Eurozone

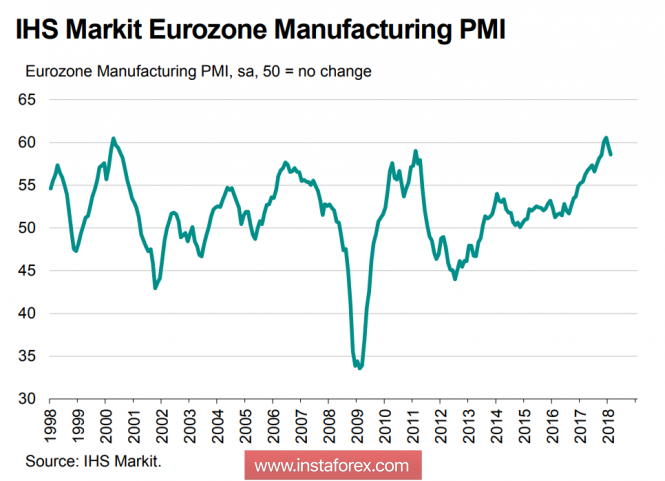

The eurozone economy is clearly tired of continuous growth over the past 12 months, updating time after time before the crisis highs. Following the ZEW and Ifo indices, which showed a slowdown in growth, HIS Markit confirmed the trend. It is impossible to maintain record growth for such a long time.

The production PMI shrank to 58.6p from 59.6p in January, remaining, nevertheless, near the historical highs.

It should also be noted and a slight decrease in the Gfk index for Germany from 11.0 to 10.8p, all these data enabled the bears to seize the initiative.

Eurostat's preliminary report on consumer inflation in February did not add enthusiasm either. Instead of the expected growth of the base index to 1.1%, the January level was 1.0%, which, among other things, indicates a threat of a return of deflationary pressure. In any case, the members of the Board of Governors have recently mentioned this more than once.

The euro continues to be under pressure, as against the background of the decline in indicators. The pressure on the ECB also decreases. It has no reasons to raise the rate in the foreseeable future. The currency pair EUR / USD is already close to the nearest support of 1.2165, in case it does not stand, the decline will continue up to 1.2092, where the level is quite strong.

United Kingdom

The pound received a few striking blows, falling to 1.3740 before the opening of the European session.

Nationwide housing price indices fell by 0.3% in February, annual growth was only 2.2%, both indicators are worse than forecasts. The slowdown in housing prices reflects a general slowdown in prices and a decrease in construction activity due to the threat of a rise in the price of loans.

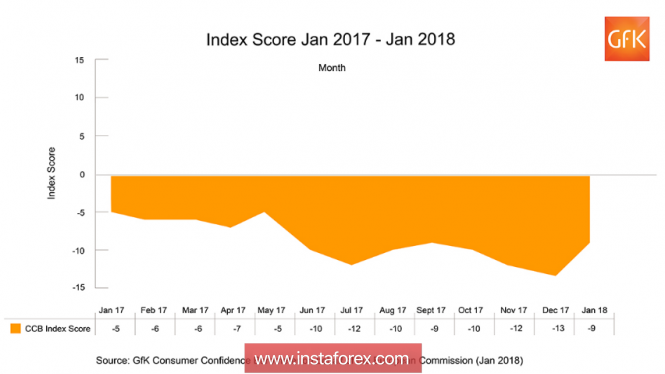

The index of retail prices from BRC decreased by 0.8%, which also turned out to be worse than forecast. The rate of inflation in the UK is high, but the consumer activity is weak. The rise in prices is due to the rise in the price of imports. The consumer confidence index is still confidently in the negative zone.

Yesterday, the main negotiator from the European Union, Michel Barnier, said that reaching an agreement on the transition period is by no means guaranteed, and Teresa May also noted that the draft agreement proposed by the EU "undermines the constitutional foundations of the country." Thus, the main driver of the pound's growth in recent months has unexpectedly changed the sign, after the expectations of the successful conclusion of the negotiations, unexpected expectations began to dominate.

Today, the Bank of England will publish data on mortgage and consumer lending in January, depending on whether expectations are met, the pound may either accelerate the fall, or try to stabilize at current levels.

On Friday, the markets will listen carefully to Carney's and May's performances, which will almost certainly add volatility. The pound as a whole is under pressure, closing below the level of 1.3763 will open the way to the support of 1.3612, but if the quotes stay above this level, then trade can go to the lateral range with the upper limit of 1.3855.

Oil and ruble

Quotes of oil could not stand aside after a wave of sales in stock markets, as the drop in stock indices is always accompanied by a decrease in business activity. At the same time, it is still far from the low of the first half of February, oil is moving objectively towards finding a balance, despite all the upheavals, as the OPEC countries + are persistently fulfilling their obligations to cut production.

Global oil reserves are declining, which is a plus for quotations, and at the moment the main issue is the sustainability of economic growth. If the US authorities provoke a further drop in the markets, Brent will decrease to support 63.50, after which it may go to test 61.50.

The ruble tested strong support at 55.50, and, frightened of its own courage, rolled higher. There are no reasons to expect a strong weakening of the ruble, external factors are favorable, including an increase in the sovereign rating, demand for OFZs and economic growth.

If the panic wave subsides, then the movement of the ruble below 55.50 is practically guaranteed, in this case it will look for support closer to 54.10. A little more likely at the current stage of trading in the range with the upper limit of 57.60.

The material has been provided by InstaForex Company - www.instaforex.com