Eurozone

On Wednesday, the focus was on data on consumer inflation. An unexpected result of the price dynamics in the US and Germany provoked a correction in the euro.

The first data came from retail sales in Germany for the month of April, which turned out to be unexpectedly strong at 2.3% up against the forecast of 0.7%. Then, the European Commission presented its view on the business climate in the eurozone, which also turned out to be better than expected. Consumer prices in Germany rose by 2.2% in April, which was a complete surprise, since a month ago growth was zero.

At the same time, the revised data from the US for the first quarter were significantly worse than expected. GDP growth was revised from 2.3% to 2.2%. The basic index of personal consumption expenditure fell from 2.5% to 2.3% and the price index was lowered. Collectively, these data indicate that inflation growth may not be strong enough to justify high growth rates of the Fed rate, which casts doubt on the likelihood of a fourth rate hike in December and, as a result, reduces demand for the dollar.

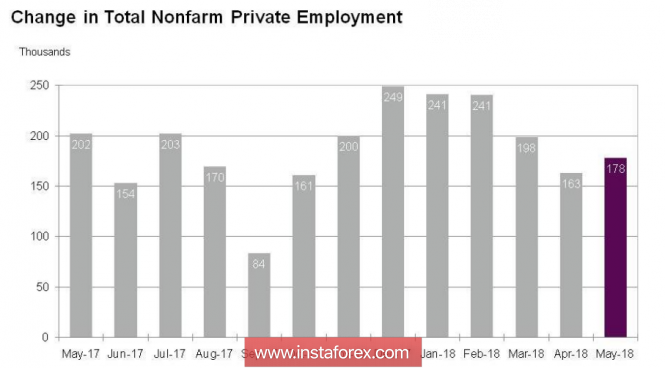

ADP reported on the growth of jobs in the private sector. The result of +178 thousand was below the forecast of 190 thousand, and thus, is a conditions for corrective growth in the main currency pair.

Until the end of the week, there may be an increase in volatility, since both Thursday and Friday are quite saturated with macroeconomic news. Today, there will be preliminary data on inflation in the eurozone for the month of May, as well as price indices for personal spending and income in the US for April, which can significantly adjust inflation expectations. Tomorrow, the same report will be published on the US labor market for May, which will give an opportunity to assess how confident the Fed will feel at the key meeting on the rate that will take place after 2 weeks.

The euro is likely to continue corrective growth. The end of the week is likely to reach the level of 1.1790. The further dynamics will be determined by the report on the US labor market.

United Kingdom

Brexit did not follow the same scenario as was planned. Such a conclusion needs to be drawn from the news in preparations for the second referendum on EU membership that will begin soon. The UK obviously does not receive any benefits from withdrawing from the EU, as capital flows indicate a drop in confidence in the pound and the stability of the British economy as a whole.

The pound, unlike the euro, will remain under pressure until the end of the week, as no important macroeconomic news is expected, and even weak data from the US could not provoke a correction. It is possible to rise to 1.3325, after which sales will most likely resume.

Oil

Despite the fact that the balance of supply and demand efforts of OPEC + has been significantly corrected, new data indicate that the struggle for control over the oil industry can resume with renewed vigor.

OPEC Secretary General Mohammed Barkindo said on Tuesday that it is necessary to increase investment in the oil industry in order to avoid supply shortages in the near future. This statement added weight to the earlier plans of Russia and Saudi Arabia to start considering the issue of increasing oil production already in the near future, as the OPEC + deal fulfilled its role and the balance as a whole was restored.

At the same time, the United States has reached a clean second place in the world in terms of production, and intends to increase it further. It seems that the main oil-producing countries will proceed from this meaning that the world has entered a phase of economic growth and oil consumption will grow with ever-increasing speed.

Quotes are recovering again after correction last week, the probability of re-testing is $ 80 per barrel. For Brent, it looks higher but the bull scenario is unlikely to resume until the OPEC + meeting in the second half of June. Short-term trading is more likely in the range of 76/79 dollars per barrel.

The material has been provided by InstaForex Company - www.instaforex.com