EUR / USD

The main event yesterday was the announcement of the White House about the final decision to impose "militant" duties on steel (25%) and aluminum (10%) against the EU, Mexico and Canada. For the EU, this is the volume of goods at 6.4 billion euros. The effect of these duties comes from today. All countries announced an early response.

Italy had developed its own issue. In the search for a compromise, Paolo Savone was offered the position of minister for relations with the EU, but a supporter of the single currency, Giovanni Tria, was appointed as minister of finance.

Macroeconomic indicators of the euro area and the US came out good. The base consumer price index in the euro area for May showed growth to 1.1% YoY against the forecast of 1.0% YoY, the total CPI rose to 1.9% YoY against expectations of 1.6% YoY and the April indicator in 1.2% YoY. The unemployment rate remained at 8.5% against expectations of a decline to 8.4%.

In the United States, personal income of consumers in April increased by an expected of 0.3%, while personal expenses increased by 0.6% versus waiting for 0.4%. The business activity index in the manufacturing sector of the Chicago region for May increased from 57.6 to 62.7, with the forecast was 58.2. This is a significant indicator that tax reforms have a positive effect in the industrial Chicago district. The weekly report on the number of applications for unemployment benefits showed a decrease in applications to 221 thousand from 234 thousand before, with the forecast of 228 thousand. The decline showed incomplete sales in the secondary real estate market in April, indicating the fall at -1.3% against expectations of 0.4 % growth.

Today, an important data on US employment was released and the euro came up in a neutral position at the opening level of the week. During this time, the preconditions for a strong labor data were created. The forecast for Non-Farm Employment Change for May is 189 thousand against 164 thousand in April. The unemployment rate is expected to be unchanged at 3.9%. The average hourly wage is expected to increase by 0.2% after many are not satisfied with 0.1% in April. On the same day, the business activity index in the US manufacturing sector for May (ISM Manufacturing PMI) will be released, with the forecast of 58.3 versus 57.3 in April. But, yesterday's growth of the Chicago index gives preconditions for the indicator to exit above the forecast. Construction costs in the United States for April are expected to increase by 0.8%.

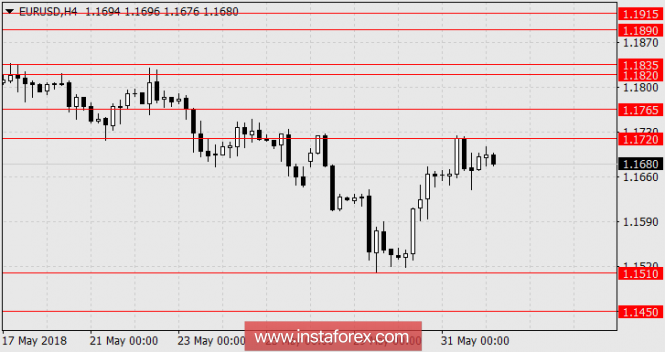

So, the good economic data were under pressure due to initiation of US trade war. We are waiting for the euro to decline to 1.1510 and 1.1450.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com