EUR/JPY non-volatile bullish trend is quite intact which is expected to lead to further bullish pressure in this pair. JPY economic reports have been quite mixed recently where Household Spending report was published negative at -0.2% from the previous value of 2.3% which was expected to decrease at 0.8%, Unemployment Rate was unchanged at 2.8% and BOJ Core CPI report was published with a slight increase to 0.4% from the previous value of 0.3% which was expected to decrease to 0.2%. Despite the positive economic reports, JPY failed to gain momentum over EUR yesterday which does signal that EUR is quite stronger in comparison. Today JPY Retail Sales report was published at 1.9% from the previous value of 2.2% which was expected to decrease to 1.0%. Though the report was better than expected the report also indicates to the slight decrease to 1.9% from 2.2% which might lead to further weakness of JPY over EUR in the coming days. On the EUR side, today German Prelim CPI report is going to be published which is expected to decrease to 0.1% from the previous value of 0.4% and Spanish Flash CPI report is expected to increase to 1.7% from the previous value of 1.5%. The expectation of the economic reports is quite mixed in this case but any positive outcome today will lead to further gain on EUR for the coming days.

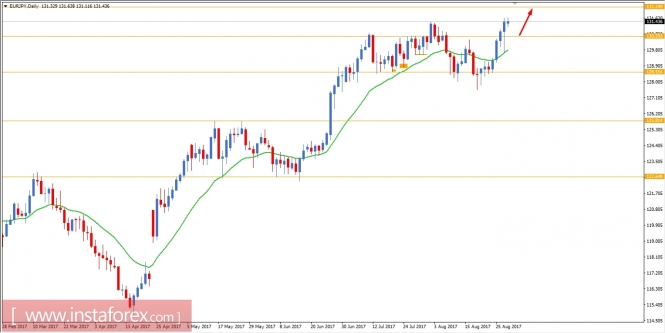

Now let us look at the technical view, the price is currently residing above 130.60 support level which is expected to gain further with a target towards 132.20 resistance level. Recently the price has bounced off the dynamic level of 20 EMA which may lead to greater impulsiveness along the way. As the price remains above 128.50 support level the bullish bias is expected to continue further.