The renewal of the October low will increase the risks of continuing the southern campaign of XAU / USD pair. The "bears" are inspired for XAU / USD for new attacks because of the victory of Shinzo Abe's party in the parliamentary elections in Japan, the departure into the shadows of the North Korean issue, the strong dollar and the growth of the yield of US Treasury bonds. Sellers of precious metals are seriously set to update the October low near the mark $1260 for an ounce and continue the peak towards the psychologically important level of $1200.

Gold was not able to compete with income-producing bonds. On one side, strengthening the dollar leads to a rise in the cost of imports in the countries which includes the key consumers of the physical asset. In this regard, the growth rate of 10-year US debt obligations to the maximum mark for the previous 7 months and the USD index to the August peaks are serious arguments in favor of selling the XAU/USD pair. Moreover, the world stock indexes are not tired of rewriting records. Hence, the liberal democracy democrats in Japan allowed the Nikkei 225 to reach a 21-year high, contributing to the growth of USD / JPY to the level of 114. The market is seeking refuge for their assets amid the conditions of decreasing uncertainty in the Land of the Rising Sun and de-escalation of the conflict in North Korea. They have been aggressively disposed of, which increases the risks of continuation precious metal of the southern trend.

Dynamics of USD / JPY and gold

Source: Bloomberg.

Strengthening the dollar and raising the rates of the US debt market is supported by news from the U.S. whereby, it increased sharply the chances of realizing the tax reform after passing the draft budget for the next fiscal year. It is able to disperse the US economy to 3% or more, which increases the likelihood of a more rapid tightening of the monetary policy of the Federal Reserve in 2018. The market is almost confident that the Central Bank will raise the rate on federal funds in December. Therefore, it will continue to be under pressure before the year ends.

The future fate will depend on the opinion of the derivatives market on the relative future rate trajectory of the Fed. Currently, the derivatives are expected to be at 1.8% by the end of 2018, which involves two acts of monetary restriction. Nevertheless, the indicator may shift to 2.3% (4 acts) if the head of the Fed is taken by Kevin Warsh or John Taylor, according to Nordea research. Short-term gold may respond to the chances of victory of Janet Yellen or Jerome Powell, but the resumption of the S&P 500 rally gives the potential of the bullish correction for XAU / USD limited.

Thus, there are "bearish" sentiments in the precious metal market, but there are also optimists. In particular, the Bank of Russia bought 34 tons in September, which was the most serious result since October 2016. At the end of 9 months, 163 tons were purchased, and the total value of gold reserves increased to 57.2 million ounces.

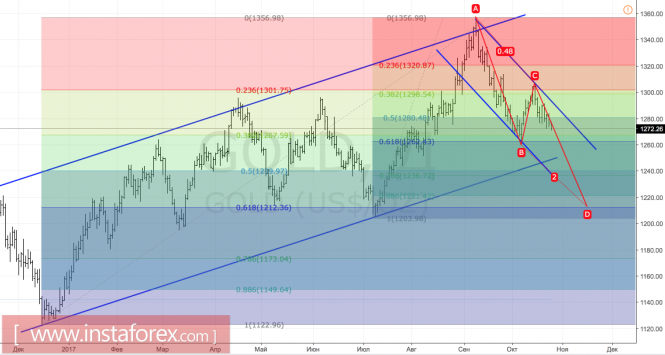

Technically, the inability of bulls in gold to keep quotes above an important level of $ 1,280 per ounce indicates their weakness. In case of updating the October low near the $ 1260 mark, the pattern AB = CD with a target of 200% will be activated. It corresponds to the area $ 1210-1215.

Gold, daily chart