Donald Trump, after announcing five candidates for the Fed presidency, has paused, putting the market under pressure. The new head of the Fed, whoever it turns out to be, will continue the policy of tightening monetary policy, which currently consists of two areas namely raising rates and reducing the balance.

At the current rate, the market's opinion is already set: the session on November 2 will not give any new information, the rate will be raised in December, and the probability of the next step in March 2018 is now more than 40%. This high probability reflects the market assumption that a new head will replace Yellen with more pronounced hawkish intentions.

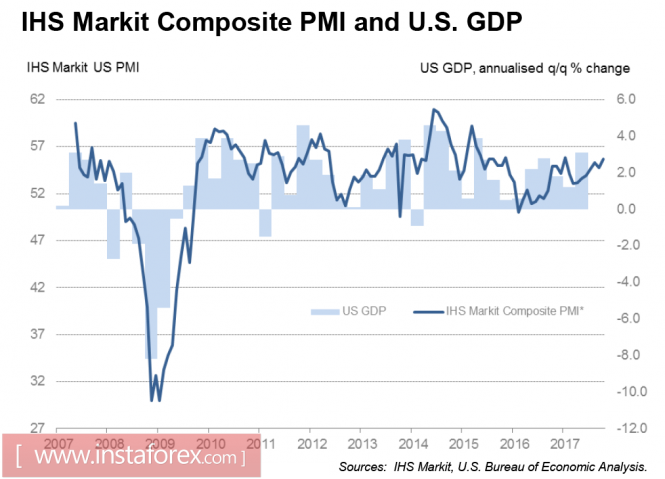

It is clear that the tightening of the monetary policy should be accompanied by an increase in the main macroeconomic indicators, which include economic growth, the labor market, and inflation. On the first point, if we base it from the reports, the situation can be considered satisfactory. The gap between the indicators of business activity from the ISM and the lagging PMI Markit began to decline at last. Preliminary data for May indicate that according to Markit, the US economy is booming. Activity in the services sector increased to 55.9p against 55.3p while the production index and the composite index reached a 9-month high, reaching 54.5p and 55.7p respectively.

There are certain dangers in inflationary expectations. The current level of inflation lags behind the 2% target set by the Fed and strictly speaking, the focus on inflation should force the Fed to take a break. However, the question of the rate, in this case, is not so much an economic problem but a political one. Donald Trump needs to announce the beginning of reforms during the economic recovery rather than the recession. This is because in this case, it will be much easier to organize the flow of investments into the economy, which is an extremely important factor in the face of growing pressure on the budget. The Fed, in turn, cannot sell signals of weakness, since it risks putting fuel into the furnace of deflationary expectations.

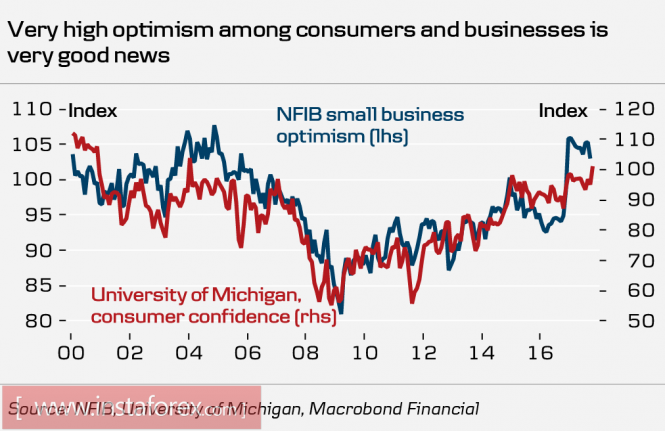

In order for everyone to realize their goals, they need confidence in the future that the Fed will raise the rate in December and Trump will announce the beginning of reforms. Positive expectations also contribute to the growth of consumer confidence, which is currently at long-term highs. This capital can only be used correctly.

The market is slowly but surely unfolding in facing the dollar. It is clear that in this spread, a significant part is the delayed expectations. However, these expectations should lie on the prepared ground so the rhetoric of the Fed leadership will continue to be hawkish along with the main indicators of the state of the economy to support the demand for US assets.

Today, you need to pay attention to the publication of the report on orders for durable goods. Given the growth of ISM and PMI Markit, it may turn out that the September figures will outperform expectations and the dollar may receive a signal to resume growth. On Friday, the first preliminary GDP data will be released in Q3 as well as another important indicator namely the index of spending on personal consumption. Its growth relative to Q2 will give the bulls confidence, since it will point to stable consumer demand and the likelihood of inflation.

The continued strengthening of the stock market and the sale of bonds indicate that investors are not too afraid of tightening financial conditions. They are confident that the positive effect of the upcoming tax reform will cover losses. Such optimism will continue to exert pressure on defensive assets, in particular, gold, franc, and yen. The Australian dollar will also remain under pressure due to weak data on inflation. The loonie's prospects will be determined today by the Bank of Canada.

In general, the dollar is the main favorite of autumn and any temporary weakness should be used for new sales.

The material has been provided by InstaForex Company - www.instaforex.com