NZD/USD has been quite impulsive with the bullish gains after bouncing off the support area of 0.7250 recently. The price has been quite impulsive with the bearish pressure after the positive USD Employment Change report was published on Friday but as expected the bearish pressure lasted for a certain period before the bulls took charge. Today, NZD Employment Change report was published at 0.5% which was better than the expectation of 0.4% but the rate decreased from the previous value of 2.2%, Unemployment Rate decreased to 4.5% from the previous value of 4.6% which was expected to increase to 4.7%, and Labor Cost Index was published with a decrease to 0.4% from the previous value of 0.7% which was expected to be at 0.5%. NZD having mixed economic reports did confuse the market sentiment whereas NZD is currently struggling to sustain the gains it has received recently. On the USD side, today, FOMC Member Dudley is going to speak about the upcoming monetary policies and the interest rate decision which is expected to have a rise on March 2018. Moreover, Crude Oil Inventories report is going to be published today as well which is expected to decrease to 3.2M from the previous figure of 6.8M. As of the current scenario, Corrective market sentiment is expected to be published as the recent NZD economic reports failed to provide the required push in the market, but still NZD is expected to have an upper hand over USD in the coming days until USD comes up with any positive economic report to support its gains.

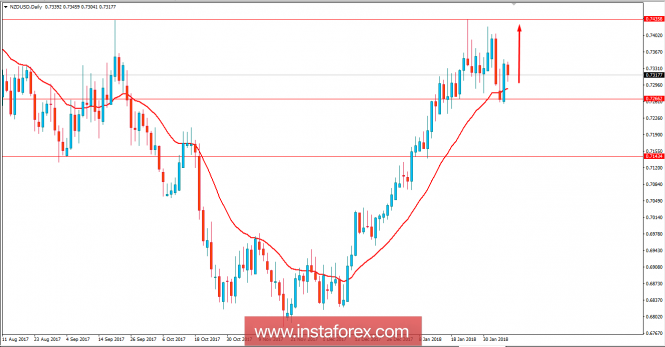

Now let us look at the technical view. The price is currently residing above the dynamic level of 20 EMA and the 0.7250 support area. The recent bullish Engulfing bar has already engulfed a certain portion of the bearish pressure in the market which is expected to push the price much higher towards the 0.7450 resistance area in the coming days. As the price remains above the 0.7250 support area, the bullish bias is expected to continue further.