EUR/GBP is currently residing inside the corrective resistance zone between 0.87 to 0.8750 area whereas the bearish trend is quite intact as well. EUR has been the dominant currency in the pair for last few days inside the impulsive bearish trend in progress as GBP was struggling for gains amid mixed economic reports recently. Today, the eureozone's Current Account report was published with a better-than-expected figure of 35.1B decreasing from the previous figure of 39.0B which was expected to decrease to 32.3B. On the other hand, today the UK Retail Sales report was published with a decrease to -1.2% from the previous value of 0.8% which was expected to be at -0.5%. Today, MPC official Cunliffe is due to speak later today. His speech is expected to be quite neutral about the UK key interest rate and monetary policy. As for the current scenario, the market is quite volatile amid alternating impulsive bullish and bearish pressure. This provides no definite trend pressure on either side. GBP has been affected by worse economic reports, thus pushing the price lower. This indicates strength of EUR which is expected to continue further in the coming days. To sum up, EUR is expected to have an upper hand over GBP, so the pair is set to continue its bearish trend further.

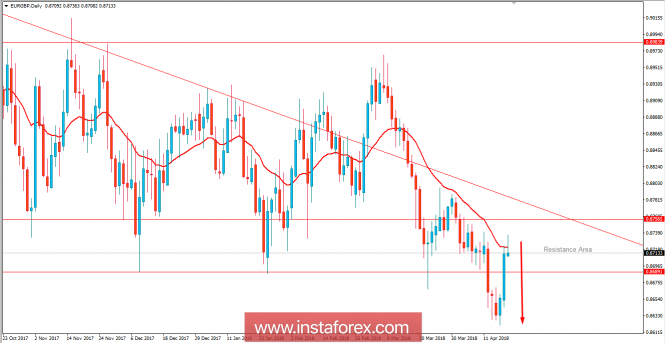

Now let us look at the technical view. The price has recently rejecting off the dynamic level of 20 EMA in the non-volatile bearish trend which is expected to push the price much lower towards 0.84 support area in the coming days. The retracement towards the dynamic level is an indication of more bears entering the market to input more impulsive bearish pressure in the coming days. As the price remains below 0.8750 area, the bearish bias is expected to continue further.