The first appearance of the new head of the Fed, Jerome Powell, in the US Congress turned out to be more hawkish than the markets expected and led to sell-offs in the stock markets. Powell on duty outlined the situation of the US economy, recognizing the changes as positive, and confirmed his intention to follow the policy of "gradual raising rates."

Everything would be fine, but then, in answering questions from congressmen, Powell unexpectedly hinted at the opportunity to improve his personal forecast. The markets saw in his words a readiness to consider an additional rate increase this year.

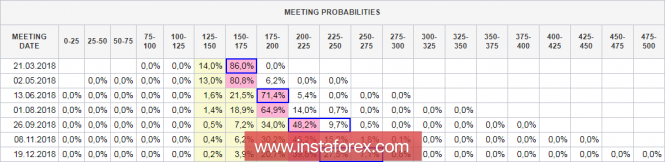

Thus, Powell's speech made an expected impression on the markets, but the threat of a fourth rate hike is growing again. According to the CME futures market data, the markets are convinced of two increases in a row in March and June, in September the probability is more than 50%, and in December - more than 30%. As practice shows, after the rate increase on March 21, all other figures will also rise, that is, the probability of a fourth increase will increase.

Markets expectedly reacted with the fall, which was the strongest after the collapse in early February. It is difficult to expect otherwise because exactly the same fears returned that provoked the previous collapse.

Former US Treasury Secretary Lawrence Summers said in an interview with Bloomberg that he expects the recession to come in the coming years, and in his opinion, it may become more long and painful than in 2008. Summers identified budget deficits at all levels as markers, from municipal to federal, which will only increase as the tax reform is implemented. The greatest danger Summers sees is that when a new crisis begins, the authorities will not have the opportunity to mitigate it, because the possible tools have already been exhausted.

Thus, the stock market is again under threat, the fall of which can drag along and many related indicators. In the coming days, the market will assess the threat level, and if it considers it to be quite strong, one should expect another collapse in the stock markets and a sharp wave of demand for protective assets.

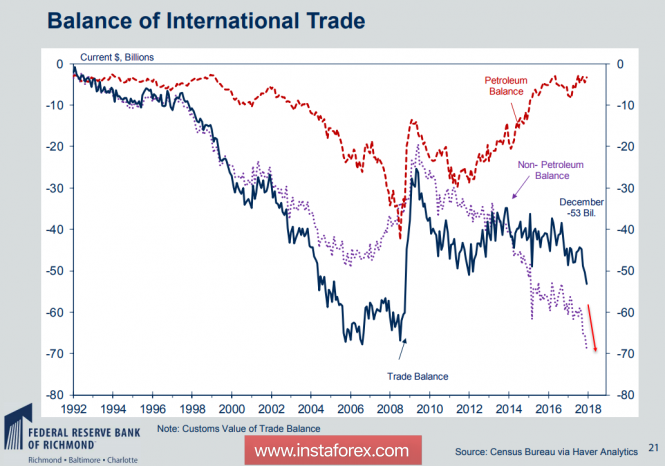

The markets are currently disoriented. Powell said that the economy is recovering, and the published macroeconomic data seems to be talking about it, in particular, the GDP growth in the fourth quarter was 2.5% according to the updated data, but President Trump, again and again, raises the question of the need to review customs tariffs and "return fair exchange". In the US relationship with major trading partners. If you look at the US trade balance without taking into account oil and petroleum products, whose import has significantly decreased in recent years, you can see that there is a sharp increase in the deficit along the whole spectrum of trade. In other words, America has nothing to offer the world in exchange for imports, except weapons and dollars. How to correct the emerging situation is completely unclear.

Today, a report on personal consumption spending will be published in January, after the publication of quarterly data on price changes on Wednesday, attention to this indicator will be increased. To bring down the growing wave of panic, it is necessary to see the growth of personal consumption, while forecasts are not stable. Experts expect the growth of expenses and at the same time lower incomes.

A little later, there will be data on the production PMI from Markit and ISM, and of course attention will be focused on Powell's next speech, and right after it the Fed's position will be commented on by the head of the Federal Reserve Bank of New York, Dudley, who is considered the most influential member of the Cabinet after Powell.

If the market sees a new threat, it is likely another decline in stock markets, the growth of the dollar against commodity assets and the demand for protective ones, in particular, on the yen and franc. Under pressure are the Australian and Canadian dollar, they look weaker than all.

The material has been provided by InstaForex Company - www.instaforex.com