USD/CAD has been quite impressive amid impulsive bearish pressure which led the price towards the support area between 1.2950-1.3050. USD has been struggling for gains in light of recent worse-than-expected economic reports despite the positive change in employment.

Today US PPI report was published with a decrease to -0.1% from the previous value of 0.0% which was expected to increase to 0.2% and Core PPI also decreased to -0.1% from the previous value of 0.1% which was expected to increase to 0.2%. Moreover, today Crude Oil Inventories report is going to be published which is expected to increase to -1.3M from the previous figure of -4.3M. Besides, FOMC Member Brainard is going to speak about the upcoming monetary policy and timing for monetary tightening.

On the other hand, CAD has been quite feeble amid employment reports which did not quite encourage CAD gains over USD in the process. Despite downbeat economic data even today, CAD managed to sustain the gains which indicates the strength of CAD over USD for a while. Today Canada's Capacity Utilization Rate report was published with an increase to 85.5% from the previous value of 83.7% but it failed to meet the expectation of 86.9%. Ahead of the NHPI report to be published tomorrow which is expected to be unchanged at 0.1%, CAD is quite stable at the current market situation.

Meanwhile, ahead of the US CPI and Retail Sales reports to be published this week, USD has been quite weak against CAD whereas further negative outcome of the upcoming reports may add to CAD gains in the future.

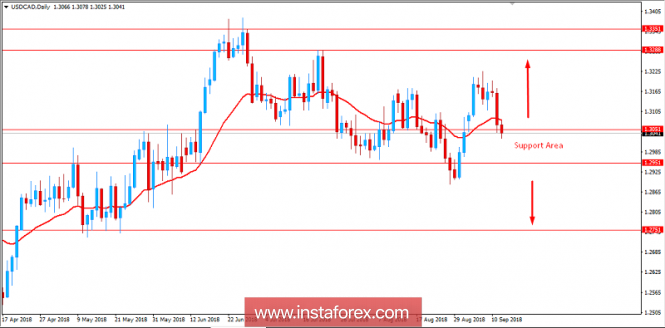

Now let us look at the technical view. The price is currently residing below 1.3050 area which has been one of the strongest event area observed so far. The area between 1.2950-1.3050 has been quite corrective and volatile, so a daily close below or above this area is indeed required to determine trend momentum in the pair for the coming days. As the price remains below 1.3350 area, the bearish bias in this pair is expected to continue further.

SUPPORT: 1.2750, 1.2950, 1.3050

RESISTANCE: 1.3050, 1. 3300-50

BIAS: BEARISH

MOMENTUM: VOLATILE