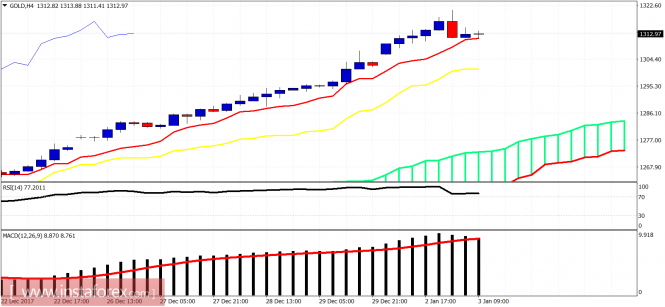

Gold made new highs yesterday near $1,318. Trend remains bullish. Gold price has reached an important resistance area. I remain bearish on Gold but would want to see this week to turn bearish for my scenario of a move towards $1,210 to remain valid.

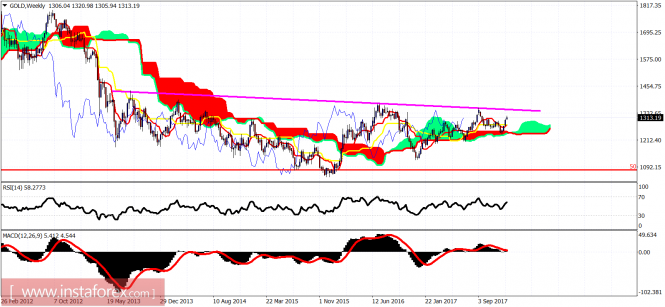

Gold price has bounced off the Ichimoku cloud as expected. The price is approaching the magenta trend line resistance. As long as we are below this resistance trend line, there is still a chance for a pull back at least towards $1,270.

The material has been provided by InstaForex Company - www.instaforex.com