Today, the minutes of the September 20 meeting of the Federal Open Market Committee (FOMC) will be published. The text of the protocol is of interest from the point of view of assessing the financial risks that the US economy may face in the process of tightening financial conditions. The policy of a strong dollar, which is implemented by the US financial and political authorities, has a number of dangerous consequences that the country's economy may face if it is not fully prepared for such cardinal steps. Accordingly, the level of evaluation of internal discussion from the point of view of possible risks can greatly affect the position of the dollar in the short term.

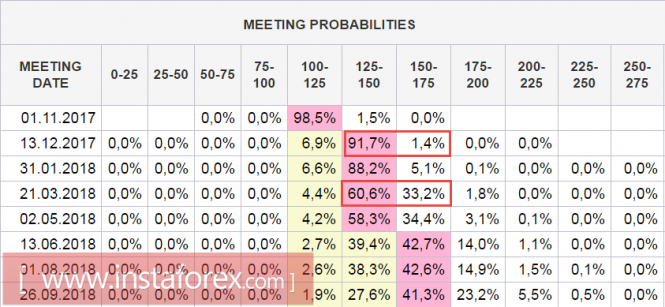

At the moment, the market is based on the fact that the rate will be raised again in December by a quarter of percent. The probability of this event exceeds 90% according to the CME futures market data, while the next increase may take place in March, and not in June, as it was considered absolutely recently.

This morning, the head of the Federal Reserve Bank of Dallas, Robert Kaplan, said that the Fed does not need to wait for signs of accelerating inflation, as the global economy grew "faster than expected," and delays may lead to the fact that in the future will have to raise rates at a faster pace. Kaplan, in fact, again repeated the same set of arguments, which are voiced from time to time by his colleagues, the US is moving towards full employment, inflation will rise anyway, the business climate and consumer confidence improve, and therefore the rates need to be raised immediately.

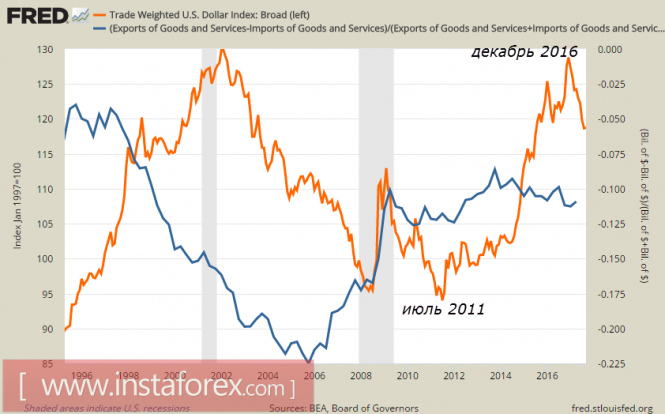

Fears that the growth of the dollar index will lead to a deterioration of the already bad trade balance, in fact, do not pose a serious problem. From July 2011 to December 2016, the trade-weighted index of the dollar (TWI) grew by 37%, and from such a significant growth one would expect a deterioration in trade. However, the ratio of the trade balance to the volume of trade, which, as a rule, has an inverse relationship to the TWI index, has changed quite insignificantly over the same period, which indicates a weak dependence of trade on the dollar index.

In other words, a strong dollar is unlikely to worsen the US trade position, but it will solve a number of other problems.

Apparently, the US will still begin implementing the policy of a strong dollar, the latest statements by cabinet members set up the markets for this scenario.

On Thursday, the attention will be focused on the dynamics of producer prices in September, which largely preempts data on consumer inflation. Experts expect a slight increase in August, the release of data in line with expectations will support the dollar.

Friday will be quite saturated and can cause increased volatility in the markets. At 13:30 London time, data on consumer inflation and retail sales will be published in September. Retail is expected to show growth of 0.4% after a 0.2% decline a month earlier, and consumer inflation will return to 2.0% after three months of weakness. A little later will be published the preliminary index of Michigan on consumer confidence, in addition, a number of representatives of the Fed will make comments.

The expectations themselves are quite positive, and if the result is not worse, the dollar by the end of the week may resume aggressive growth, primarily against commodity currencies. Markets will proceed from the fact that the scenario implemented by the Fed and the Trump administration will lead to a decrease in demand for risky assets, which gives a chance to strengthen the yen, possibly reducing the week to support 108.40 / 90 in the long term. The growth of EUR/USD in recent days is corrective and limited to resistance at 1.1880, after which the decline may resume.

The material has been provided by InstaForex Company - www.instaforex.com