Trading plan for 11/10/2017:

The Japanese Nikkei 225 index closes at highest level since 1996. The European indices follow the sentiment in Asia and open higher as well. EUR/USD is trading close to 1.1830 resistance, USD/JPY is trading at 112.41, virtually unchanged. Gold declines a little and Crude Oil rally towards $51.21 level.

On Wednesday, 11th of October the event calendar is light with important news releases, but the main event of the day is FOMC Meeting Minutes release. In the meantime, we will have two speeches by FOMC members: Robert Kaplan and Charles Evans. Moreover, the news from Spain might influence the price volatility today as Catalan leader Carles Puigdemont announced in the Catalan parliament that he is taking a mandate from citizens to declare independence of the region, but has proposed that the parliament suspend the effects of the declaration of independence in order to start talks.

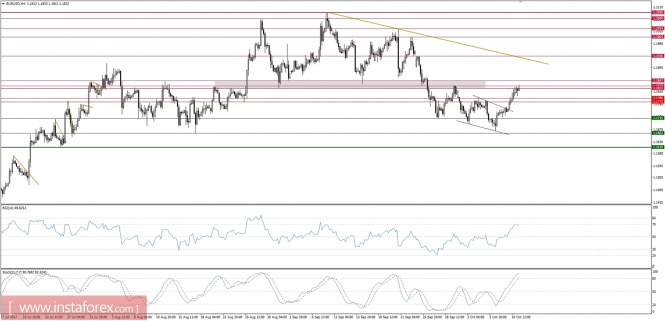

EUR/USD analysis for 11/10/2017:

The FOMC Meeting Minutes release is scheduled at 06:00 pm GMT. The minutes are likely to confirm that the Fed is on track for a December hike, although the market is pricing in a 70% chance so far. However, the minutes may reveal more about how the Fed's balance between a stronger economy and still too low inflation is viewed. Previous minutes have shown diverging views with one camp (majority) trusting the Philips curve (lower unemployment leads to wage pressure eventually) while another camp is in favor of awaiting clearer signs that inflation is actually moving towards the Fed's target of 2.0%. Any mention regarding a rolling to balance sheet sooner than expected will likely strengthen the US Dollar across the board again.

Let's now take a look at the EUR/USD technical picture on the H4 time frame. The market is trying to break through the technical resistance at the level of 1.1830 in order to extend the rally towards the level of 1.1847 and then 1.1936. The momentum remains strong, but the market conditions are slowly turning overbought. The nearest support is seen at the level of 1.1786.

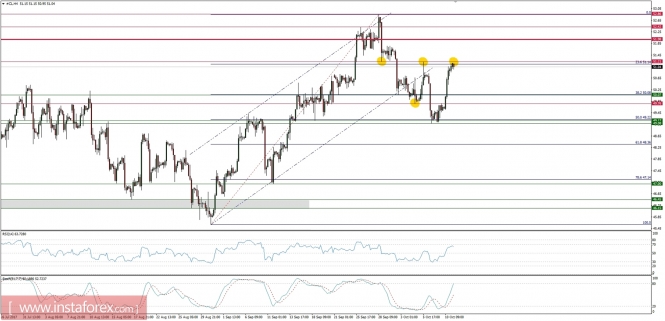

Market Snapshot: Crude Oil testing the resistance

The price of Crude Oil rebounded sharply from 50% Fibo level and now is testing the technical resistance at the level of $51.21. If this level is broken, then the bulls will likely move higher towards the local swing top at the level of %52.86. The strong momentum supports the bullish bias.

Market Snapshot: NZD/USD in a narrow range

The price of NZD/USD keeps trading in a narrow range between the levels of 0.7058 - 0.7089 in oversold market conditions. The chances for a corrective rally higher towards the level of 0.7131 are increasing and the price behavior at this level will determine future price movements.