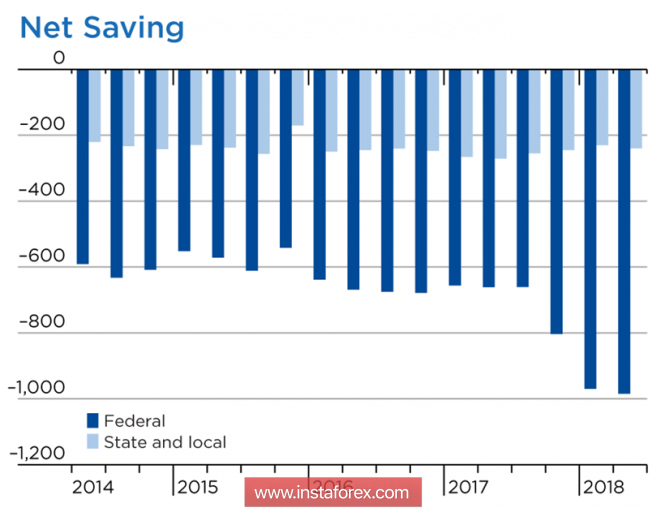

The tax reform has led to a strong increase in borrowing at the federal level, public sector financing is generated from borrowed money, as of the beginning of the third quarter, the difference between current revenues and current federal government spending has risen to $ 1.333 trillion.

There is a paradoxical situation, formal macroeconomic indicators, such as GDP growth, inflation, and the labor market, look very decent, giving the Fed the opportunity to maintain aggressive rhetoric and bring the plan at a rate and reduce the balance to the planned levels before the recession. On the other hand, all this prosperity is built on a very shaky foundation, outstripping the growth of debts.

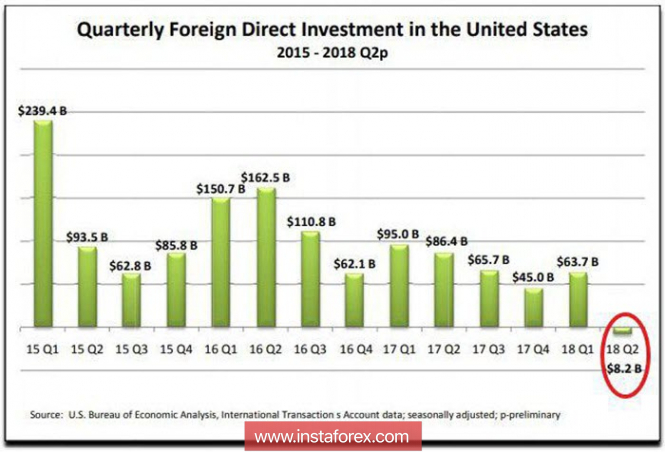

We have already noted that the dynamics of the inflow of foreign capital into the US securities market looks negative. Exactly the same situation with foreign direct investment, which is not directed to securities, but directly to the development of companies, the creation of new businesses and jobs, Trump's trade war has not led to an increase in investment, but, on the contrary, to their outflow.

Trump, launching tax reform and creating conditions for the repatriation of capital, expected that high duties would force US companies to transfer production to the US, but the chances of such a scenario are still small. Negative flow is a direct consequence of the reduction of direct investment from China, that is, a direct consequence of trade wars.

Thus, the main intrigue for today's meeting of the FOMC is whether the Committee will keep aggressive rhetoric, relying on the formally high indicators of the state of the US economy, or will be forced to correct it pigeonhole. A sign of this correction may be a change in the positions of FOMC members on the long-term forecast for the rate, currently it is 2.9% and it is possible to raise the forecast to 3.0% (bullish) or, conversely, a decrease to 2.8%, which could provoke a strong sell-off of the dollar.

EUR / USD

The euro, as expected yesterday, is trading in a narrow range in anticipation of the outcome of the FOMC meeting. No noticeable internal drivers of the eurozone this week does not offer, the dynamics of the euro will depend on the change in expectations for the dollar. Immediately before the announcement of the results of the FOMC meeting at 19.00 London time, it is necessary to monitor the change in the dollar exchange rate, a possible growth will mean that investors tend to a more hawkish scenario and open long positions in the dollar, a lack of growth or decline will mean that investors expect the dollar to fall following the meeting.

GBP / USD

The pound looks worse Wednesday morning than the euro, as it is under additional pressure, both because of the failure of the Brexit talks and the slowdown in economic growth. The CBI report on industrial orders in September unexpectedly fell to -1p versus + 7p in August, which is the worst result in 4 months and reflects an increase in concerns about cooling in the industry. If bullish expectations for the dollar get an implementation, GBP / USD runs below support at 1.3053, which will mean the bear's interception of the initiative.

The material has been provided by InstaForex Company - www.instaforex.com