The corrective mode of EUR/GBP seems to be never ending as the corrective bearish squeeze is turning more volatile every day. Ahead of the high impact economic reports from the UK, EUR has gained impulsive momentum which might be a signal of further gains in the coming days. Today, German Gfk Consumer Climate report was published as expected at 10.8 decreasing from the previous figure of 11.0, French Consumer Spending decreased to -1.9% from the previous value of -1.2% which was expected to increase to 0.5%, French Prelim CPI was unchanged at -0.1% which was expected to increase to 0.3%, French Prelim GDP was published unchanged as expected at 0.6% and German Unemployment Change report was published better than expected. Moreover, the eurozone CPI Flash Estimate was published as expected at 1.2% decreasing from the previous value of 1.3% and Core CPI Flash Estimate report was published unchanged at 1.0%. Though the economic reports revealed mixed readings, EUR managed to sustain its grounds under impulsive GBP pressure in the pair. On the GBP side, today Gfk Consumer Confidence report was published with a further deficit as expected at -10 decreasing from the previous deficit of -9 and BRC Shop Price Index was also published with a greater deficit of -0.8% decreasing from the previous value of -0.5%. Moreover, tomorrow UK Manufacturing PMI report is going to be published which is expected to have a slight decrease to 55.1 from the previous figure of 55.3 and Net Lending to Individuals is expected to increase to 5.4B from the previous figure of 5.2B. To sum up, ahead of the high impact UK report to be published tomorrow, certain gain on the EUR side has been quite remarkable. The market currently became quite indecisive with the today's impulsive bullish momentum whereas the market sentiment has been bearish for a few days now. As for the current scenario, further correction is expected in this pair until EUR sustains its gains to proceed higher, aiming to break above this range-bound price area. Otherwise, the UK might come up with better economic reports to dominate EUR further and break below the range area.

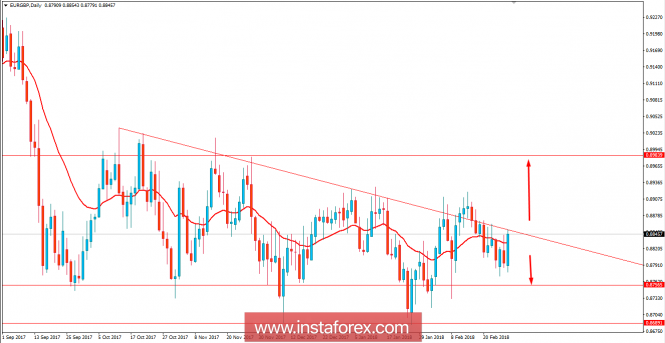

Now let us look at the technical view. The price has been quite impulsive with the bullish gains which followed the previous bearish price action leading the price lower below the trend line resistance. The price is currently residing at the edge of 0.8850 price area from where a daily close above the area is expected to lead to further bullish pressure in the pair with a target towards 0.90. On the other hand, if the price manages to reside below 0.8850 with a daily close, the bearish bias is expected to continue in this pair.