Dear colleagues.

For the currency pair Euro / Dollar, the price for the current moment is in correction and the continuation of the movement downwards is expected after the breakdown of 1.1335. For the Pound / Dollar currency pair, we continue to move downwards after the breakdown of 1.2727, we consider the upward movement as a correction. For the currency pair Dollar / Franc, we follow the formation of the upward structure of August 9, the level of 0.9915 is the key support. For the currency pair Dollar / Yen, the price forms the potential for the top of August 13. For the currency pair Euro / Yen, the price is in correction and forms the potential for the top of August 13. For the Pound / Yen currency pair, the price is in correction and forms the potential for the top of August 13.

Forecast for August 14:

Analytical review of currency pairs in the scale of H1:

For the currency pair Euro / Dollar, the key levels on the scale of H1 are: 1.1539, 1.1471, 1.1433, 1.1403, 1.1360, 1.1335 and 1.1282. Here, we follow the downward structure from August 8. At the moment, the price is in correction. The continuation of the movement downwards is possible after the passage at the price of the noise range of 1.1360 - 1.1335. In this case, the potential target is 1.1282, from this level we expect a rollback upward.

The short-term upward movement is possible in the corridor of 1.1403 - 1.1433 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1471 and this level is the key support for the downward structure. Its breakdown will have to develop an upward movement. In this case, the target is 1.1539.

The main trend is the local downward structure of August 8.

Trading recommendations:

Buy: 1.1403 Take profit: 1.1431

Buy 1.1435 Take profit: 1.1470

Sell: 1.1333 Take profit: 1.1284

Sell: Take profit:

For the Pound / Dollar currency pair, the key levels on the H1 scale are: 1.2913, 1.2845, 1.2802, 1.2727, 1.2684 and 1.2655. Here, we determined the subsequent goals from the local downward structure of August 7. The continuation of the movement downwards is expected after the breakdown of 1.2727. In this case, the target is 1.2684 and in the corridor of 1.2684 - 1.2655 is the consolidation of the price, from this range, we also expect a pullback upward.

The short-term upward movement is possible in the corridor of 1.2802 - 1.2845 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2913 and this level is the key support for the bottom. Its passage by the price will have to form the initial conditions for the top.

The main trend is the local downward structure of August 7.

Trading recommendations:

Buy: 1.2802 Take profit: 1.2843

Buy: 1.2847 Take profit: 1.2910

Sell: 1.2727 Take profit: 1.2685

Sell: Take profit:

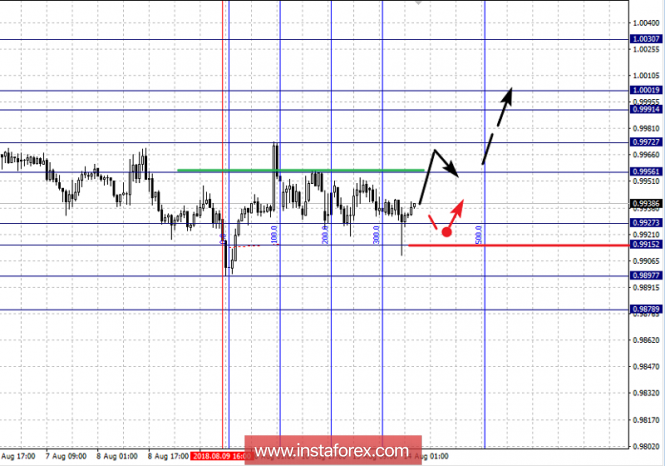

For the Dollar / Franc currency pair, the key levels on the scale of H1 are: 1.0030, 1.0001, 0.9991, 0.9972, 0.9956, 0.9927, 0.9915, 0.9897 and 0.9878. Here, we follow the formation of the ascending structure of August 9. The continued upward movement is expected after the breakdown of 0.9956. In this case, the target is 0.9972 and the breakdown of which, in turn, should be accompanied by a pronounced upward movement to the level of 0.9991 and in the corridor of 0.9991 - 1.0001 is the consolidation. The potential value for the top is the level of 1.0030, from this level we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 0.9927 - 0.9917 and the breakdown of the last value will have to develop a downward structure. Here, the target is 0.9897. The potential value for the bottom is the level of 0.9878.

The main trend is the formation of the ascending structure of August 9.

Trading recommendations:

Buy: 0.9956 Take profit: 0.9970

Buy: 0.9974 Take profit: 0.9990

Sell: 0.9925 Take profit: 0.9915

Sell: 0.9913 Take profit: 0.9898

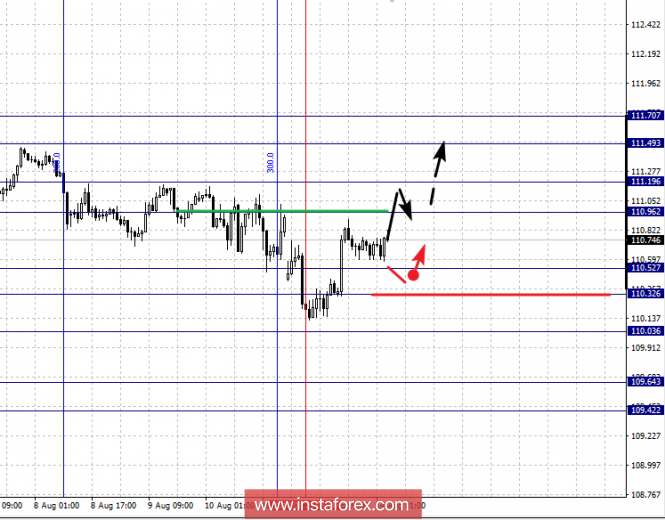

For the currency pair Dollar / Yen, the key levels on a scale of H1 are: 111.55, 111.27, 111.10, 110.69, 110.31, 110.03 and 109.63. Here, the price has formed a small potential for the development of the upward movement of August 13 in the correction. The short-term upward movement is possible in the range of 110.96 - 111.19 and the breakdown of the last value will lead to the development of an upward cycle. In this case, the target is 111.49. The potential value for the top is the level of 111.70, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the range of 110.52 - 110.32. Hence, there is a possibility of a turn up and the breakdown of the level of 110.32 will lead to the continuation of the downward trend. In this case, the target is 110.03. We consider the level of 109.43 as a potential value for the bottom, after which we expect consolidation in the corridor of 109.64 - 109.42.

The main trend is the downward structure from August 1, the formation of the potential for the top of August 13.

Trading recommendations:

Buy: 110.96 Take profit: 111.16

Buy: 111.22 Take profit: 111.47

Sell: 110.50 Take profit: 110.34

Sell: 110.28 Take profit: 110.05

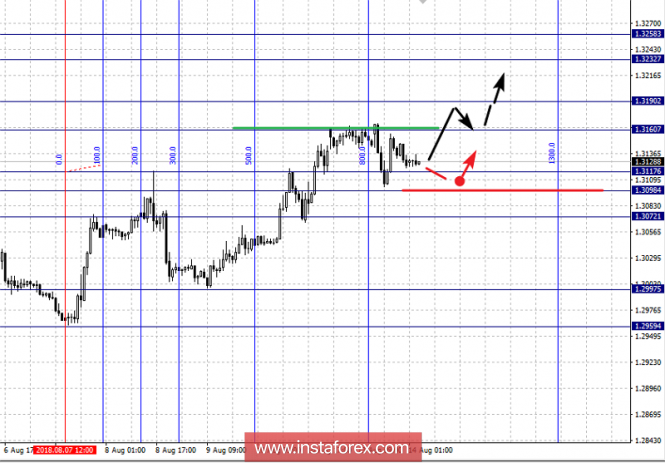

For the Canadian Dollar / Dollar currency pair, the key levels on the H1 scale are: 1.3258, 1.3232, 1.3190, 1.3160, 1.3117, 1.3098 and 1.3072. Here, we follow the development of the upward cycle of August 7. The short-term upward movement is possible in the corridor of 1.3160 - 1.3190 and the breakdown of the last value should be accompanied by a pronounced movement to the level of 1.3232, near this level is the consolidation. The potential value for the top is the level of 1.3258, upon reaching which we expect a pullback downwards.

The short-term downward movement is possible in the corridor of 1.3117 - 1.3098 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3072 and this level is the key support for the top.

The main trend is the upward cycle of August 7.

Trading recommendations:

Buy: 1.3160 Take profit: 1.3188

Buy: 1.3192 Take profit: 1.3230

Sell: 1.3117 Take profit: 1.3100

Sell: 1.3096 Take profit: 1.3072

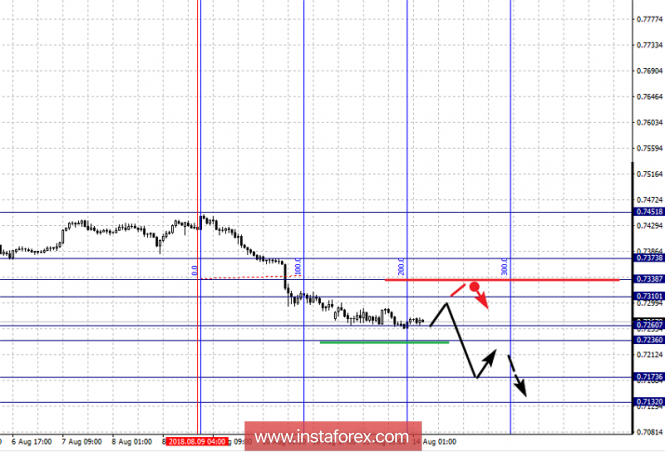

For the Australian Dollar / Dollar currency pair, the key levels on the scale of H1 are: 0.7373, 0.7338, 0.7310, 0.7260, 0.7236, 0.7173 and 0.7132. Here, we follow the formation of the downward structure of August 9. The continued downward movement is expected after the passage at the price of the noise range of 0.7260 - 0.7236. In this case, the target is 0.7173. The potential value for the downward movement is, for the time being, the level of 0.7132, after which we expect a pullback to the top.

The short-term upward movement is possible in the corridor of 0.7310 - 0.7338 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.7373 and this level is the key support for the downward structure.

The main trend is the formation of a downward structure from August 9.

Trading recommendations:

Buy: 0.7310 Take profit: 0.7336

Buy: 0.7339 Take profit: 0.7370

Sell: 0.7236 Take profit: 0.7175

Sell: 0.7170 Take profit: 0.7134

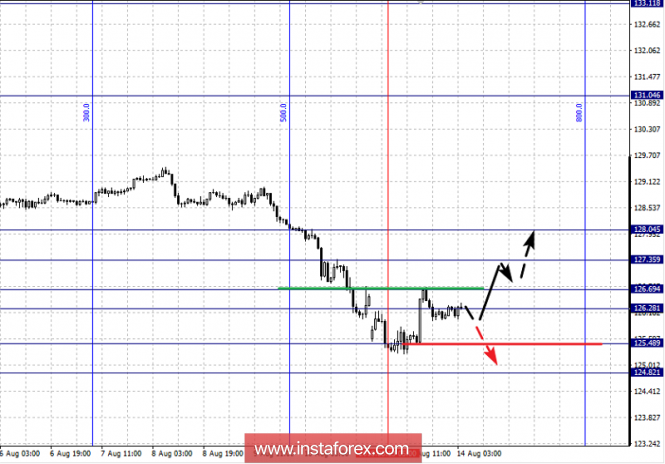

For the EUR / JPY currency pair, the key levels on the scale of H1 are: 128.04, 127.35, 126.69, 126.28, 125.48 and 124.82. Here, the price is in correction and forms a small potential for the top of August 13. A breakdown at the level of 125.48 will lead to a short-term downward movement. In this case, the potential target is 124.82, from this level there is a high probability of a turn up. The short-term upward movement is possible in the corridor of 126.28 - 126.69 and the breakdown of the last value will lead to an in-depth movement. Here, the target is 127.35 and this level is the key support for the downward structure from August 1. Its passage will have to form the initial conditions for the upward cycle. In this case, the target is 128.04.

The main trend is a downward structure from August 1, we expect a correction.

Trading recommendations:

Buy: 126.28 Take profit: 126.67

Buy: 126.71 Take profit: 127.33

Sell: 125.46 Take profit: 124.87

Sell: Take profit:

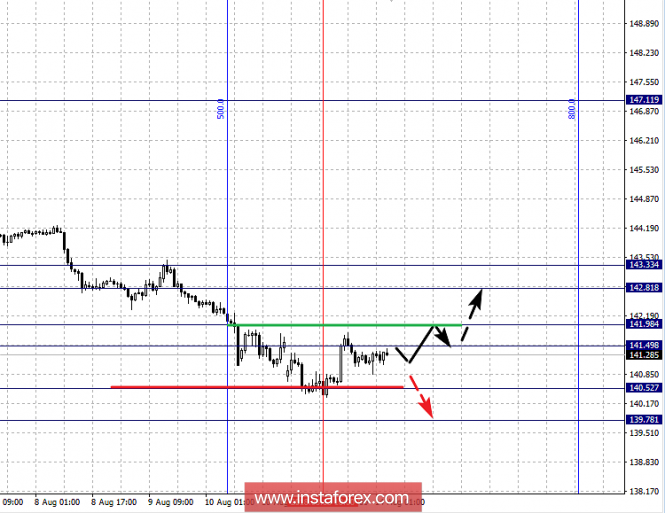

For the Pound / Yen currency pair, the key levels on the H1 scale are: 143.33, 142.81, 141.98, 141.49, 140.52 and 139.78. Here, the price is in correction and forms a small potential for the top of August 13. The short-term downward movement is possible in the corridor of 140.52 - 139.78 and from the level of 139.78, we expect a key turn to the top. The short-term upward movement is possible in the corridor of 141.49 - 141.98 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 142.81 and the range of 142.81 - 143.33 is the key support for the downward cycle. Before it, we expect the initial conditions for the top to be formalized.

The main trend is the downward trend from August 1, we expect a correction.

Trading recommendations:

Buy: 141.50 Take profit: 141.95

Buy: 142.00 Take profit: 142.80

Sell: 140.50 Take profit: 139.85

Sell: Take profit:

The material has been provided by InstaForex Company - www.instaforex.com