Yesterday, the US dollar collapsed to a three-year low after US Treasury Secretary Mnuchin expressed his approval for a decline in the interest rates. Mnuchin said that a weak dollar is good for trade and opportunities, confirming the fears of the market as the US government proceeds to implement measures of strict protectionism.

To correct the trade balance of the Trump administration, one must get rid of the image of a strong dollar. This is beyond doubt, a dangerous path, since a weak dollar will help to squeeze its sphere of application. However, the administration is confident that there'll be another exit, which may not be the case.

Eurozone

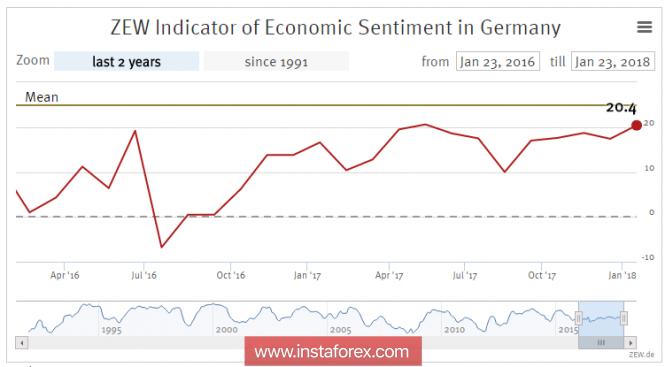

According to ZEW, the German business confidence index is one step from the update of the 30-month high. The January value reached the level of 20.4p while the forecast remains confidently optimistic. For the next 6 months, this criterion will supposedly gain 95.2p out of 100p. This is the strongest forecast from December 1991.

The sentiment regarding the outlook for the eurozone also increased by 2.8p to 31.8p, which indicates optimistic expectations.

According to the European Commission, the level of consumer confidence in January has updated to the historic record and reached 1.3p. According to IHS Markit, the consolidated PMI of eurozone countries reached 58.6p, which is the highest since June 2006.

In general, the situation before the ECB meeting looks confidently positive. It is assumed that the ECB will leave the current policy unchanged, since it is still too early to cancel incentive measures because of weak inflation. At the same time, a sharp increase in the euro could force Draghi to change rhetoric at a press conference to bring down the bullish sentiment, as the eurozone is not fully ready to strengthen the currency. If Germany's safety margin is high, then for the countries of Eastern and Southern Europe, the profitability threshold is already close, if not overcome, and the rapid strengthening of the euro can negate all the achievements of the last two years.

No serious factor is yet to be seen in favor of the dollar and it will not be easy to bring down the bullish mood. The euro could make another spurt higher than 1.25 following the meeting which could lead to too high volatility. The chances of a corrective decline remain weak.

United Kingdom

Given the slowdown in inflation and weak data on retail sales in December, there were serious concerns that the report on the labor market will show a slowdown in real incomes. However, the report was better than expected. Unemployment remained at the same level of 4.3%, while the average wage without premiums increased by 2.5% in the last 3 months including November. This led to the formation of one more factor for strengthening the pound. This increased the chances of a rate hike by the Bank of Englan

The pound reacted with rapid growth which, combined with the apparent weakness of the dollar, led to a cumulative effect. The pound came close to the level of 1.43, having played a full fall after Brexit. A few people expected such a scenario a month ago but now, only the technical overbought is on the side of the bears. Too many factors remain in favor of the pound's growth.

Strong resistance is seen at 1.4405 which is possibly near consolidation. There is no reason for a full-fledged turnaround. Correction requires positive news from the US, which looks unlikely at the moment.

Oil

Oil continues to be in the rising channel. The market does not see any reasons for the reversal of quotes. The IMF raised the forecast for world oil prices for 2018 by 9.7 dollars against the forecast in October 2017 to 59.9 dollars per barrel. The largest banks also adhered to confident bullish forecasts. Barclays raised the forecast for WTI from $ 55 to $ 60 / bbl, BNP Paribas sees the same level for WTI and $ 65 / bbl for Brent.

The growth of quotations is promoted by verbal interventions. In particular, it is the comments of the delegations of Russia and Saudi Arabia in Davos about the probability of prolongation of the OPEC + agreement for another half a year before the end of 2018.

OPEC + seems to have reached full internal agreement, since the restriction of production has led to an increase in real incomes without the intention to abandon its policy.

The material has been provided by InstaForex Company - www.instaforex.com