AUD/USD is still trading in non-volatile bullish trend without any major retracement even towards the dynamic level of 20 EMA along the way. The weakness of USD lead to further impulsive gains of AUD whereas upbear economic reports from Australia helped its currency to sustain gains. Recently, Australia's MI Leading Index report was published with an increase to 0.3% from the previous value of 0.1% and CB Leading Index was unchanged at 0.3%. Without negative results in the recently published economic reports, AUD sustained the momentum ahead of the US preliminary GDP report which is due on Friday. Today, US Unemployment Claims report is going to be published which is expected to increase to 239k from the previous figure of 220k, Goods Trade Balance report is expected to show less deficit at –68.6B from the previous figure of -70.0B, New Home Sales is expected to decrease to 679k from the previous figure of 733k, but CB Leading Index is expected to have a slight increase to 0.5% from the previous value of 0.4%. Most of the forecasted results of US economic reports to be published today are quite negative that is expected to lead to further gains of AUD in the coming days. As for the current scenario, any positive figure in the US reports today and in the flash GDP report is expected to lead to some bearish pressure in the pair i.e. recovery of USD against AUD. However, AUD is expected to dominate further in the long term.

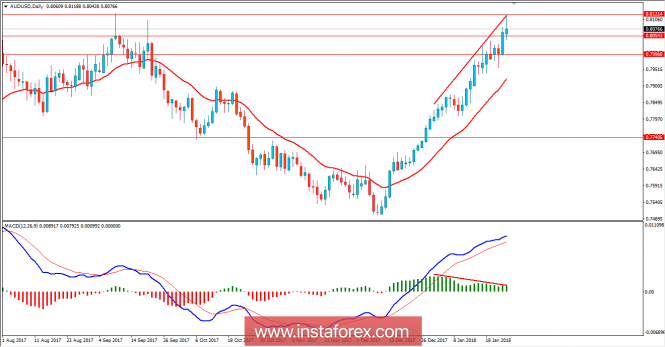

Now let us look at the technical view. The price is still in the area of Bearish Divergence where 0.81 resistance area is expected to hold the price and push lower towards the dynamic level of 20 EMA in the coming days. The volumes are not quite increasing with the gains of AUD in the current scenario, which is more probable to push the price lower. As the price remains below 0.81, the bearish bias is expected to continue to push the price lower with target towards 0.80 and dynamic level.