GBP/USD has been quite non-volatile with the bearish trend earlier which has led the price to reside below 1.2850 support area with a daily close. Ahead of the GBP and USD high impact economic reports this week, certain volatility is expected in this pair for the coming days.

Today GBP Average Earning Index report is going to be published which is expected to be unchanged at 2.5%, Claimant Count Change is expected to have a positive impact with a decrease to 2.3k from the previous figure of 7.8k and Unemployment Rate is expected to be unchanged at 4.2%. Moreover, tomorrow GBP CPI report is going to be published which is expected to have a slight increase to 2.5% from the previous value of 2.4%. Though there are still some questions about how BREXIT is going to play out but having certain tensions in the process, better economic reports are expected to boost the GBP gains in the future.

On the USD side, today NFIB Small Business Index report is going to be published which is expected to slightly decrease to 106.9 from the previous figure of 107.2 and Import Price is expected to increase to 0.1% from the previous value of -0.4% in the process. Additionally, tomorrow USD Retail Sales report is going to be published which is expected to decrease to 0.2% from the previous value of 0.5% and Core Retail Sales is expected to be unchanged at 0.4%.

As of the current scenario, the acceleration of US economy this year is expected to slow down in 2019 whereas other major economies are expected to dominate US in several ways. Before that currently ahead of the UK high impact economic reports, USD forecasts are quite dovish and expected to inject certain volatility and bullish pressure in the process before the bearish trend continues to push lower.

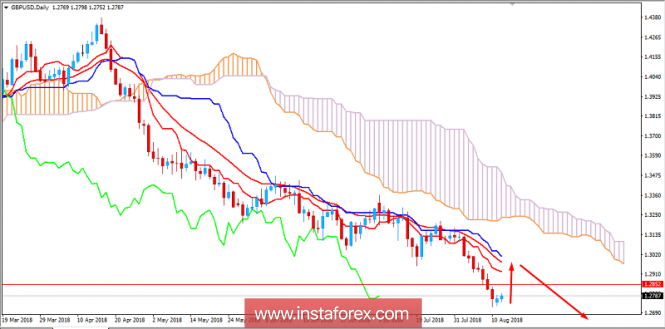

Now let us look at the technical view. The price is currently quite bullish as residing below 1.2850 area which is expected to be retested before the price continues to push lower with target towards 1.2550 in the coming days. The trend is non-volatile and expected to push the price impulsively after certain bullish retracement in the process. As the price remains below 1.30 area with a daily close, the bearish bias is expected to continue.

SUPPORT: 1.2550

RESISTANCE: 1.2850, 1.30

BIAS: BEARISH

MOMENTUM: VOLATILE