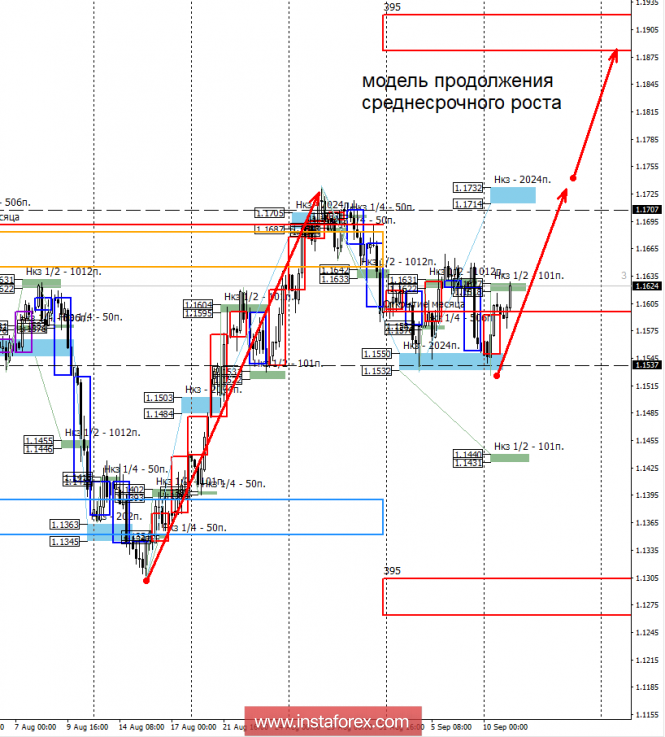

Yesterday, there was another test of the weekly short-term fault of 1.1550-1.1532, which led to an increase in demand. Today, the pair is testing the determining resistance. This will provide an opportunity to consider both purchases and sales of the instrument after the close of the American session.

Yesterday's growth led to the continuation of work within the medium-term accumulation zone. Today, the pair is testing the determining zone of resistance NCP 1/2 1.1627-1.1618. The further priority will depend on how the US session closes. If the closure occurs below the specified zone, the flat will continue, and the first goal of the fall will again be a weekly short-circuit. Closure of today's trading above the zone will allow talking about the resumption of long-term bullish momentum. The purpose of the growth will be a one-week short-term short-term period of 1.1732-1.1714, which will allow any fall to be used to obtain profitable purchase prices.

Work within the framework of the flat implies a partial fixation of purchases made from the level of 1.1537 on the current NCP 1/2. The rest of the long position can be transferred to a breakeven and left in case of continued growth.

An ascending model can become a priority for a long time, as the pair could not overcome the main medium-term support in the form of a weekly short-term. Closure of today's US session above NCP 1/2 will allow you to exit the accumulation phase. The August maximum will be the first goal of the upward movement, which will continue the momentum begun in the middle of last month. The potential for growth is 250 points, which makes long trades profitable after the implementation of the reversal pattern.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com