For the first time since 2014, both types of oil managed to start the year at a price higher than $60 per barrel due to positive news from the United States and the growth of geopolitical tensions in the Middle East. At the end of the five-day period, by December 22, US oil reserves contracted for the sixth time in a row and reached 431.9 million barrels, the lowest since October 2015. The indicator fell by 20% from its record highs in March 2017. At the same time, the number of rigs have not been increasing for a week in a row, and production marked its first decline (-35 thousand b/s) since October. On the market, rumors have increased that WTI would consolidate above $60 per barrel for a long time. Thus, the report from Baker Hughes started to signal an increase in the activity of drillers.

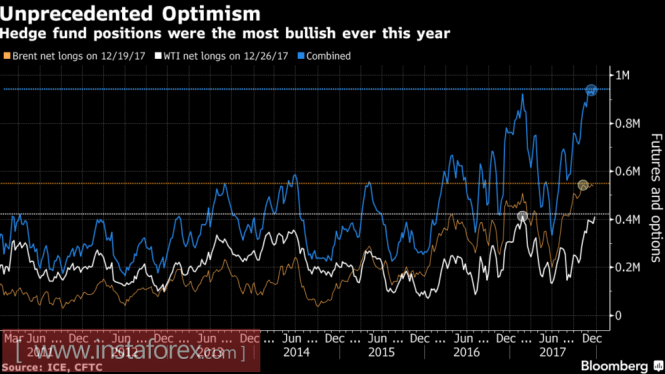

The conflicts between anti-government demonstrators and the military in Iran continues for the fourth day and are one of the most daring challenges for the country's clerical leadership since 2009. Along with the forward movement of the world economy, upward (according to the IEA forecasts, global demand in 2017 rose by 1.5 million b/s and will continue in the same spirit (+1.3 million b/s) in 2018), the improvement of the US oil market and the weakness of the US dollar, the growth of geopolitical tensions in the Middle East are factors that allowed the "bulls" for Brent and WTI to start the year of the Dog on a positive note. With an outlook of a bright future, oil speculators do not get tired of raising their net long positions. According to data from the US Commodity Futures Trading Commission, the net long position on WTI amounted to 411,972 futures and options contracts, which is very close to a record set in February 2017.

Dynamics of speculative positions for Brent and WTI

Source: Bloomberg.

Theoretically, large-scale folding of long positions against the background of profit-taking is charged with a deep immersion of oil, as it was at the beginning of last year. However, in order to frighten speculators, strong arguments are needed. We must admit that the resumption of the operation of the pipeline system in the North Sea did not become such an argument.

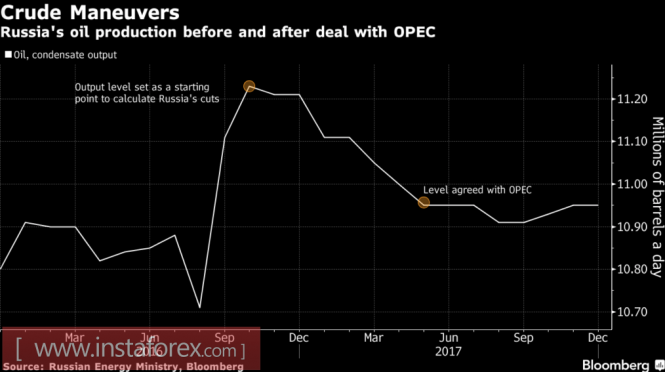

Investors are optimistic about the extension of the agreement between OPEC and other producer countries in reducing production by the end of 2018, although this history has black spots. In particular, the average production of oil in Russia increases for the ninth consecutive year and reached the level of 10.98 million b/s, the highest since the collapse of the USSR. How could this happen if Moscow adheres to its obligations and reduces production by 300 bps? At the same time, all partners are happy ... The reason should be sought in the rapid growth of the indicator to 11.23 million b/s in October 2016, a few weeks before the conclusion of the Vienna agreement.

Dynamics of oil production in Russia

Source: Bloomberg.

A weak US dollar is in the hands of the "bulls" for Brent and WTI, which cannot come to any senses due to the disappointment about the reluctance of the market to win back the factor of tax reform.

Technically, reaching a target of 161.8% on the AB = CD pattern increases the risk of a pullback. However, if brent crude will soon be able to gain a foothold above $67 per barrel, the chances of continuing the rally in the direction of the target will increase by 200%.

Brent, daily chart