While Kurdistan is at war with the federal forces of Iraq, OPEC is optimistic about the stabilization of the situation on the oil market, and while Brent is preparing for the first time in two years to storm the psychologically significant level of $60 per barrel, the United States is altering the world for themselves. The growth of the difference in prices between the North Sea and Texas oil varieties to the highest levels from 2015 led to an increase in U.S. exports and the displacement of competitor producers from the world market. The United States is actively taking its place, increasing its share. It remains only to insure price risks, and we can safely continue what was started. According to the estimates of London brokerage PVM, US companies hedged 70-80% of their supplies in 2017 and only 25% by 2018. The price increase creates an excellent opportunity for selling futures under risk management projects and puts a ceiling for WTI.

The growth of the spread Brent-WTI looks quite logical against the backdrop of the continuous increase in production in the United States and the implementation of the Vienna agreements of OPEC. Since November 2016, the cost of the North Sea variety has risen by approximately 20%, which allows Secretary General Mohammed Barkindo to speak optimistically about stabilizing the situation on the market. Russia and Saudi Arabia, which account for about a fifth of the world's production of crude oil, are ready to extend the terms of the agreement, at least until the end of 2018, and urge other countries to join them. British Petroleum believes that if we take into consideration the supply and demand, the prices are where they should, but the presence of geopolitical risks increases the likelihood of Brent going above $60 per barrel.

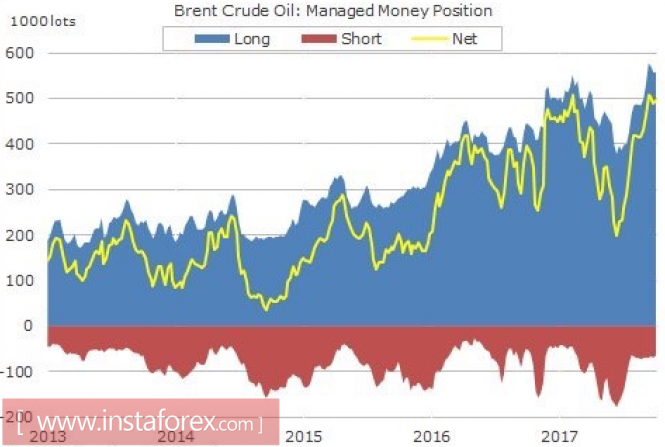

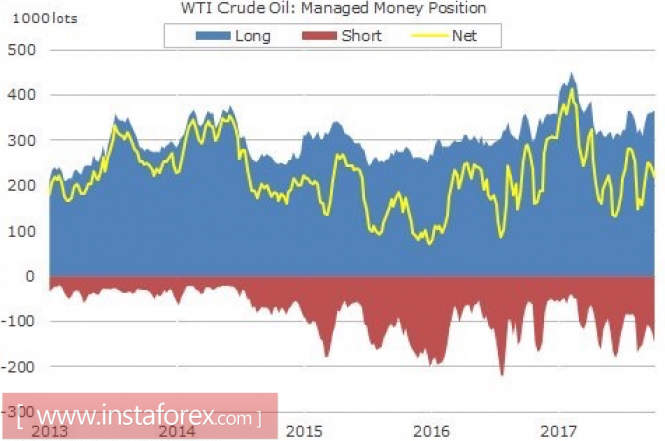

Commerzbank, on the contrary, assumes that the rally is exhausted. The market is deaf in one ear, as it hears only "bullish" news and ignores "bearish" ones. At the same time, the growth of the long differential by Brent and WTI to the maximum level in history increases the risks of reversal. By the end of the week, by October 17, speculators had increased their net long positions in the North Sea grade by 1.2%, while net longs in Texas, on the contrary, decreased by 8.2%.

Dynamics of speculative positions for Brent

Source: Bloomberg.

Dynamics of speculative positions on WTI

Source: Bloomberg.

However, bulls have a trump card in their sleeves, which they rarely recall: since the prices exceeded $100 per barrel, the mining companies significantly reduced the volume of investments, which sooner or later will affect the production of black gold. Meanwhile, investors are discussing the seizure by the federal forces of Iraq of the oil-rich Kurdish region of Kirkuk and assess how much supplies can decrease. Geopolitics continues to support the "bulls" for Brent and WTI support, however, the question often arises on the agenda: where is the ceiling?

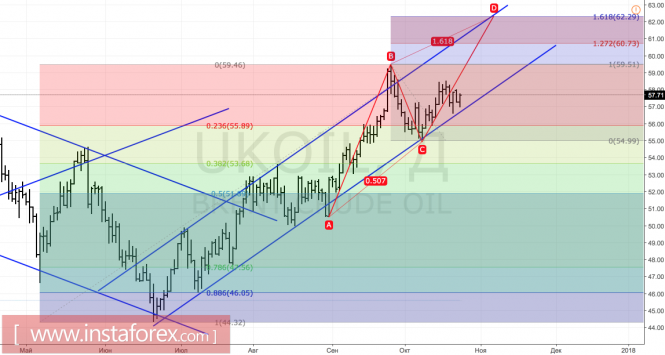

Technically, the inability of the "bears" to bring Brent quotes out of the rising trading channel indicates their weakness. Updating the September highs close to $59.5 per barrel activates the pattern AB = CD with targets at $60.7 and $62.3 per barrel.

Brent, daily chart