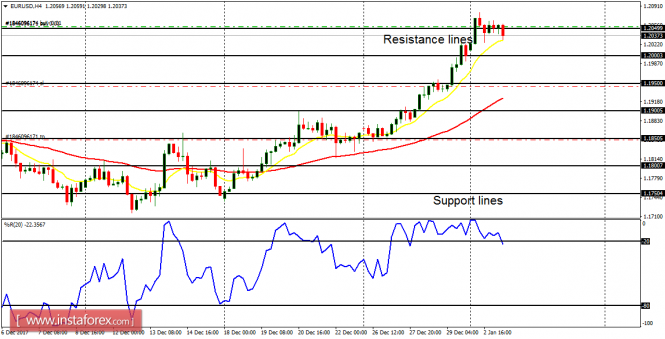

EUR/USD: This pair moved flat on Monday having reached the resistance line at 1.2050. The price may be able to move further upwards this week reaching the resistance line at 1.2100. However, the outlook on EUR pairs is bearish for this week and for this month. Thus, a bearish movement can begin anytime.

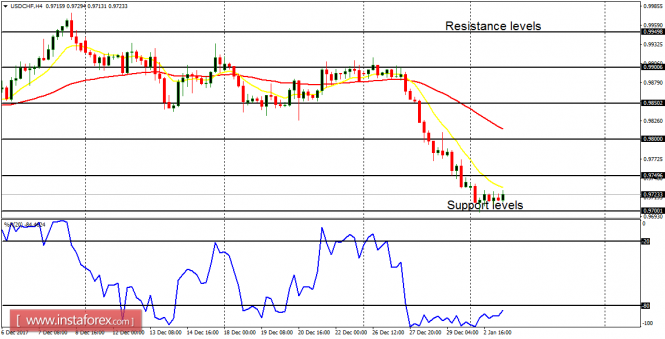

USD/CHF: The USD/CHF consolidated on January 2 having moved strongly upwards last week. The support levels at 0.9700 and 0.9650 could be tested this week, and they could possibly be breached this month.

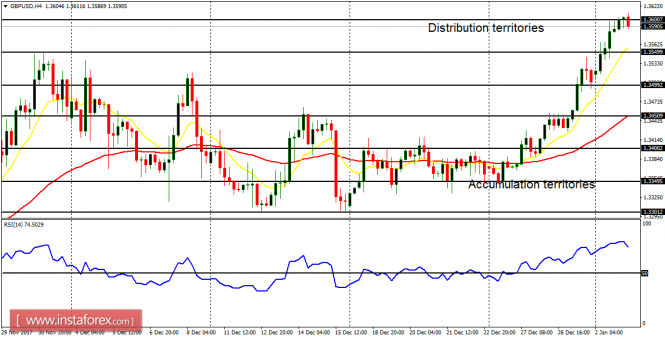

GBP/USD: The GBP/USD went upwards by 90 pips yesterday testing the distribution territory at 1.3600. Since last Thursday, price has gained 220 pips, leading to a Bullish Confirmation Pattern in the market. Further bullish movement is possible today even if there is a strong bearish correction afterwards.

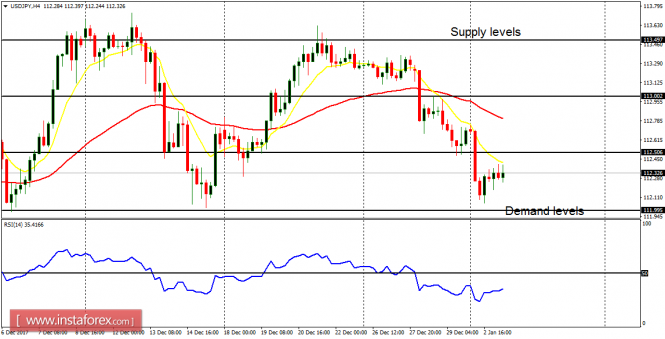

USD/JPY: The USD/JPY went further downwards yesterday and then consolidated until the end of the day. There is a Bearish Confirmation Pattern in the market, and further bearish movements are a possibility. The demand levels at 112.00 and 111.50 could be tested this week. They could even be exceeded.

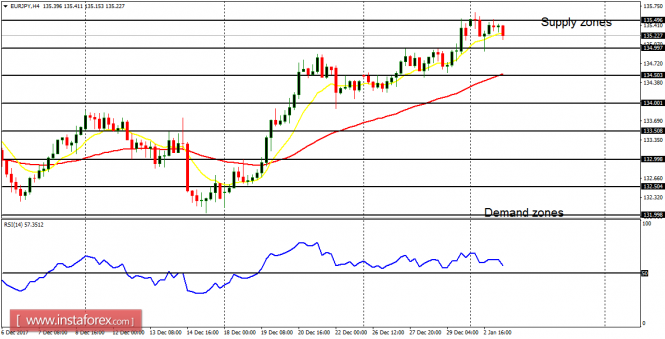

EUR/JPY: There is a bullish bias on this cross – brought about by the stamina in the euro itself. It is probable that the bulls would continue to pushing the price higher towards the supply zones at 135.50 (which has previously been tested) and 136.00. This condition can be fulfilled before the much expected bearish run that could place trade anywhere between this week or next.