NZD/USD has been quite bullish today after being dominated by USD since the price broke below 0.7250 area with a daily close. NZD has been quite positive with the economic reports this week but it actually gained momentum over USD on the weakness for worse economic reports on the USD side.

This week, NZD Trade Balance report was published with an increase to 294M from the previous figure of 193M which was expected to be at 100M, ANZ Business Confidence increased in deficit -39.0 from the previous figure of -27.2 and Official Cash Rate report was published unchanged as expected at 1.75%. Today NZD Building Consent report was published with a significant increase to 7.1% from the previous negative value of -3.6% which is indeed a great improvement. As a result, NZD is currently being observed to gain good momentum over USD in the process.

On the USD side, after a decrease in Final GDP from 2.2% to 2.0% yesterday, USD lost some grounds against NZD in the process. Today USD Core PCE Price Index report is going to be published which is expected to be unchanged at 0.2%, Personal Spending is expected to decrease to 0.4% from the previous value of 0.6%, Personal Income is expected to increase to 0.4% from the previous value of 0.3%, Chicago PMI is expected to decrease to 60.1 from the previous figure of 62.7 and Revised UoM Consumer Sentiment is expected to have slight decrease to 99.1 from the previous figure of 99.3.

As of the current scenario, USD economic reports to be published are forecasted to be dovish and expected to weaken the USD gains in the process whereas NZD is currently expected to gain momentum being backed by positive economic reports published recently. To sum up, NZD is expected to have an upper hand over USD in the coming days.

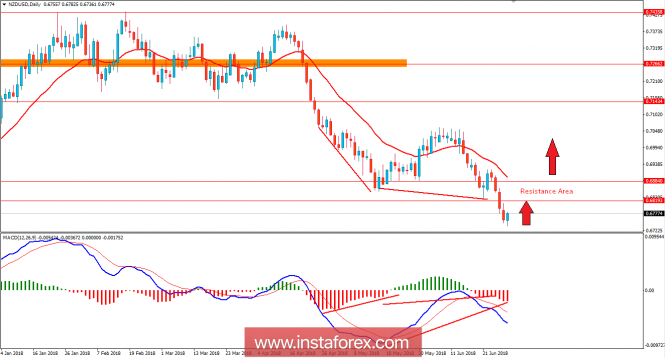

Now let us look at the technical view. The price is currently quite bullish in nature which is expected to push higher towards the resistance area of 0.68 to 0.69 area. Later, if the price manages to break above 0.69 with a daily close, a further bullish pressure is expected to push the price higher towards 0.7150 area in the future. Having strong Bullish Divergence backing up the bullish momentum, the price is expected to push higher as it remains above 0.67 with a daily close.